TL;DR: Where Are Companies Turning as They Reconsider Navan?

Navan is popular for corporate travel and expenses, but in 2026 many companies are questioning if it really delivers on customer support, savings, and transparency. Common concerns include AI-powered customer support during travel disruptions, inconsistent savings, and hidden fees that adds up as the frequency of travel increases.

Companies these days are prioritizing platforms that offer savings, predictable pricing, and fast access to human support when things go wrong. Some have started exploring options like Amex GBT, BCD Travel, Emburse, and TravelBank while others are exploring options that address these issues – like ITILITE, which has gained traction for delivering on its promises.

Navan alternatives—a quick summary:

| Platform | Key Features | Key Differentiators vs Navan | Pricing |

| ITILITE | Travel + expense + cardsIncentivized cost-conscious bookingPolicy automationAdvanced analytics | Human-led support (sub-10s)Guaranteed hotel savings (20%+)No inventory biasHigh cashback cards | $10 per trip (travel)$9 per active user/month (expense)No platform or support fees |

| Amex GBT | Global booking networkAgent-assisted travelRisk management tools | Strong global reachHuman counselors availableEnterprise-grade support | Contract-basedVariable service & support fees |

| BCD Travel | Global TMC coverageAgent + self-service modelTraveler tracking | Strong consulting supportHotel rate monitoring | Custom pricingMembership + booking fees |

| Perk (TravelPerk) | Global inventoryFlexible cancellations | Fast human supportFlexiPerk refunds close to travel | $99–$299/month+ ~3% booking fee |

| TravelBank | Travel + expense managementRewards-based bookingMobile-friendly | Cost incentives for employeesSimple policies | Free (≤20 users)Paid tiers from ~$5K/year |

| SAP Concur | Travel + expense automationERP integrationsCompliance controls | Deep finance integrationEnterprise reporting | $5–$20 per bookingExtra fees for modification |

| Emburse | Expense automationPolicy enforcementReal-time spend visibility | Finance-first controlsStrong expense analytics | $8–$12 per user/month |

| Ramp | Corporate cardsExpense automationSpend controls | Strong finance automationSmart card controls | ~$15 per user/month |

Introduction

For a long time now, Navan has been one of the leading platforms for corporate travel management. It offers travel booking, including hotels and flights, expense management, and corporate cards on a single platform. Given these features, it has emerged as an all-encompassing alternative to traditional travel management companies or booking websites. For many tech and software-first companies, Navan delivers some clear benefits: a consumer-friendly booking experience, easy expense tracking and reconciliation, and the ability for employees to earn loyalty points while traveling for work.

However, as the volume of corporate travel has increased, and companies and employees have become savvier and more knowledgeable, they have voiced some concerns with Navan and started looking for alternatives. The main reasons behind this shift include lack of reliable customer support when things go wrong and less-attractive savings on hotels and flights. Increasingly, companies are exploring alternatives that offer greater transparency, stronger savings, and more dependable customer service.

More on why users are exploring alternatives to Navan:

While Navan is often praised for its user interface and booking experience, many user reviews and discussions on community forums like Reddit have brought forth some recurring concerns. These concerns are not only about surface-level features but also ask deeper questions about the core value proposition and whether Navan delivers on it or not.

1. Questionable customer support during critical moments

One of the most common pain points the users have highlighted is related to Navan’s customer support. Several travelers reported being routed to AI chatbots during urgent situations like flight cancellations, missed connections, or last-minute changes in plans. While AI can be efficient – and faster – for simple queries, it often fails to provide effective support when travelers are stranded and need immediate human assistance.

In some reviews and forum discussions, customers have described long hold times, sometimes exceeding 30 minutes, which further delays resolutions during time-sensitive situations. Unreliable support during business travel can translate directly into losses in business, lower productivity, and frustrated employees.

2. Growing scrutiny over actual savings

One of Navan’s major value propositions, as mentioned on their website, is increased savings for companies. But a closer look has revealed that hotel rates on Navan are not as attractive as they should be. When users are booking a consolidated travel program, they should enjoy at least 20% discounts in most cases compared to when they book directly. But more often than not, these savings are not realized.

3. Inventory and pricing bias

Another issue that has been discussed by users is inventory bias. Some customers claim Navan seems to prioritize certain hotel options based on commissions that Navan earns rather than the lowest available rate or best value for the traveler. This may work well in the short run, but over time, it can erode customer trust.

4. High transaction fees and unexpected charges

Although Navan has a free plan, many users have reported that it ends up charging a per-trip fee of up to ~$25. This comes along with service charges which the customer is not made aware of earlier. When these fees are not clearly stated upfront, they can lead to financial surprises and friction between travel, finance, and accounting teams.

What are the top Navan competitors worth exploring?

1. ITILITE

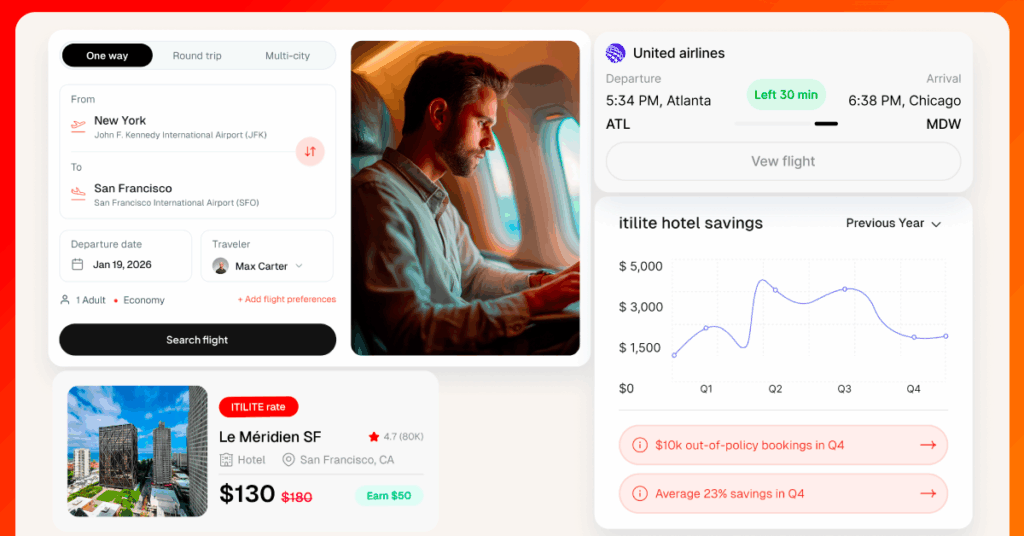

ITILITE is an all-in-one travel, expense, and corporate card platform catering to modern, cost-conscious businesses. It is among the fastest-growing travel and expense management companies globally.

ITILITE offers a clean, user-friendly experience and stands out from its competitors by focusing sharply on two things that matter most to finance teams and those who are actually traveling: real savings and reliable, human-led customer support. For companies looking for alternatives to Navan, ITILITE is a strong, value-driven replacement.

ITILITE’s key features and benefits

- Savings rewards that influence user behavior: ITILITE actively nudges its clients’ employees toward cost-conscious options during booking. Users are rewarded for selecting lower-cost flights, hotels, or rental cars. Thus, ITILITE helps organizations with reducing corporate travel costs.

- Guaranteed hotel discounts: ITILITE guarantees at least 20% lower hotel prices compared to rates that are available on online booking websites.

- Flexible policies and approvals: Business travel policies can be customized by employee level, flight class, hotel categories, city-specific spend limits, and more. Approval chains are equally flexible, which enables organizations to control travel without appearing heavy-handed.

- Human-driven, 24/7 customer support: Customer support is ITILITE’s core value proposition. The platform offers round-the-clock, human-driven support, ensuring travelers can connect with a real agent within seconds, regardless of where they are in the world.

- Corporate cards with cashback: ITILITE issues its own physical and virtual corporate cards with spend and merchant controls. Companies can earn up to 2.5% cashback on all card spends, which is higher than many other companies, which cap cashback at 1%.

- Automated expense reconciliation: Employees can swipe cards and upload receipts on the go, while expenses are automatically created, categorized, and tagged to the correct GL codes which can then be reconciled in the ERP, reducing manual effort.

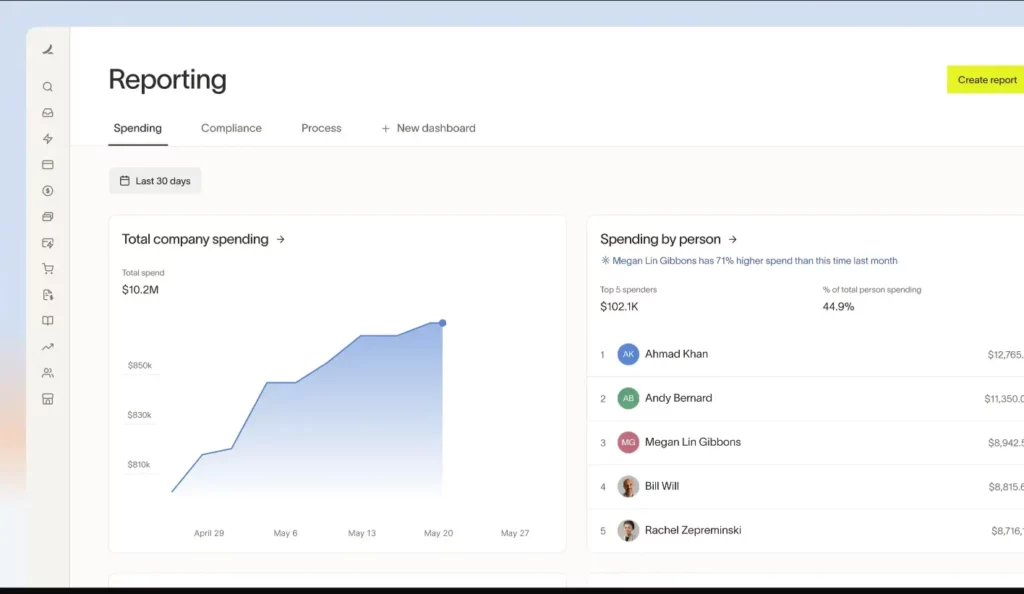

- Advanced reporting and analytics: ITILITE lets you create unlimited custom reports at no additional cost. Its AI-powered modules, Iris and Mastermind, contribute to this. Iris is a conversational chatbot that can answer queries related to travel and expense data, while Mastermind provides actionable recommendations to reduce spend on travel by benchmarking key metrics with peer companies.

Key differences between ITILITE and Navan

- Customer support is the most visible differentiating factor between ITILITE and Navan. While Navan relies heavily on AI bots for customer support, ITILITE remains firmly human-led. This is something many companies prioritize during high-value and high-stress travel situations.

- Savings is another key difference. In many cases, hotel prices on ITILITE’s portal are 10-25% lower than the same listings on Navan for the same property and dates.

- ITILITE issues its own card which enables higher cashback rewards (up to 2.5%) compared to Navan’s third-party card partnerships.

ITILITE pricing:

- Travel: $10 per trip

- Expense: $9 per active user per month

- No platform fees, no integration fees, and no support charges

This transparent pricing structure makes it easier for finance teams to forecast and calculate costs without unexpected add-ons.

2. Amex GBT

American Express Global Business Travel (Amex GBT) is a popular corporate travel management company which has integrated tools for travel booking, travel policy compliance, expense tracking, and traveler support. It operates across 140+ countries, and has a large network of travel partners.

Amex GBT’s key features and benefits

- Comprehensive booking and itinerary tools: Amex GBT allows companies to book flights, hotels, rail, and ground transport in one platform, with integrated policy compliance and reporting.

- 24/7 traveler support: The platform offers 24/7 assistance through travel counselors and digital channels in case there are itinerary changes or disruptions.

- Risk management: Amex provides real-time alerts and support for travelers which allows organizations to ensure the safety of their employees.

- Expense integration & analytics: Amex GBT’s platform includes automated expense tracking, reporting dashboards, and analytics to give finance teams insights into travel spend and compliance.

Key differences between Amex GBT and Navan

- Amex GBT and Navan differ on how modern their platforms and pricing models are. Amex GBT operates more as a traditional travel management company. Navan, on the other hand, positions itself as a tech-driven travel company which offers users an intuitive interface and clearer pricing.

- Navan is also largely transparent about its costs, whereas Amex GBT’s pricing is contract-based, with service fees and support costs varying by client and usage.

- Amex GBT provides support to its clients through counselors and agent networks, while Navan relies more on automation and AI.

Amex GBT’s pricing

- Amex GBT does not have a publicly listed rate. Instead, bookings are contract-based and vary by company size, travel volume, and negotiated terms.

3. BCD Travel

BCD Travel is one of the world’s largest corporate travel management companies and serves clients in more than 170 countries. It helps businesses manage travel with a combination of technology and human support. It brings together its own digital tools with human travel experts to provide a seamless travel experience to its clients.

BCD Travel’s key features and benefits

- Global corporate booking capabilities: This facility is offered across flights, hotels, rail, and ground transport, with options for both self-service and agent-assisted trips.

- Mitigating travel risk: BCD Travel does this with real-time alerts, traveler tracking, and crisis support.

- Hotel price assurance: Companies can monitor rates and rebook a hotel if rates lower during the cancellation window.

- It also gives travel managers visibility into spend and compliance.

Key differences between BCD Travel and Navan

- BCD Travel and Navan differ most in operating model and user experience. BCD Travel works like a traditional travel management company with agent-assisted services whereas Navan is a technology-driven platform focused on self-service booking and unified travel + expense management.

- Navan focuses on providing users with a modern interface and integrated expense tools, while BCD focuses on global coverage and consulting.

BCD Travel’s pricing

- BCD Travel uses custom pricing based on contract terms rather than per-user or per-trip fees. For its BCD Travel Direct offering (a packaged self-service + expert support model), pricing includes a membership or service fee plus additional fees for bookings such as air travel or hotel.

- Because pricing varies, companies have to request a quote.

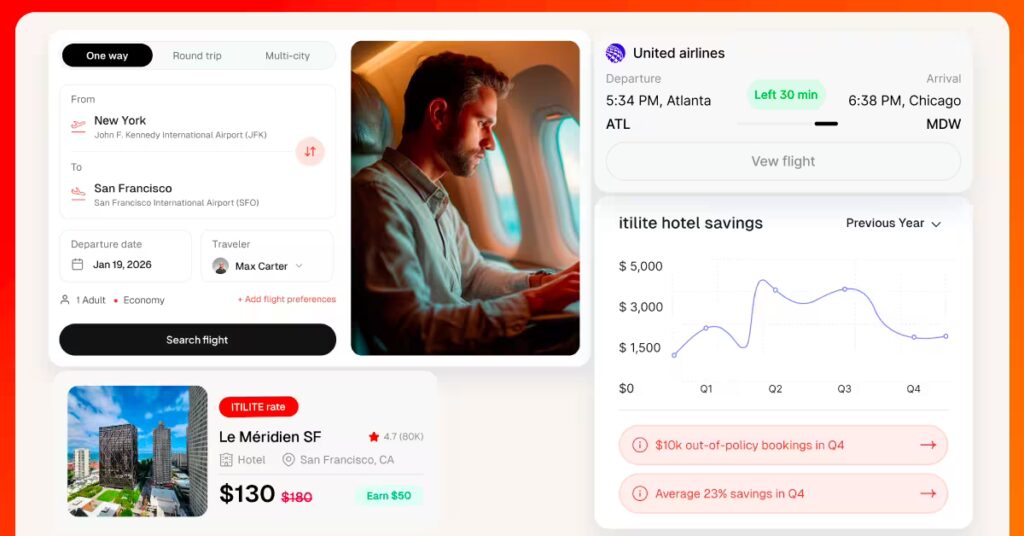

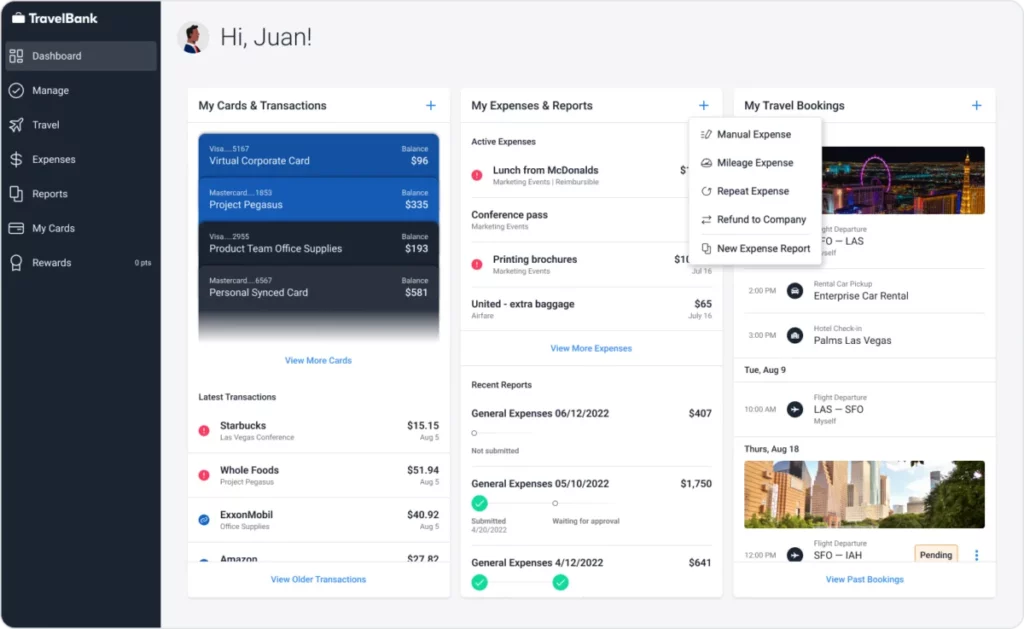

4. TravelBank

TravelBank is a travel and expense management platform that helps businesses book flights, hotels, and cars, while also managing travel policy, spend controls, and reimbursements. It has a rewards program to encourage cost-conscious booking, and is often used by small- to mid-sized companies.

TravelBank’s key features and benefits:

- Integrated travel + expense booking: Flights, hotels, and car rentals are managed within a single interface, and policy controls and approval are part of the system.

- Rewards and cost incentives: TravelBank incentivizes employees to choose cost-effective travel options and helps organizations reduce spend.

- 24/7 support: Dedicated travel support is available around the clock through phone, chat, email, and platforms like Slack.

- Mobile + desktop experience: It has a user-friendly interface that works on both, desktops as well as mobile phones.

Key differences between TravelBank and Navan:

- Navan offers access to more complex, real-time analytics and spend insights for larger, data-driven travel programs, while TravelBank’s reporting is more basic and suited to simpler budgets.

- Navan has more sophisticated rule-based travel policies that also account for employee needs, whereas TravelBank’s policy controls are simpler and effective for smaller teams.

TravelBank’s pricing:

- Starter: Free for up to 20 users.

- Premium: Starts around $5,000 per year with additional oversight tools and a travel rebate

- Elite: Around $10,000 annually with deeper insights, integrations, and a 2% travel rebate.

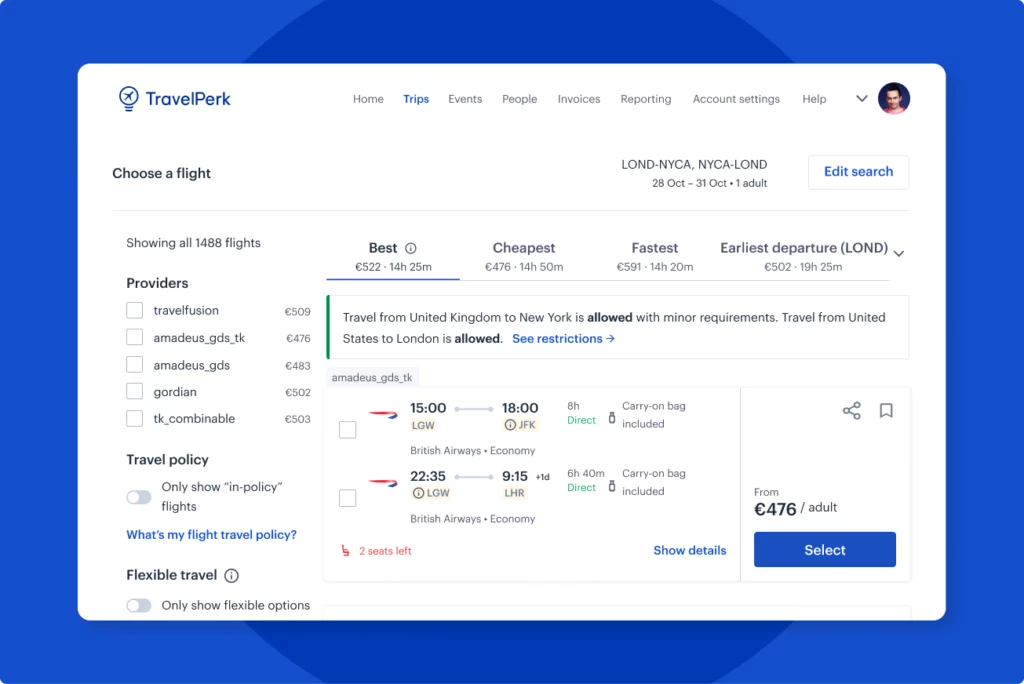

5. TravelPerk (now Perk)

Perk (formerly TravelPerk) is a corporate travel and spend platform which aims to simplify business travel booking, policy compliance, expense workflows, and spend visibility in a single interface. The company rebranded from TravelPerk to Perk in 2025 as part of a strategic evolution toward a broader travel and spend management platform.

Perk’s key features and benefits:

- Extensive global travel inventory: Perk provides access to flights, hotels, car rentals, etc., from multiple suppliers with negotiated rates.

- 24/7 customer support: It targets a response time of 15 seconds, ensuring travelers have timely access to help if they need it.

- Flexibility with FlexiTravel: Customers have the option to cancel bookings up to two hours before the trip with refunds of 80% of the fare under flexible plans.

Key differences between Perk and Navan:

- Perk offers flexible travel with features like FlexiPerk (cancellable bookings close to departure), making it attractive for teams with changing plans. Navan focuses more on policy enforcement and program-level optimization.

- Perk offers fast human support, especially for cancellations and changes. Navan relies more on automation and AI-led flows first.

Perk’s pricing:

- Premium: $99 per month + 3% of booking value

- Pro: $299 per month + 3% of booking value

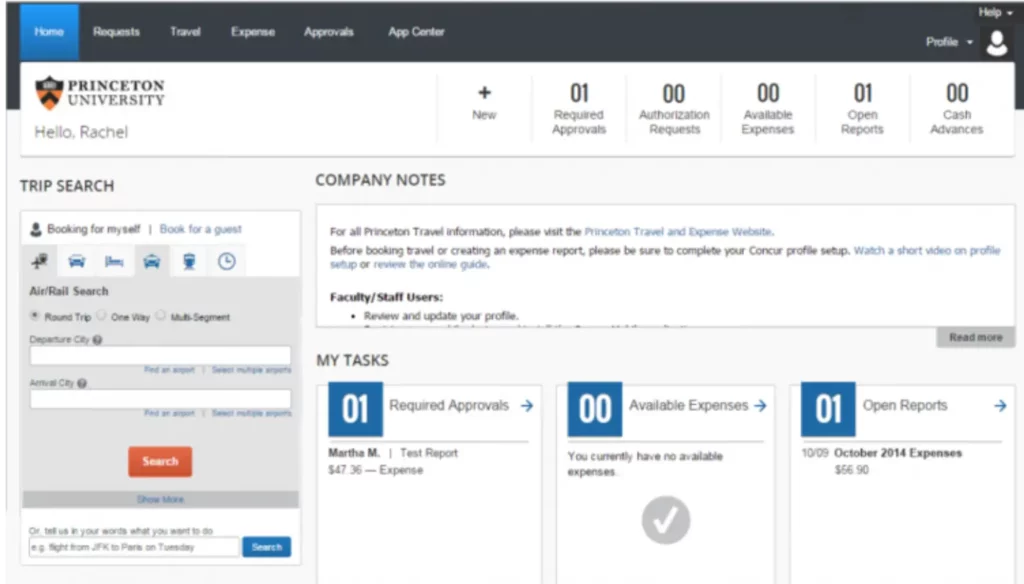

6. SAP Concur

SAP Concur is a long-established travel, expense, and spend management platform that provides clients with a suite of solutions like travel booking, automated expense reporting, invoice management, and so on. It is widely integrated with ERP and also offers users mobile access as well as ease-of-use features like AI receipt capture while tracking expenses.

SAP Concur’s key features and benefits:

- Integrated travel and expense management: SAP Concur helps connect travel bookings with automated expense reporting and policy enforcement in one system.

- Automated workflows and reduction in errors: It reduces errors by capturing and enforcing expenses, itinerary data, and corporate policies automatically.

- Reporting and analytics: Dashboards and analytics tools offer real-time views of spending, with AI-supported expense reporting and auditing.

Key differences between Concur and Navan:

- SAP Concur focuses on strong integration capabilities, compliance tools, and deep spend visibility. Navan, in contrast, emphasizes a simpler, more modern user interface and AI-driven automation.

Concur’s pricing:

SAP Concur charges a per-booking fee, which is between $5 and $20, with extra charges for modification and support upto $35 per modification / support call.

7. Emburse

Emburse helps companies automate expense reporting, travel expense tracking, invoices, and spending visibility. The platform emphasizes real-time spend visibility, integrated travel and expense capabilities, and analytics to improve compliance.

Emburse’s key features and benefits

- Real-time expense and travel data visibility: The platform captures spend as it happens to spot and reduce risk.

- Automated receipt capture and categorization: Clients can scan and auto-fill receipt information to reduce manual data entry.

- Policy compliance and approval workflows: Ensure offers configurable controls that enforce travel and expense policies automatically.

Key differences between Emburse and Navan

- Emburse’s core strength is expense and spend management with integrated analytics and controls, prioritizing finance-team visibility and policy compliance.

- Navan, in contrast, began as a travel-first platform that tightly integrates travel bookings with corporate card and expense workflows in one unified user experience.

Emburse’s pricing

- Basic Plan: $8 per user per month

- Plus Plan: $12 per user per month

8. Ramp

Ramp is a corporate spend and finance management platform that helps companies automate expenses, set travel policy controls, and complete bill payments. It started as a corporate card provider but has expanded into broader finance and travel-linked spend automation.

Ramp’s key features and benefits

- Corporate cards with smart controls: Companies can issue unlimited physical and virtual cards with merchant, category, and spend limits to reduce unauthorized expenses.

- Automated expense and spend management: Ramp captures and matches receipts, categorizes transactions, and enforces expense policies, eliminating manual reporting work.

- Integrated travel policy controls: Users can set travel policies and spending controls so flights, hotels, and related expenses adhere to company rules.

Key differences between Ramp and Navan

- Ramp’s strength is in finance and spend automation, whereas Navan is a travel-first platform designed primarily for booking and managing travel with integrated expense workflows.

- When it comes to corporate card controls, Ramp is quite advanced. You can add merchant-level and spend-level restrictions

Ramp’s pricing

- Ramp costs around $15 per user per month + platform fees. Free plans are also available.

Conclusion

With so many options, there is no one-size-fits-all alternative to Navan. What works well for one company may not suit another.

As companies rethink Navan in 2026, the decision increasingly comes down to a few basics: real savings, transparent pricing, dependable support, and ease of use for both travelers and finance teams.

FAQs

ITILITE stands out with human-led support and sub-10-second response times via phone, chat, and email, ensuring real help during emergencies and disruptions

Amex GBT and BCD Travel provide strong global reach but dated user experiences. ITILITE also offers extensive global inventory with a modern platform and highly rated mobile app.

Prioritize dependable human support, transparent pricing, and unbiased search recommendations that align with company travel policies, cost controls, and traveler preferences.

Most companies transition within one to two weeks. ITILITE can go live in two to three days, with complex finance integrations extending setup to two weeks.