Free Virtual Corporate Cards

Issue unlimited virtual corporate cards instantly at no cost, set spend limits and merchant controls, and reconcile transactions automatically via ITILITE.

These Free Virtual Credit Cards are designed to simplify expense management and provide security for business spending.

Trusted by 500+ companies

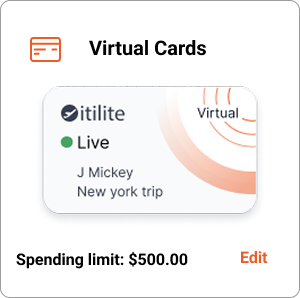

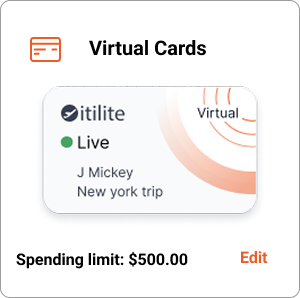

Instant issuance and unlimited virtual card creation

Create unlimited virtual cards in seconds for employees, vendors, and bookings — each with tailored limits, expiry, and merchant rules, all managed centrally.

- Instant digital card issuance on demand

- Per-card spend limits, expiry, and merchant rules

- Generate single-use cards for hotels and vendors

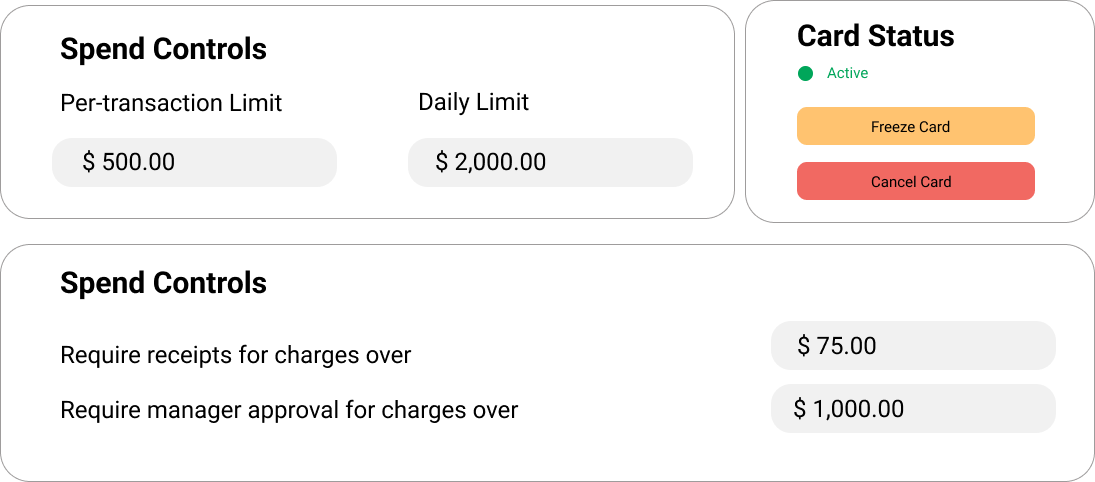

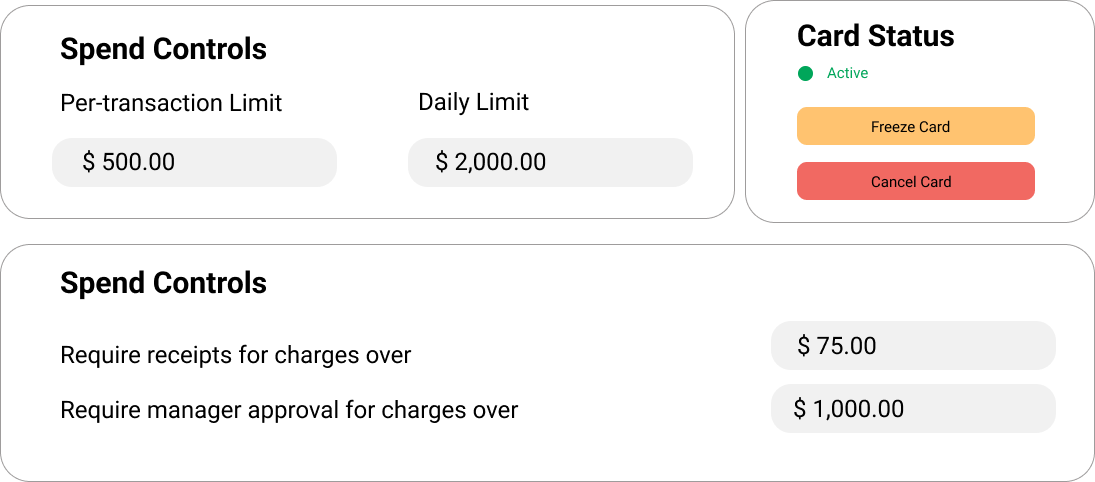

Security controls: limits, merchant rules, single-use

Define per-card spend caps, merchant category blocks, single-use tokens, or recurring numbers, and instantly freeze or cancel cards for better fraud protection.

- Block merchants by category instantly

- Freeze or cancel cards with one click

- Require receipts and approvals for high-value charges

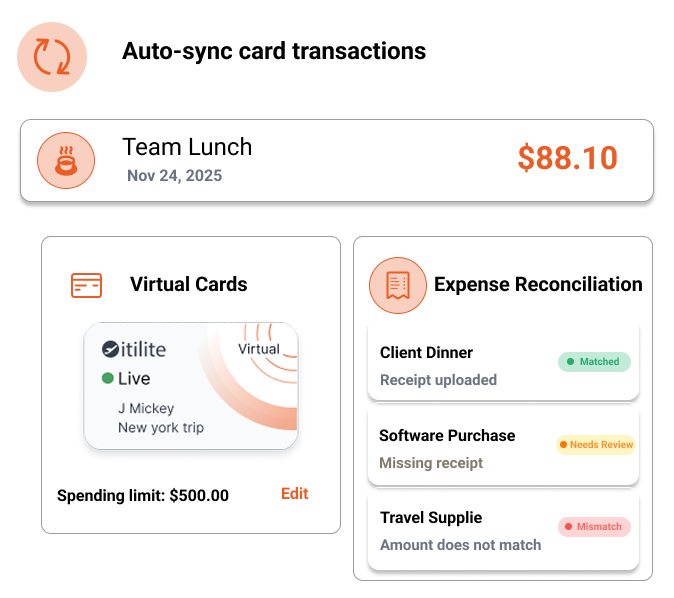

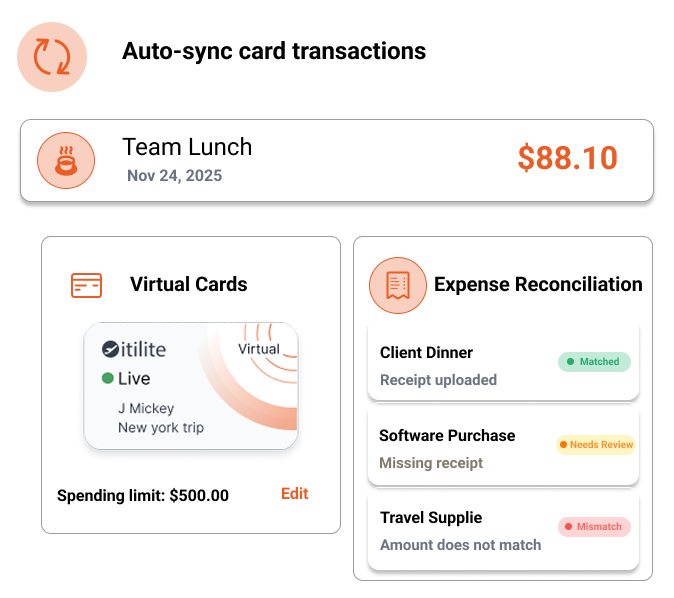

Automated reconciliation and real-time visibility

Card transactions sync instantly to ITILITE for automated matching, reporting, approval routing, and audit-ready records.

- Auto-match transactions to bookings and projects

- Approval routing to managers for large spends

- Download audit-ready reports in seconds

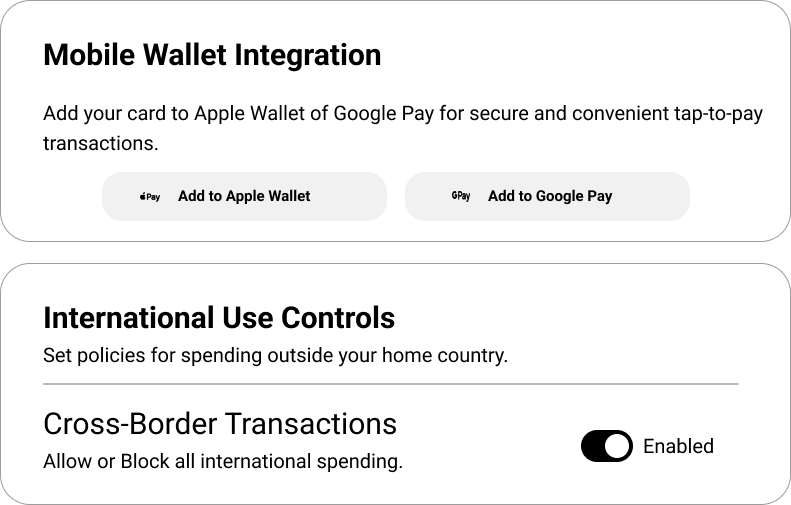

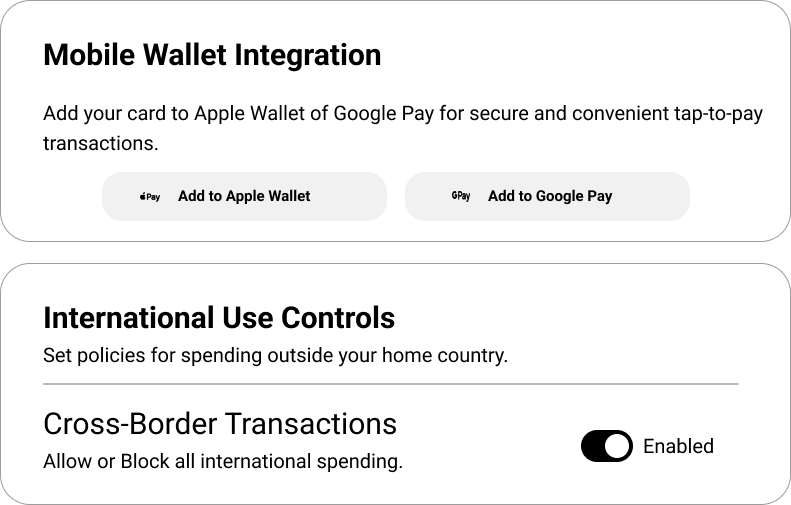

Global acceptance, mobile wallets, and international use

Use cards worldwide via Mastercard and add them to Apple Pay or Google Wallet for tap-and-pay convenience while monitoring international fees and policies.

- Accepted globally via Mastercard networks

- Add to Apple Pay and Google Wallet for tap pay

- Control cross-border spend and currency limits

Cost, cashback, and how ITILITE monetizes the program

ITILITE offers flat cashback on all spends and earns interchange and SaaS revenue, enabling free issuance while keeping the expense platform highly integrated.

- Flat 1.5% cashback on all card spends

- Higher cashback on ITILITE travel bookings

- No issuance, replacement, or annual card fees

Everything You Need to Know About Virtual Corporate Cards

Learn how virtual corporate cards work, their benefits, and best practices for managing business expenses securely and efficiently with ITILITE. These beginner-friendly guides also explain the advantages of Free Virtual Credit Cards for corporate use.

Understanding Virtual Corporate Cards: A Beginner’s Guide

Virtual corporate cards are digital cards that companies issue to employees or teams to pay for business expenses. Unlike traditional plastic cards, these cards are generated online and can be set up with specific limits, expiration dates, and merchant restrictions. They are designed to make expense management easier, safer, and more controlled.

How Virtual Corporate Cards Work

Virtual corporate cards are created by a company administrator using a platform like ITILITE. Each card can be customized:

- Spending limits: Set maximum amounts for each card

- Expiration dates: Cards can expire after a certain date or after one use

- Merchant restrictions: Limit which types of businesses or vendors the card can be used at

Employees can use virtual corporate cards for online payments, mobile wallets, or specific vendor transactions. For example:

- Single-use cards are perfect for one-time purchases like hotel bookings

- Multi-use cards are ideal for recurring payments like software subscriptions or regular vendor bills

Benefits for Finance and Operations Teams

Virtual corporate cards make life easier for finance and operations teams:

- Automatic syncing: Every transaction appears instantly in the expense platform

- Easy reconciliation: Expenses are automatically linked to projects, trips, or departments

- Real-time visibility: Managers can see spending as it happens

- Policy enforcement: Spending limits and merchant rules are applied automatically

Employees no longer need to pay out-of-pocket or submit paper expense reports. Virtual corporate cards and Free Virtual Credit Cards handle most of the tracking automatically.

Why Security Matters

Security is one of the biggest reasons companies switch to virtual corporate cards. Features include:

- One-time-use numbers: Each transaction can have a unique card number

- Spending limits per transaction: Reduce risk of overspending or fraud

- Merchant restrictions: Block unsafe or unapproved merchants

- Instant freeze or cancellation: Cards can be disabled immediately if misused

These protections reduce fraud compared to traditional corporate cards.

Things to Keep in Mind

Before adopting virtual corporate cards, beginners should know:

- User allocation: Assign one card per employee or vendor for accurate tracking

- Recurring payments: Use multi-use cards for subscriptions or regular bills

- International use: Cards run on Mastercard networks and work globally; international fees may apply

Careful planning ensures spending stays organized, secure, and compliant with company policies.

Frequently Asked Questions

How do I get ITILITE virtual cards?

Your company admin signs up for ITILITE, completes onboarding, and issues virtual cards instantly via the dashboard or mobile app.

Are there fees to issue virtual cards?

No. ITILITE issues Free Virtual Credit Cards with no sign-up, annual, or replacement fees; subscription pricing for the software may apply separately.

Can virtual cards be single-use?

Yes. Single-use virtual cards are perfect for one-off hotel bookings or vendor payments to reduce fraud risk.

How many virtual cards can we create?

Unlimited. Each employee, vendor, or project can have a dedicated card.

Do virtual cards work internationally?

Yes. They run on Mastercard networks globally; international transaction fees may apply.

Can I add virtual cards to mobile wallets?

Yes. They can be added to Apple Pay or Google Wallet for tap-and-pay transactions.

How does reconciliation work?

Transactions auto-sync to ITILITE and link to bookings, projects, and policies for faster reconciliation.

Can I control merchant categories for cards?

Yes. Admins can block or limit merchant categories per card to prevent off-policy spend.

Do we get cashback on card spends?

Yes. ITILITE offers flat cashback on all card spends and higher cashback on travel bookings.

Are virtual cards secure?

Yes. They reduce exposure using tokenized numbers, per-card limits, single-use options, and instant freezes.