Easy Expense Reporting for Business Travel

Simplify corporate spending with ITILITE’s platform for easy expense reporting, business expense tracking, and corporate expense tracking.

Trusted by 500+ companies

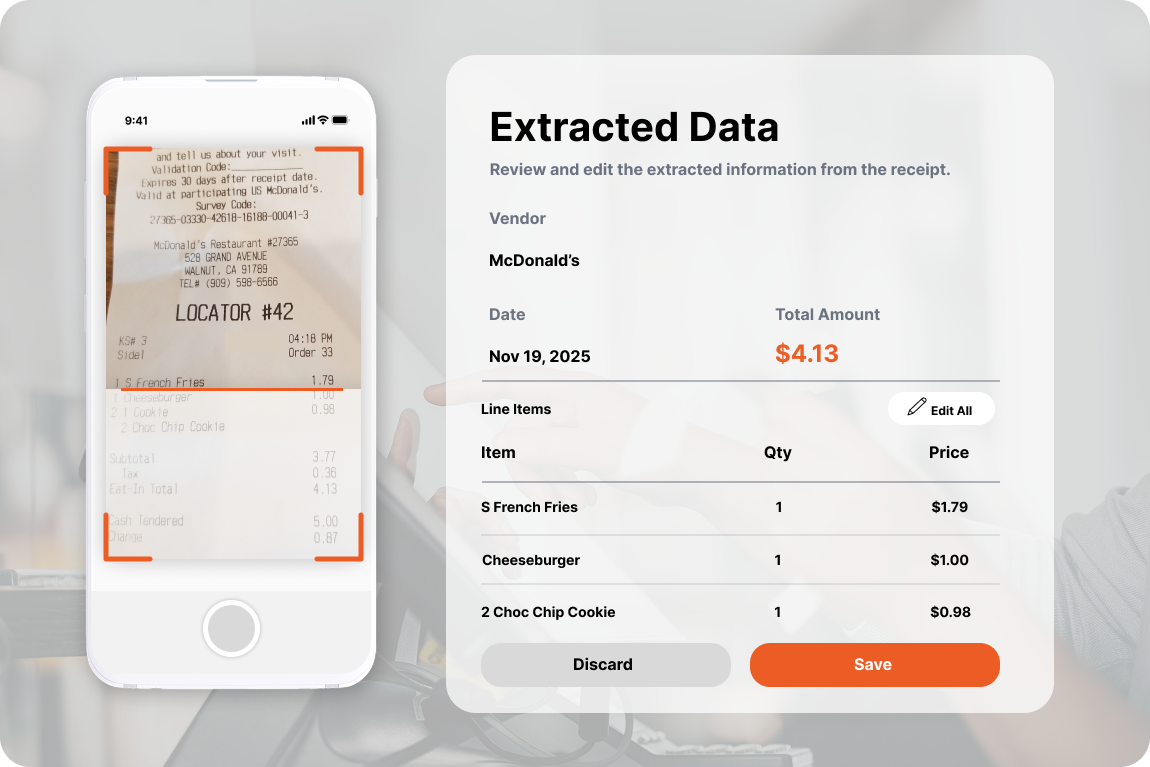

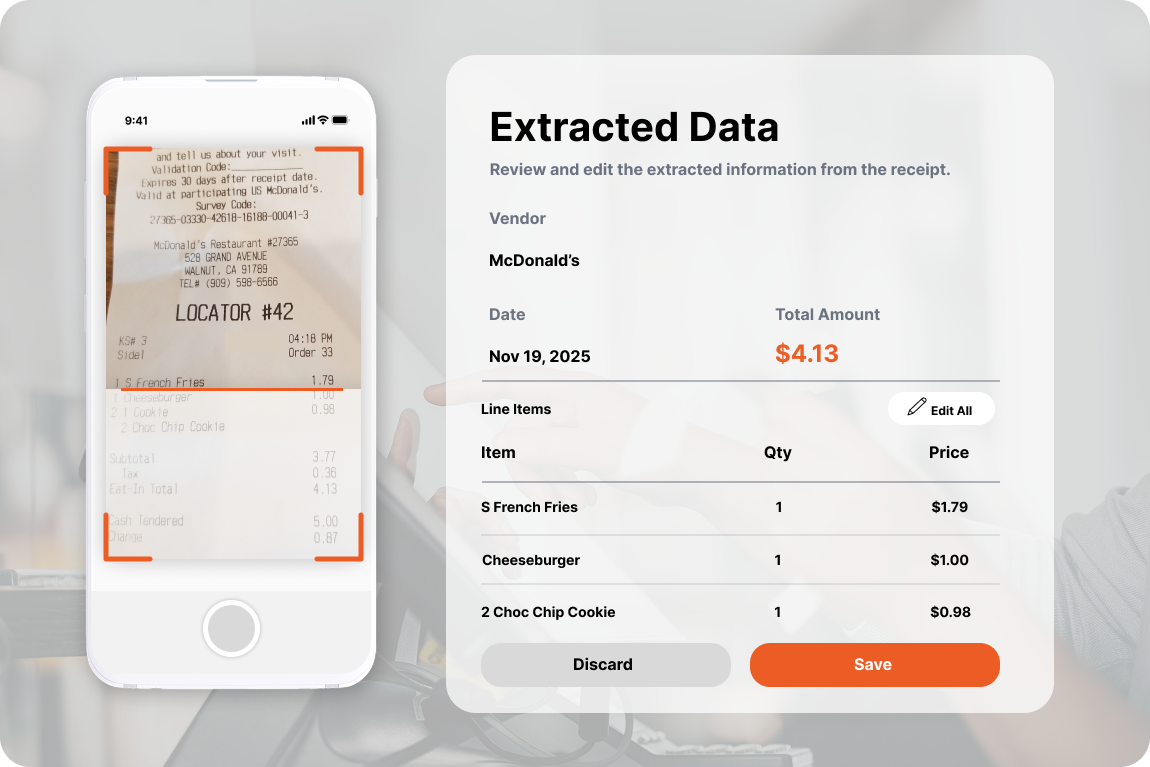

Automated Receipt Capture

Snap receipts instantly with ITILITE’s AI-powered OCR. Auto-read, categorize, and draft expenses for accurate business expense tracking.

- Capture receipts instantly via mobile app

- AI auto-categorizes expenses for accuracy

- Draft expense reports without manual entry

- Reduce errors in business expense tracking

Policy Enforcement & Fraud Detection

Ensure compliance with corporate expense policies. ITILITE flags out-of-policy or suspicious expenses automatically in real-time.

- Real-time policy compliance checks

- Detect duplicate or fraudulent expenses

- Reduce manual auditing efforts

- Maintain corporate expense tracking integrity

Streamlined Approval Workflows

Multi-level approval workflows simplify management. Managers review, approve, and track expenses directly from the app.

- Customizable approval chains

- Approve on mobile or desktop

- Track approval status in real-time

Corporate Card Integration

Connect personal or corporate cards. ITILITE automatically syncs transactions and simplifies reconciliation for accurate business expense tracking.

- Auto-sync card transactions

- Virtual cards with spending limits

- Simplify expense reconciliation

- Improve corporate expense tracking

Real-Time Reporting & Analytics

Gain live insights into spending patterns. ITILITE dashboards provide actionable data for budgeting and cost control.

- Track expenses in real-time

- Generate customizable reports

- Identify cost-saving opportunities

- Enhance corporate expense tracking accuracy

Fast Reimbursements

Accelerate reimbursements with ACH integration. ITILITE ensures employees get reimbursed quickly without manual delays.

- Process reimbursements in one cycle

- Reduce employee out-of-pocket expenses

- Seamless integration with accounting

- Improve business expense tracking efficiency

Complete Guide to Easy Expense Reporting

Click to read a detailed guide on best practices, tools, and tips for business expense tracking and corporate expense tracking.

Why Expense Tracking Matters

Accurate expense tracking gives businesses full visibility into spending. By recording, categorizing, and monitoring every expense, finance teams can manage budgets effectively, reduce overspending, and stay audit-ready. Easy expense reporting ensures employees submit expenses correctly while supporting tax compliance.

Best Practices for Easy Expense Reporting

- Separate Accounts: Keep business and personal finances separate for clarity.

- Regular Recording: Log expenses daily or weekly to maintain accuracy.

- Detailed Documentation: Keep receipts and invoices digitally using software.

- Categorize Expenses: Organize costs by type to identify trends and save money.

- Automate Processes: Use tools like ITILITE to reduce errors and manual work.

- Review Periodically: Finance teams should compare expenses to budgets for informed decisions.

Choosing the Right Software

Selecting an expense tracking solution depends on business size, workflow complexity, and integration needs. Key features to look for include:

- Mobile receipt capture and AI-powered categorization

- Policy enforcement and fraud detection

- Customizable approval workflows

- Real-time reporting and analytics

ITILITE combines all these features in a single platform for seamless corporate expense tracking.

Automating Expense Categorization

AI-powered software reads receipts automatically, extracts vendor names, dates, and amounts, and assigns them to the correct category. This reduces human error, speeds up reporting, and ensures accurate business expense tracking.

Benefits of Real-Time Tracking

Real-time visibility allows finance teams to:

- Control spending proactively

- Detect fraudulent claims quickly

- Ensure employees follow expense policies

- Make data-driven budget decisions

Using ITILITE, businesses can turn expense tracking into a strategic advantage.

Supporting Tax Compliance

Maintaining digital records simplifies claiming deductions and preparing for audits. Software like ITILITE ensures all receipts and expenses are accurately logged, categorized, and stored for tax purposes, maximizing eligible deductions.

Conclusion

Easy expense reporting, combined with corporate expense tracking, improves efficiency, reduces errors, and gives organizations complete financial control. ITILITE’s platform provides a fully integrated solution for modern businesses seeking automation, accuracy, and compliance.

Frequently Asked Questions

How does ITILITE automate easy expense reporting?

ITILITE uses OCR and AI to capture receipts, categorize expenses, and draft reports automatically.

Can ITILITE enforce corporate expense policies?

Yes, ITILITE flags out-of-policy spending in real-time to ensure compliance.

How fast can reimbursements be processed?

Reimbursements are typically processed within one business cycle using ACH integration.

Does ITILITE integrate with corporate cards?

Yes, ITILITE syncs transactions automatically and supports virtual card spending limits.

How does AI detect duplicate or fraudulent claims?

Machine learning analyzes patterns and flags suspicious or duplicate expenses.

Can I track expenses in real-time?

Yes, ITILITE dashboards provide instant visibility across all employees and departments.

Does ITILITE work with accounting systems?

Yes, ITILITE integrates with QuickBooks, NetSuite, SAP, and other major platforms.

Can employees submit receipts from their phones?

Absolutely, the mobile app allows instant receipt capture and automatic categorization.

Does ITILITE help with tax compliance?

Yes, it maintains digital audit trails and ensures all expenses are documented for deductions.

How does ITILITE improve overall business expense tracking?

By combining automation, real-time insights, policy enforcement, and seamless reporting into one platform.