What is ACH?

- ACH (Automated Clearing House) is a financial network in the US used for online/electronic bank to bank transfers.

- ITILITE has launched the feature that allows our US clients to easily process approved expense report payouts through the ITILITE Expense platform.

Who is it intended for?

- Finance Admins who process payouts of approved expense reports can make use of the ITILITE Expense platform to complete the payout.

- ACH is available currently to only our USD clients.

How does it help you?

- Our clients will be able to make expense reimbursements/payouts through the ITILITE Expense platform. Previously, they would have had to handle payouts on their own and only change the status of Report payouts on our platform.

- Once the payment is completed using ACH, the Expense report will automatically be moved to the ‘Paid’ queue on our platform with the Transaction ID updated. This is the point from where Admins can migrate the payout information to their Accounting platform.

What should you do to start using ACH?

All that you as a client admin need to do is

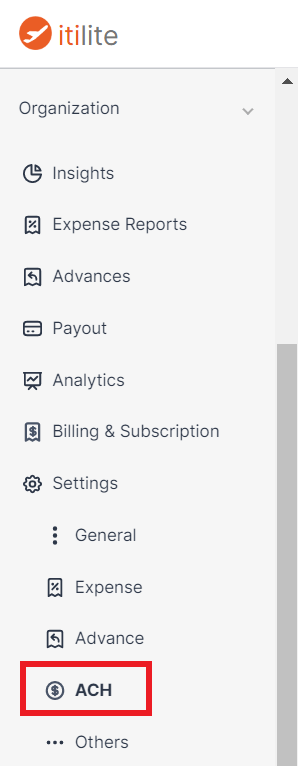

- Admins can navigate to Organization -> Settings -> ACH tab

- Admin to start the Business verification process to register their Business. This is a 2 step process where the client admin will have to provide Business details such as Business Type, Address, Beneficial owner details such as Name, Address, and Controller details. ITILITE does not store any of this information and only passes it to our third-party vendor, Dwolla, to verify the information in order to start allowing ACH payments.

- Admin to connect the bank account from which expense payouts would be processed (Funding Source)

- Employees to connect their personal bank accounts to which expense payouts would be processed from Individual -> Cards & Bank -> Bank page.

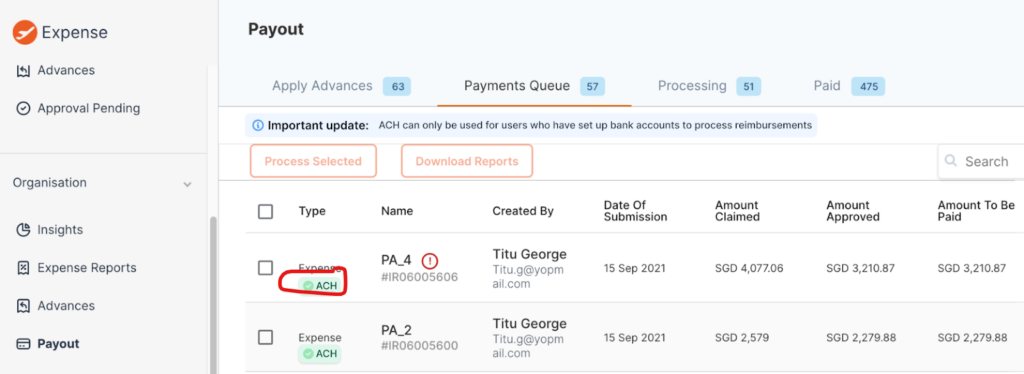

- Admins to process approved expense reports via ACH from Organization -> Payout -> Payments Queue screen for the reports eligible for ACH transactions.

- The organization has completed the Business verification on the ACH screen

- The organization has verified its Bank account

- The user to whom payout has to be made has connected their Bank account on the Bank screen

Note: Reports eligible for ACH transfers can still be processed Manually

Business Verification:

Organization -> Settings -> ACH -> Start Now

Key Terms:

- Account Admin The representative creating the business verified Customer on behalf of the business and Controller.

- Controller Any natural individual who holds significant responsibilities to control, manage, or direct a company or other corporate entity (i.e. CEO, CFO, General Partner, President, etc). A company may have more than one controller, but only one controller’s information must be collected.

- Beneficial owner Any natural person who, directly or indirectly, owns 25% or more of the equity interests of the company.

- Beneficial ownership certification An action taken by the Account Admin to confirm that the information provided is correct.

- EIN (Employer Identification Number) – A unique identification number that is assigned to a business entity so that it can easily be identified by the Internal Revenue Service.

Business Details:

| Aa Field | Description |

|---|---|

| FirstName | The legal first name of the Business Owner. |

| LastName | The legal last name of the Business Owner. |

| Email address of the Business Owner. | |

| DateOfBirth | The date of birth of the Business Owner. Formatted in YYYY-MM-DD format. Must be between 18 to 125 years of age. |

| SSN | Last four digits of the Business Owner’s social security number. If the admin is asked to re-submit the information for verification then the entire SSN might be required. |

| City | City of business’ physical address |

| PostalCode | Business’ US five-digit ZIP or ZIP + 4 code. |

| BusinessName | Registered business name. |

| DoingBusinessAs | Preferred business name — also known as a fictitious name, or assumed name. |

| EIN | Employer Identification Number. |

| First Name | First |

| Website | Business’ website |

| Phone | Business’s 10-digit phone number. No hyphens or other separators, e.g. 3334447777. |

Controller Details:

| Aa Field | Description |

|---|---|

| FirstName | The legal first name of the controller. |

| LastName | The legal last name of the controller |

| title | Job title of the Customer’s Controller. e.g. Chief Financial Officer |

| Date Of Birth | The date of birth of the controller. Formatted in YYYY-MM-DD format. Must be between 18 to 125 years of age. |

| SSN | Last four digits of the Controller’s social security number. Required for Controllers who reside in the United States. |

| address | Full address of the controller’s physical address. |

| Passport | Required for non-US individuals. Includes passport identification number and country. |

| BusinessName | Registered business name. |

Different Business verification statuses:

| Aa Field | Description |

|---|---|

| Verified | The identifying information submitted was sufficient in verifying the Customer account. |

| Reverification Needed | The initial identity verification attempt failed because the information provided did not satisfy Dwolla’s verification check. You can make one additional attempt by changing some or all the attributes. All fields are required on the retry attempt. If the additional attempt fails, the resulting status will be either ‘document’ or ‘suspended’ |

| Document Needed | Dwolla requires additional documentation to identify the Customer in the document status. Once a document is uploaded it will be reviewed for verification. |

| Suspended | The Customer is suspended and may neither send nor receive funds. Contact the Account Manager for more information. |

Steps to reduce chances of Document upload being rejected:

- All 4 Edges of the document should be visible

- A dark/high contrast background should be used

- At least 90% of the image should be the document

- Should be at least 300dpi

- Capture image from directly above the document

- Make sure that the image is properly aligned, not rotated, tilted or skewed

- No flash to reduce glare

- No black and white documents

- No expired IDs

Supported Document Types for Controllers:

- Non-expired State-Issued Driver’s Licence/Identification Card

- Non-expired US Passport

- Federal Employment Authorization Card

- US Visa

- Non-expired Foreign Passport Note: Foreign Passports are only accepted when the individual does not have an ITIN or SSN and the user must alternatively enter the Passport number.

Supported Document Types for Business:

- Other business documents apart from those mentioned below may be acceptable on a case-by-case basis.

- Partnership, General Partnership: EIN Letter (IRS-issued SS4 confirmation letter).

- Limited Liability Corporation (LLC), Corporation: EIN Letter (IRS-issued SS4 confirmation letter).

- Sole Proprietorship: Sole Proprietorships can be verified by uploading Business documents as well as Personal IDs. Acceptable documents include one or more of the following, as applicable to your sole proprietorship:

- Fictitious Business Name Statement,

- Certificate of Assumed Name; Business Licence,

- Sales/Use Tax Licence,

- Registration of Trade Name,

- EIN documentation (IRS-issued SS4 confirmation letter),

- Personal documents:

- Color copy of a valid government-issued photo ID (e.g., a driver’s license, passport, or state ID card).

Beneficial owner details:

| Aa Field | Description |

|---|---|

| firstName | The legal first name of the Beneficial Owner. |

| Lastname | The legal last name of the Beneficial Owner. |

| SSN | Full nine digits of the Beneficial Owner’s social security number. |

| date of birth | Beneficial owner’s date of birth in YYYY-MM-DD format. Must be between 18 to 125 years of age. |

| address | Street number, street name of Beneficial Owner’s physical address |

| passport | Required for foreign individuals. Includes passport identification number and country. |

Bank Verification for Organization/User:

Bank Accounts can be verified by entering the following details

- Routing Number

- Account Number

- Account Type

- Account Name

Once we can identify your Bank correctly, the user has to enter the User ID and PIN/Password of the account to verify the account. A maximum of 2 attempts are allowed to verify the Bank account.

In the scenario that the maximum attempts to verify the account are exceeded, the status changes to ‘Verification pending’ and the process moves to the Micro-deposit verification stage.

Micro Deposit Verification:

Automatically 2 micro deposits of less than .10 USD are initiated to the bank account if the conventional route to verify an account fails. This deposit may take 1-2 business days to reflect in the account statement. Once these amounts reflect in the account statement, the user can re-attempt to verify their account by entering the exact two amounts in the form available on the Bank verification page.

- Click on Verify

- Enter the 2 micro-deposit amounts in any order

- Verify the amounts

In case the micro-deposit option is not visible on the platform, do reach out to your Account manager in order to get your bank account verified.