5x faster expense reimbursements

Expedite the spend reimbursement process through faster filing of expenses and automated audits

Establish control, mitigate risks

A comprehensive expense management solution that helps you establish internal controls on the expense reimbursement process and mitigate the risk of processing incorrect expense claims

Enable lightning-fast expense reimbursements

Facilitate smooth flow of expense data from ITILITE to ERP by creating unlimited General Ledger (GL) based categories

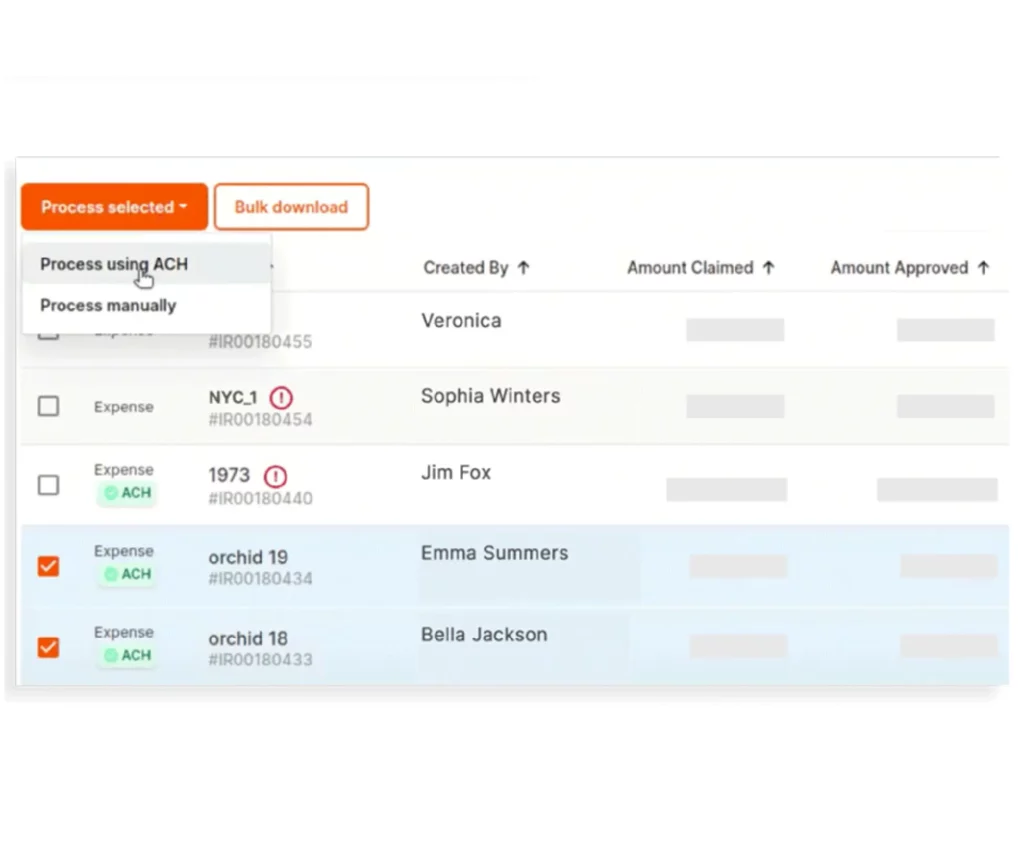

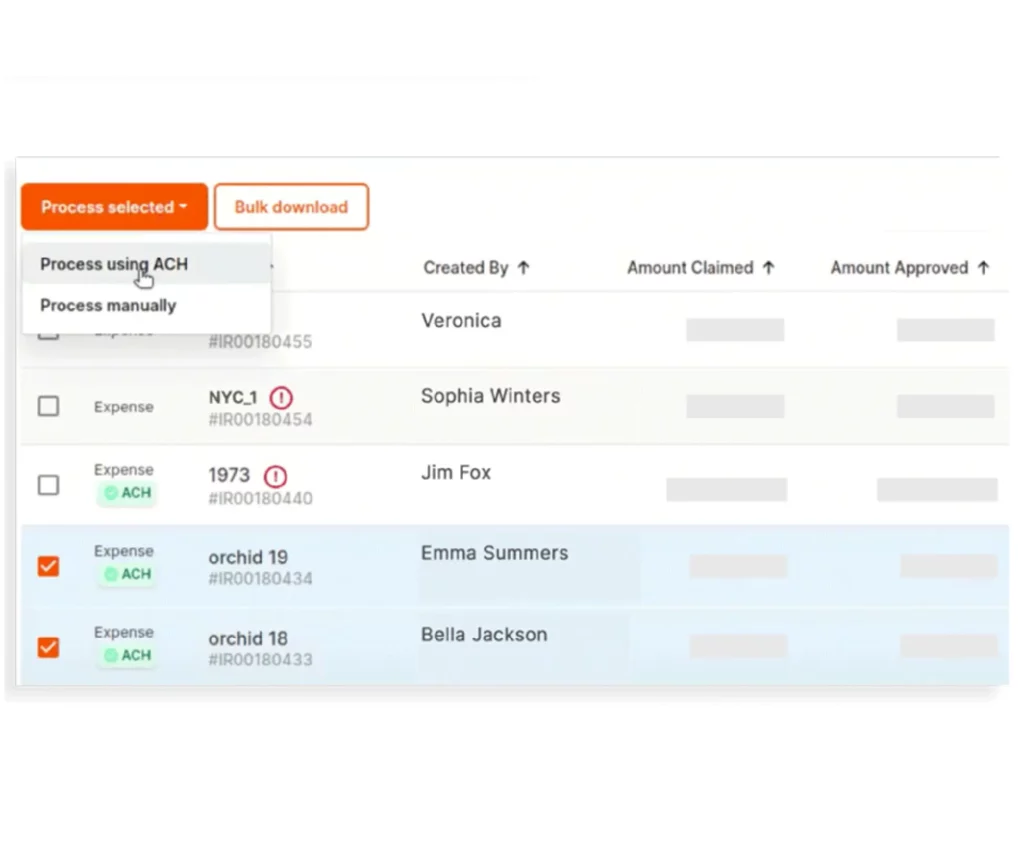

Reimburse expenses directly into employee bank accounts with a single click using ACH (US only) payments.

Automate payment updates to your ERP/ Accounting software with seamless integrations.

Simplify the expense filing process

Empower employees with smart scanning of receipts with in-built OCR technology that can read receipts and create draft expenses

File expenses faster using your existing personal/corporate credit and debit cards. Add yours from 10,000+ bank options on ITILITE.

Enable auto-creation of draft expenses for flights, hotels and rental cars when employees complete travel bookings on ITILITE Travel

Automate policy compliance and audit checks

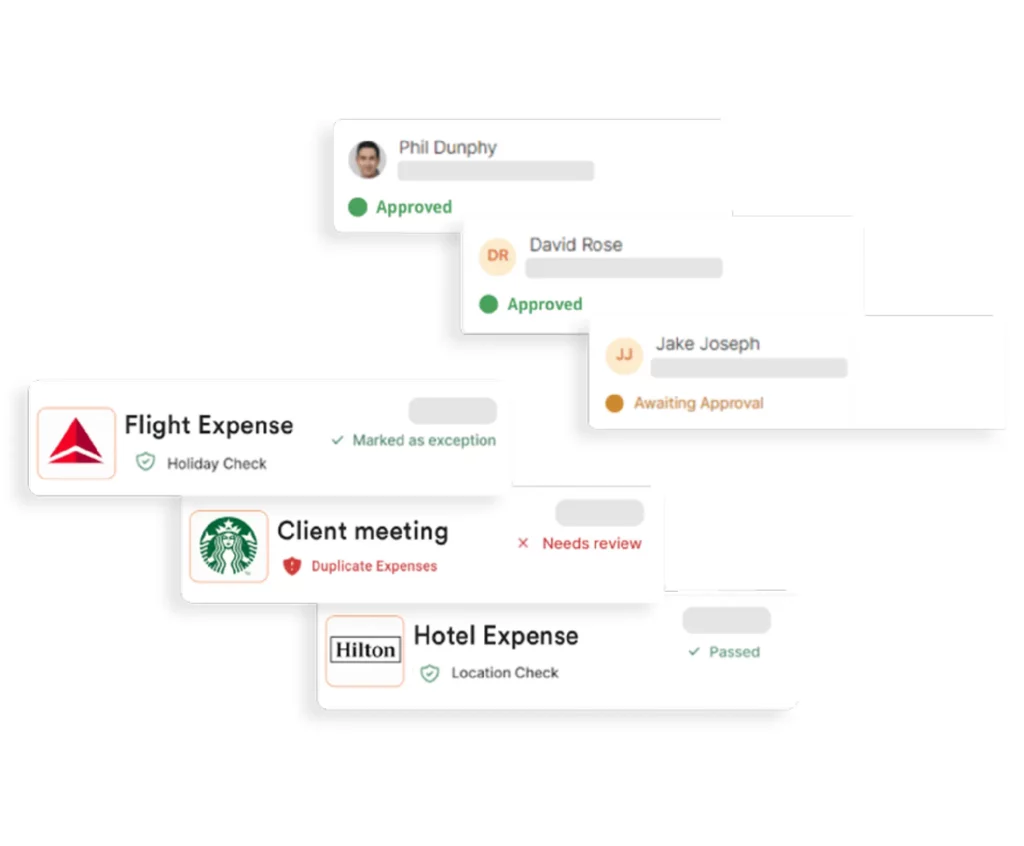

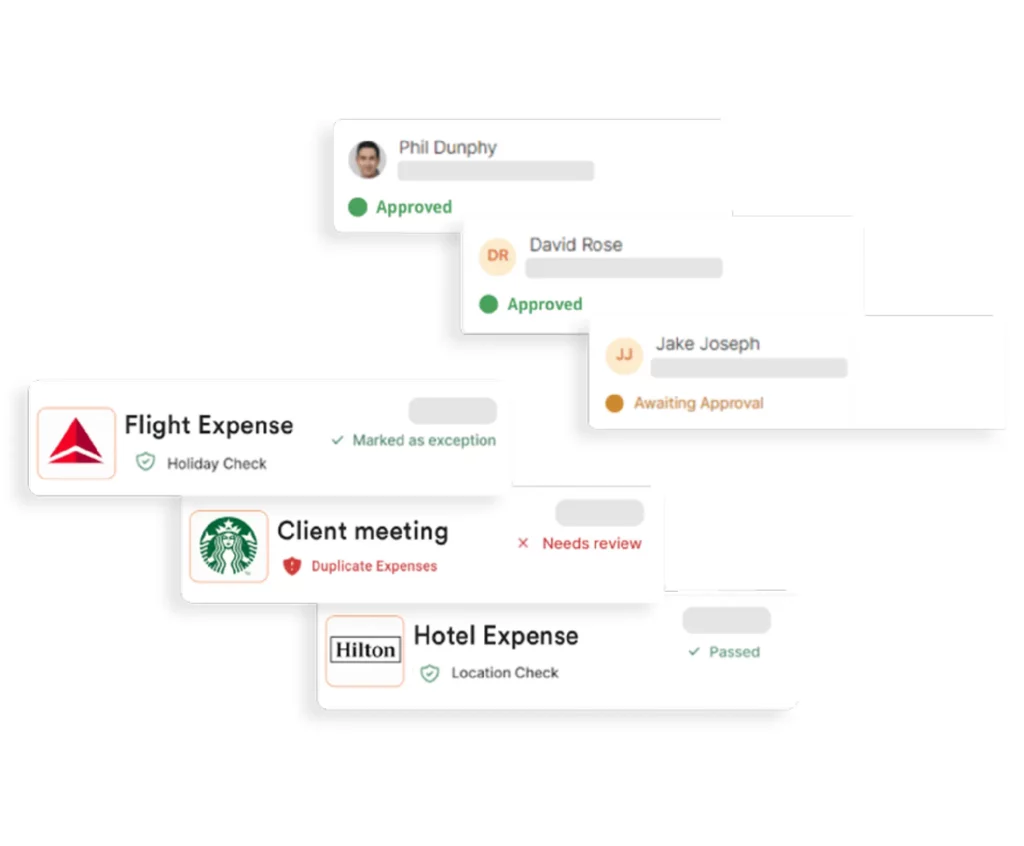

Pre-setup expense policies by categories and let employees know if they are filing any expense that is outside policy limits.

Prevent expense fraud by flagging duplicate receipts, weekend spends, and out-of-policy expenses.

Capture approval flows & leave comments against each expense rejected or approved

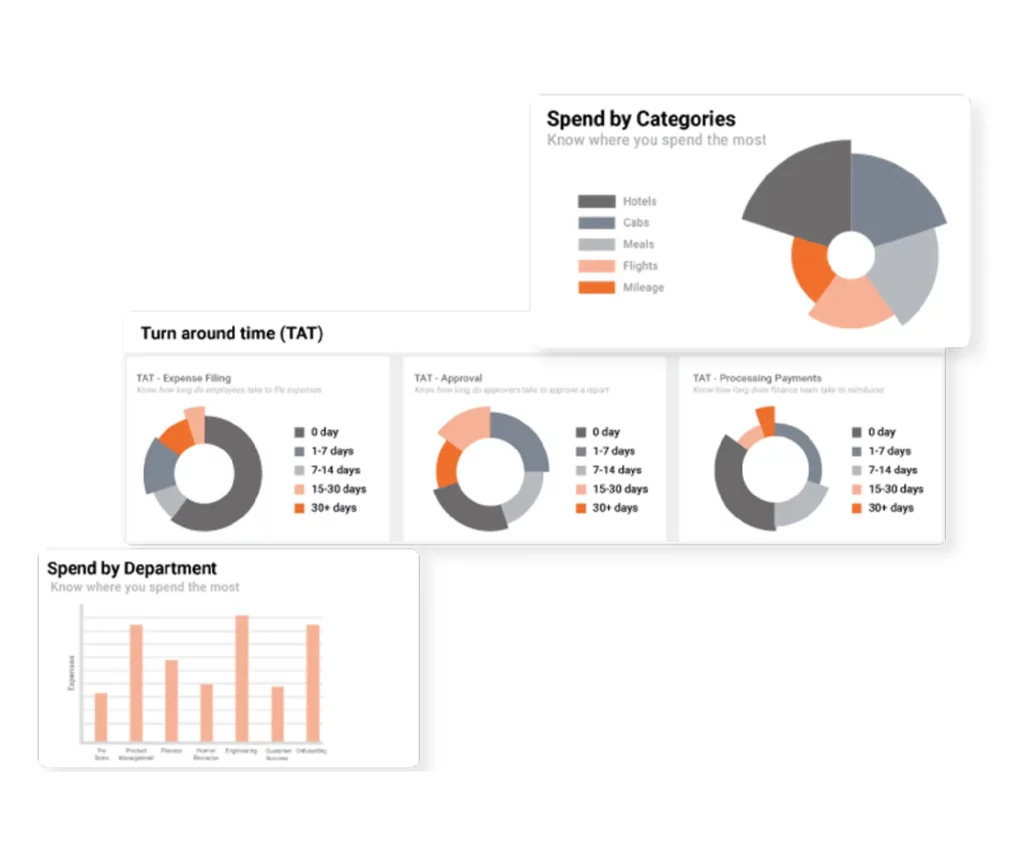

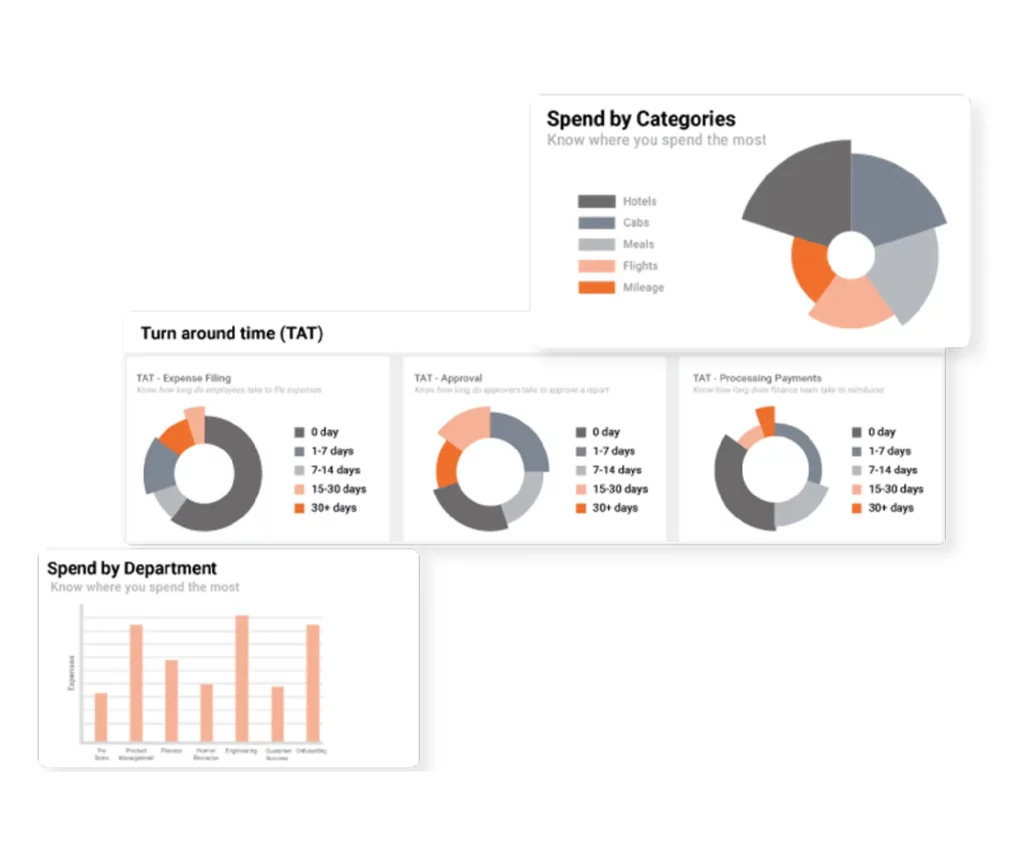

Identify trends in employee spending with real time insights

Understand your employees’ spending behaviour by scheduling custom reports to your inbox or build custom dashboards

Predict future expenses by getting visibility on draft expenses your employees are yet to file.

Dig deeper into reimbursement processes by getting a live view of time taken to file, approve and reimburse expenses to identify trends.

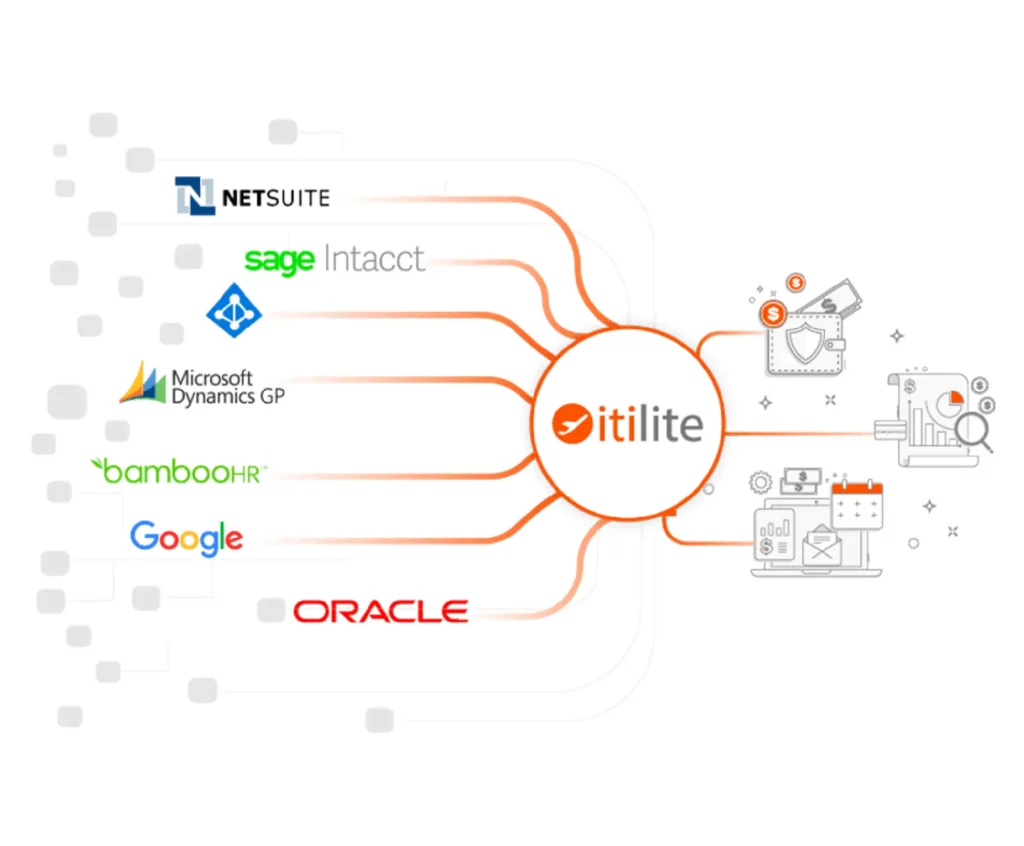

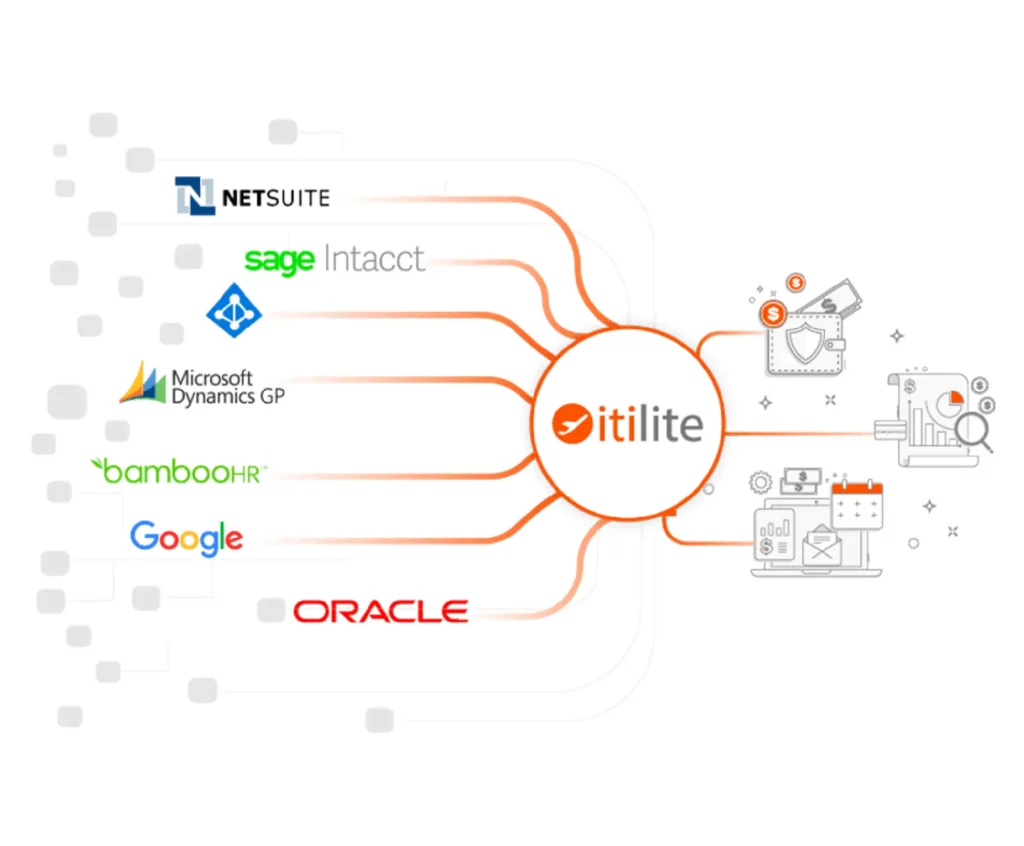

Interconnected systems streamline flow of travel & expense data

Self-configure out-of-box integrations with leading ERP systems like Quickbooks, Oracle, Sage, Freshbooks, Zohobooks & many more.

Integrate with all leading HRIS and SSO systems such as Darwinbox, Bamboo HR, Google, Azure ADFS and so many more!

Get travel data to flow automatically from ITILITE Travel and view all travel-related expenses together. Know more.

The expense system has been smooth and really helpful. It lets us manage expenses and reimburse our employees faster than ever before, making things much easier for everyone.

Best in class features so that you don’t miss out on anything

No setup fee, no monthly commit

-ment and no hidden costs. Pay only when a user files an expense or submits an expense reports

Remind employees to file expenses and managers to approve automatically

Create and manage custom expense categories per your business requirement

Configure per diem rates and custom fields required for the submitter to file per diem expenses.

Avail 24×7 human-powered customer support through calls, chats, and emails.

Get started with ITILITE Expense in hours, not weeks.

Access 10,000+ credit/debit cards and file for fuel expenses hassle-free with Wex cards

Manage and pay cash advances to employees or departments for vendor payments

Manage your team's expenses the right way

Get a comprehensive expense management platform and streamline your employee expense reimbursement process.

Frequently asked questions (FAQs)

Does itilite enable reimbursement of only travel related expenses?

No. Itilite enables a company to reimburse any type of expense. For example, expenses like meals, subscription based purchases, etc can also be easily reimbursed on Itilite.

How do reimbursement approvals work in itilite?

itilite offers two critical capabilities for approvals:

- Rule-based approvals

- Multi-level approvals

Once a user submits a reimbursement request, approvals are automatically routed to designated approver(s) based on the rules set up. Once approved, each request lands in the Payout queue for the Accounting / Accounts Payable team to audit it.

How can digitizing expense reimbursement through itilite save time?

itilite helps reduce the time consumed in each reimbursement step. For example,

- Users spend 80% less time filing requests due to features like Automated Receipt Scanning using OCR, Automated Credit Card reading, and Email forwarding expense creation

- Approvers spend less than 1 minute to approve because of intuitive approval notifications, outside policy tagging that reduces time to review

- Accounts Payable team’s work is reduced by >50% due to features like ACH payouts and ERP integrations (itilite integrates with all major ERPs such as Netsuite, SAP, Oracle, etc.)

What features does itilite offer that help me reduce reimbursement leakages?

Two of the core features of itilite—out-of-policy tagging and fraud detection—help reduce leakages. The software automatically tags expenses as Duplicates/out-of-policy so that Approvers and Accounts Payable teams can prioritize them for review.

Does itilite integrate with Credit Card feed to simplify reimbursement?

Yes, itilite is pre-integrated with all major Credit Card programs and banks.

Can you scan the receipts automatically?

Yes. The itilite mobile application offers OCR-based receipt scanning (with among the highest accurate read rates).

Do you integrate with accounting systems?

Yes. itilite integrates with all major accounting systems (e.g., Netsuite, SAP, Oracle) and other enterprise systems such as HRMS, SSO, CRM, etc.

Can I customize reimbursement rules per my company's expense policy?

itilite offers a customizable and intuitive rule engine for reimbursements. The platform administrator can set up policies and choose applicable employee groups or departments to which it should apply, all on the platform itself.

Does itilite support reimbursements in multiple currencies?

Yes, a user can apply for expense reimbursement incurred in any currency.

For reimbursing employees, what payment methods does itilite support?

Companies can pay employees with a Single Click, using itilite’s ACH payment method. Alternatively, they can download a Payout file for their ERP / Bank Account and make payments.