The process of checking and approving expense reports for business travel can be daunting if your business reimburses employees for every aspect of the travel expenses.

Having to check dozens of receipts for lodging, meals, and other expenses submitted by employees can be complicated and time-consuming. Setting per diem rates is a way to reduce admin time and record-keeping.

Read on to know more about what is per diem and diem rates in US and how to set them as per IRS guidelines.

What is a Per Diem?

Per diem has been derived from a Latin phrase meaning “per day” or “for each day”. It means a daily allowance that companies give to employees, guiding them on how much they can spend per day on food and lodging, while they travel for work. The companies can either give it in advance or the employees can get it reimbursed after returning from the trip.

Having a fixed amount to reimburse employees would help you in managing travel expenses better. Fortunately, the IRS (Internal Revenue Service) has given some guidelines for calculating per diem rates as per the location or via the high-low substantiation method.

To streamline the per diem rates, an integrated travel and expense management platform can help streamline the process and potentially reduce costs. If you’re considering implementing per diem rates for your business travel, you may be wondering how much you could save. Try using our savings calculator to estimate your potential savings on corporate travel expenses by using an integrated platform.

What does Per Diem include as per the IRS?

According to the IRS, the per diem expenses include lodging, meal, and incidental expense, as explained below:

1. Lodging expenses

These expenses include overnight stays in hotels, resorts, serviced apartments, inns, etc. The rates for lodging change based on the travel location.

2. Meal expenses

These expenses include money spent on breakfast, lunch, and dinner. The rates for meals also change based on the location of travel.

3. Incidental expenses

Incidental expenses are the extra money your employee may spend during the trip like laundry or dry cleaning services, tips given to porters, baggage carriers, hotel staff, etc.

Generally, companies combine meals and incidental expenses (M&IE) and reimburse them together.

One expense that per diem DOES NOT cover is transportation or mileage. Companies can either arrange transportation for their employees or employees can spend out of their own pockets and get it reimbursed by filing an expense report.

How Does Per Diem Work?

Since the daily allowance is fixed, using per diem makes the process of expense filing easier for employees as well. They do not have to keep and submit any expense receipts for approval.

However, to keep a track of the expenses according to the accountable expense reimbursable plan, you must ask your employees to file an expense report within 60 days of their trip, including the following information:

- Business purpose

- Date & location of the business trip

- Receipts for Lodging (if using the M&IE per diem only)

Doing so is important if you want to avoid tax implications for your employees.

Per Diem Taxability

It’s important to understand here that per diem is not a part of employees’ wages. Therefore, as long as the employee provides an expense report and payments do not exceed the federal rate, they are not taxable income.

However, an unsubstantiated reimbursement higher than the federal per diem rate would be considered taxable income.

What are the Current Per Diem Rates in the US?

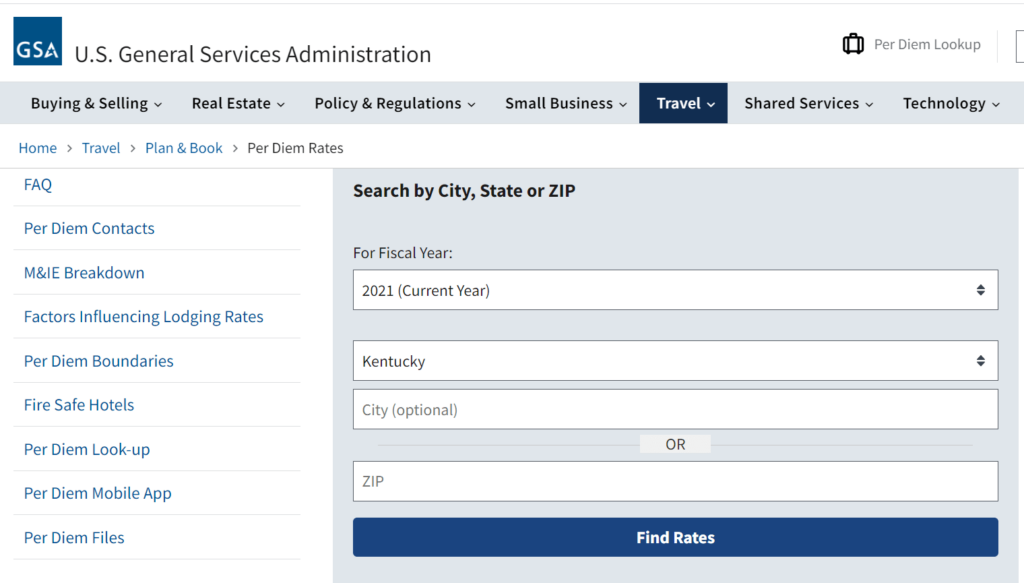

Even though companies can set their per diem rates, the US Govt. provides guidelines to help them decide it for their business travel expenses. Each year, the General Service Administration (GSA) publishes a list of standard rates, effective October 1.

To know it, visit the GSA site and enter the city or zip code of the city your employee/s would be visiting. The per diem rates would be broken down into 2 categories – lodging, and meal & incidental expenses (M&IE).

You can use the relevant per diem rate for each day your employee is out on a business trip. However, for the first and last day of travel, you only need to pay 75% of per diem rates for meals and incidental expenses.

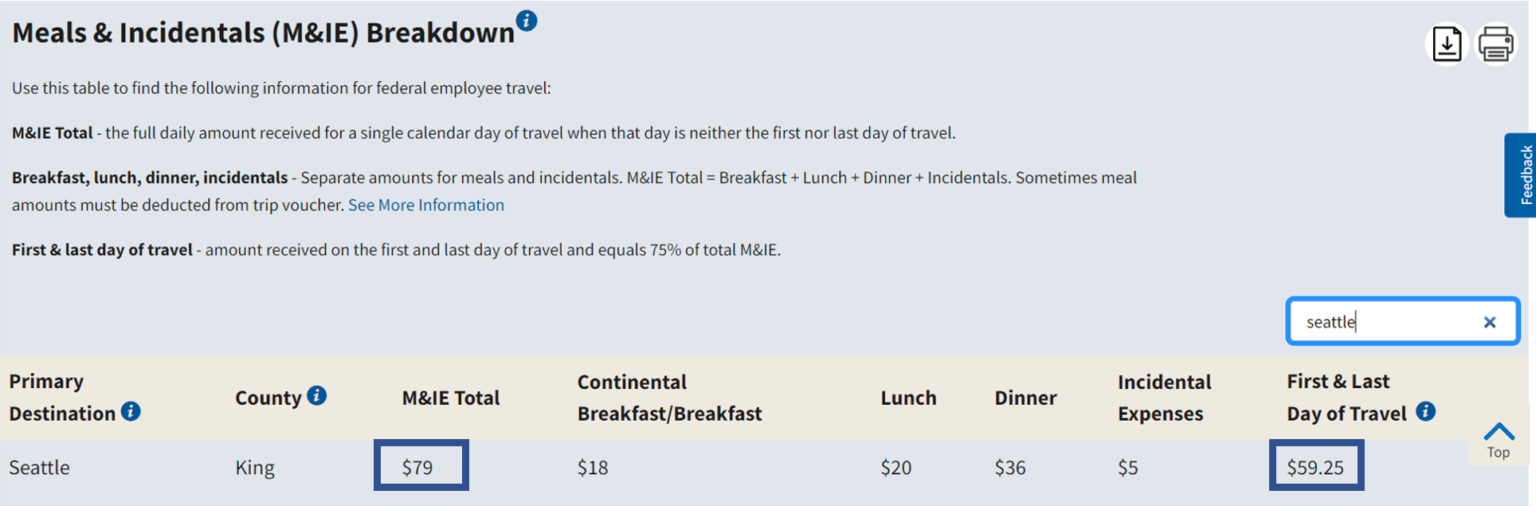

This is because it is considered that the first and last day won’t have the same level of M&IEs. Refer to this table on the M&IE breakdown page for “First and Last Day of Travel” expenses.

How to Calculate Per Diem?

Now, let’s understand how you can calculate per diem for your company with the help of an example. Assume your employee is traveling to Seattle on a 5-day business trip in May.

How is Per Diem Calculated

To calculate the total per diem:

Step 1 : Visit the GSA site, and enter Washington in the “state” box. It will display lodging and M&IE per diem rates for all cities in Washington.

Step 2 : Now, enter Seattle in the search bar on the right corner to know lodging per diem rates for each month. As you can see, it is $232 for May.

Step 3: Similarly, in the M&IE section, enter Seattle in the search bar to know the total per diem rate for meals and incidentals i.e. $79.

Step 4 : Now, add the per diems rates for each day:

| Total Per Diem of a 5-Day Trip to Seattle | |||

| Day | Lodging | M&IE | Total per diem |

| Day 1 | $232 | $59.25* | $291.25 |

| Day 2 | $232 | $79 | $311 |

| Day 3 | $232 | $79 | $311 |

| Day 4 | $232 | $79 | $311 |

| Day 5 | $232 | $59.25* | $291.25 |

So, the total amount to be reimbursed to the employee for lodging, meals, and incidentals would be $1515.5.

This is quite simple. However, if you don’t wish to check every city separately for setting per diem rates for business travel, another alternative to calculating it is the high-low substantiation method.

The IRS releases new rates each year for the continental United States: one for high-cost areas and one for all other areas. For instance, 2020-2021 per diem rates are:

| High-Cost areas | All other areas | |

| Total per diem | $292 | $198 |

| Meals and incidentals only | $71 | $60 |

To find out which places are considered high-cost, you can check section 5 of this year’s IRS bulletin. You can use any of one the above-mentioned methods if your employees are traveling within the US.

If your employees are traveling outside the US, international per diem rates are managed by the US Department of States. Visit the website to check the rates when your employees travel to different countries.

Note: International per diem rates are revised monthly. Hence, make sure you keep checking it regularly.

What if you Don’t Want to Go by the Federal Per Diem Rate?

Like we said before, you can set your per diem rates if you don’t wish to compensate at the federal rate. The IRS offers two choices for this:

- Take your total per diem amount, subtract the standard meals and incidentals rate, and treat the remainder as the lodging amount. For instance, if you wish to set your per diem at $200 and the standard M&IE is $76, then your lodging amount would be $124.

- Designate 60% for lodging and 40% for meals and incidentals in your total per diem amount. For instance, if your total per diem is $200, then $120 would be your lodging amount and $80 would be your M&IE amount.

Regardless of what method you choose to calculate per diems for your employees, it’s important to be consistent. Therefore, pick a method that works best for your business, and stick with it for all employee business travel.

Manage your Per Diems with Itilite

Once you have understood the per diem rules, you can easily reimburse your employees for their business travel expenses. However, to make the process easier, you can adopt a travel and expense management platform that automates the per diem expense approvals and reimbursements.

To understand how T&E management automation can help your company with per diem, schedule a demo with our product expert today!