Business travel expense management is one of the most challenging expense categories for an organization. Year-on-year, companies face significant losses due to fraudulent travel expense claims. Such expenses are significant overheads that can become a burden on the company’s financial bottom line if left unchecked.

So, what can you do to avoid travel expense reimbursement errors? The answer is regular travel and expense(t&e) audits.

Let’s understand what a travel and expense audit means, how it can help you combat expense fraud and how your organization can conduct it seamlessly.

What is Travel and Expense Audit?

When employees take a business trip, they incur travel expenses like commutes, food, vehicle parking, etc. After that, they submit all the expense receipts for approval and reimbursement. The process of checking the validity of those business travel expense claims submitted by employees is known as a travel and expense (T&E) audit.

The finance department is responsible for undertaking regular t&e audits. It helps them get insights into travel expense data, control travel costs, and ensure travel policy compliance.

Why Conduct a Travel and Expense Audit?

1. To Analyze Travel Expense Reports.

You need to examine whether all the expense claims are materially sound by matching records with receipts and determine what kind of expense claims have been filed and approved.

2. To Detect Suspicious Claims.

After analyzing the travel expense reports, you may find some dubious claims. For example, an employee visits multiple unknown local sites during international travel. By conducting a t&e audit, you can identify such claims and inquire how these visits are business-related and identify whether the employee is committing expense fraud.

3. To Inspect the Company’s Travel Policy Compliance.

With frequent audits, you can analyze how strictly your company’s travel policy is being implemented by looking at the number of violations. If there are multiple violations, you should check whether the company policy is practical and whether the employees can understand it clearly.

4. To Improve the Travel and Expense Management Process.

Conducting a regular travel audit can help you discover the bottlenecks in your travel and expense management process. For instance, you might find out that employees can authorize their expenses due to a vague policy clause causing overspending. After discovering such loopholes, you can take the necessary steps to mend your travel and expense management process.

5. To Gain Unbiased Expense Insights

When thoroughly analyzing various expense reports while conducting a t&e audit, you can get data-based insights into employees’ spending habits. With this information, you can detect the non-essential expenses and take action to prevent employees from incurring them in the future. Moreover, you can track department-wise travel expenditure and segregate the cost-heavy and saving-heavy departments.

Getting insights into your employees’ spending habits can help you curb unnecessary travel expenditures and maintain your company’s bottom-line results.

What are the Challenges in the Travel and Expense Audit Process?

1. Manual Processing

If your company has multiple employees and you require physical copies of expense receipts as proof, you will end up with an overwhelming amount of receipts.

Moreover, using spreadsheets to manage travel expense data manually can cause data irregularities. Irregular data can lead to disorganized audits because the auditors will have to spend significant time double-checking the claims.

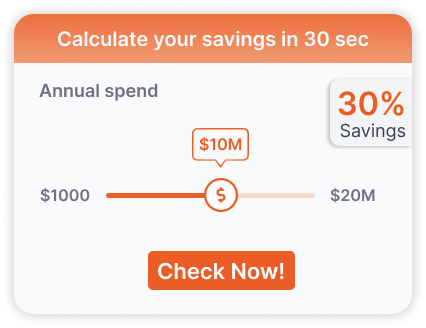

To optimize your travel and expense management costs, consider automating your travel and expense audit process. By doing so, you can eliminate errors, reduce fraud, and ensure compliance with corporate travel policies. Our savings calculator can estimate your potential savings on travel and expense management expenses by implementing an automated t&e audit process. Click here to access the calculator and learn more.

2. Complicated Travel Policies

If your travel policies are complex, employees are reluctant to go through them thoroughly. Hence, they may skim through the policy document and miss crucial points. Therefore, accidental instances of non-compliance can increase. Conducting travel and expense audits with many cases of non-compliance will increase the claim rejection rate and make the process difficult.

Draft more comprehensive and straightforward travel policies to reduce non-compliance cases and simplify t&e.

3. Employee Disputes

When the expense receipts submitted by employees don’t reconcile with the travel policy, the finance team has to reach out to employees personally and engage in a lengthy back-and-forth to justify the claims. The process can get complicated and frustrating and hinder the travel and expense audit.

Ease the reconciliation process with the help of business travel and expense management software to speed up the audits.

How to Manage the Travel Expense Audit Procedure?

1. Evaluate your Travel and Expense Management Process.

A thorough evaluation of your travel and expense management process will help you determine the policy-related flaws and fix them. The assessment should include creating travel expense checklist, checking bookings, pre-trip approvals, and final authorization.

Look for policy loopholes and workflow overlaps- no employee should be allowed to approve their expense claim. A clear workflow ensures that no suspicious expenses are approved, making audits easier.

An integrated travel and expense management system can help you improve the health of your T&E processes significantly. Check out the T&E health calculator below in order to know where your organization currently stands and the scope for improvement.

2. Check your Travel and Expense Policy.

If you draft a clear travel and expense management policy, it will help reduce cases of non-compliance. Conducting t&e audits with lower non-compliance will be easier.

So, while making a travel policy, you should clearly define the roles of various stakeholders and set up a practical budget limit. Your policy should be understandable to the employees to comply with. Additionally, If your employees can view the policy in real-time while booking, they will be able to keep away from going over budget.

3. Impose Expense Submission Deadlines for Manual Audits.

If your finance team audits the expenses manually, and all your employees file expenses close to the reconciliation time, it burdens the auditor. Therefore, they will not be able to go through all the expenses to verify their validity.

Conducting travel and expense audits becomes futile if the auditors cannot adequately examine expense reports. Hence, it is essential to impose a submission deadline on employees if you plan to conduct a manual audit so that the auditors have the required time to validate the expense reports and gain insights.

4. Choose Selective Reports for a Thorough Examination.

If the auditors scrutinize each expense report for historical data, the travel and expense audit will become time-consuming and strenuous.

Therefore, when choosing audit reports, they should pick their battles and select a few pieces for detailed examination. Reports from travel-heavy departments like sales will be more extensive and give a better overview of the nature of expenses.

5. Conduct Travel and Expense Audits Before Reimbursement.

If you conduct a travel audit before reimbursing the expenses, you will save time and energy. Your finance team will not have to extract the funds issued to non-compliant claims. However, if you audit before reimbursement, it can cause more delays in the process.

Opting for automated business travel and expense management software to help employees file expense claims in real-time and send the expense reports for approval promptly will speed up the process.

6. Verify all Financial Records

The final step in conducting a seamless travel audit is the verification of all the financial records until all the errors are resolved. To verify financial records, your finance team has to re-calculate all the expense reports and investigate any leftover suspicious claims. They must carry out this process until they can explain all the discrepancies and suggest corrective actions.

How can Expense Management Software Aid Seamless Travel and Expense Audit?

An automated expense management software solution can make audits easier by automating your company’s travel and expense management process.

Let’s look at how automating the t&e management process will help make the audits easier.

1. Real-Time Receipt Submission

Travel and expense management software offers digital receipt management through which your employees can submit their expense receipts as and when incurred. They can also create an expense report and send it for approval to their managers promptly. As a result, there are no data irregularities, making travel and expense audits error-free.

2. No Over-Budget Booking

A unified travel and expense management software like itilite allows you to set a budget limit according to employee level, departments, etc. and only offers policy-compliant booking options. As a result, there are no over-budget bookings and policy violations, making the t&e audit faster.

3. Clear Workflow

Travel and expense management software creates a detailed workflow in your organization by defining who will be responsible for which approval. Therefore, it significantly reduces the chances of the finance team approving a suspicious claim because each claim has to go through multiple checks.

Select the Right Software for Seamless Travel and Expense Audit

Conducting regular t&e audits can help you control travel costs, increase travel policy compliance, and gain insights into your organization’s travel expense data.

You can enhance the efficiency of your travel and expense audit by automating your expense management process with the help of itilite travel and expense management software. itilite offers you an automated audit and fraud detection feature that auto-flags duplicate claims, weekend spending and out-of-policy claims. This ensures fraud-free expense management process and helps in saving your finance team’s time as they do not need to validate each claim individually.

We offer a free demo of itilite with all the features so that you can experience improved expense management yourself.