Corporate Expenses Cards

Discover how Itilite’s Corporate Expenses Cards simplify payments, automate expense reporting, and give you real-time visibility into employee spending, all while enforcing company policies.

Trusted by 500+ companies

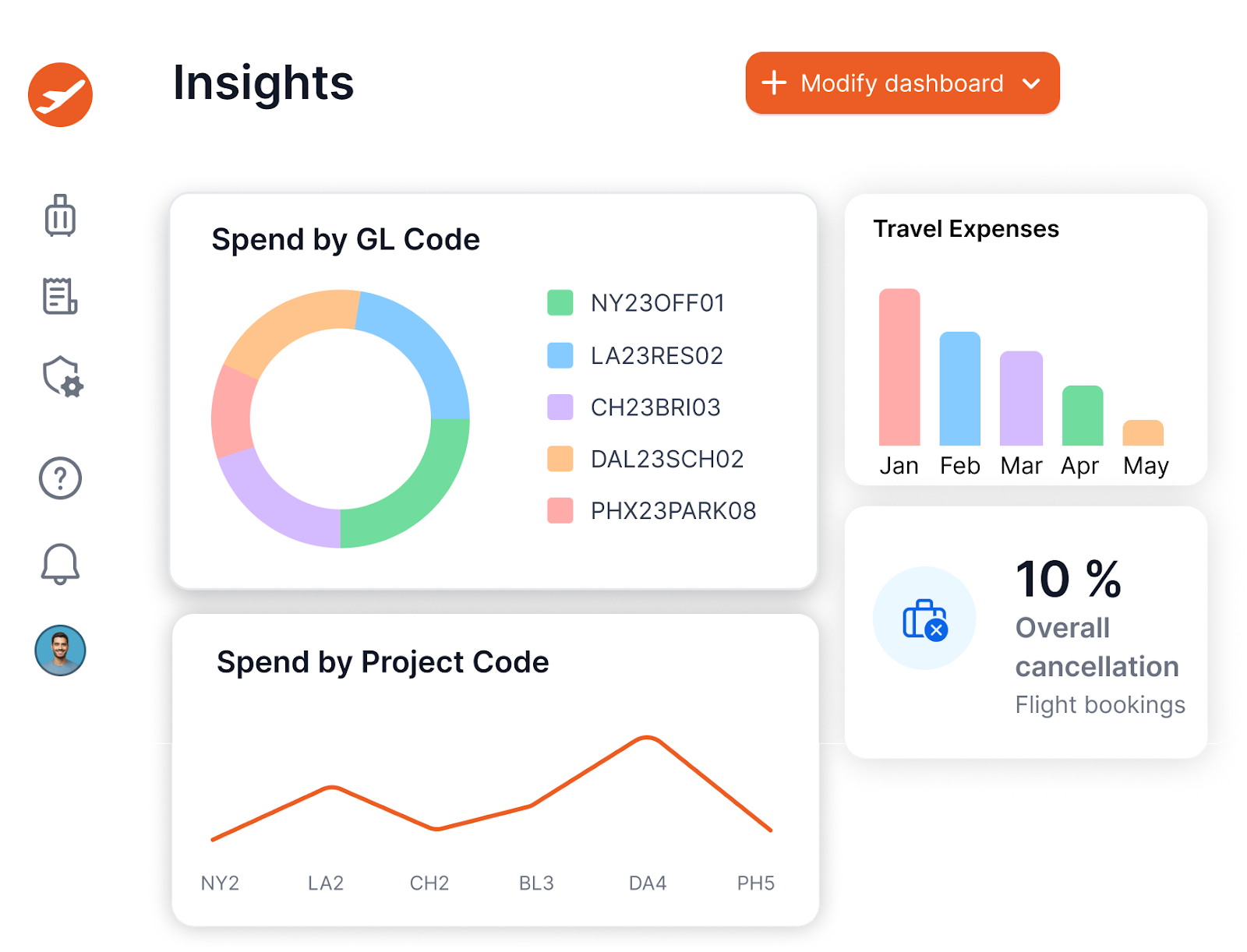

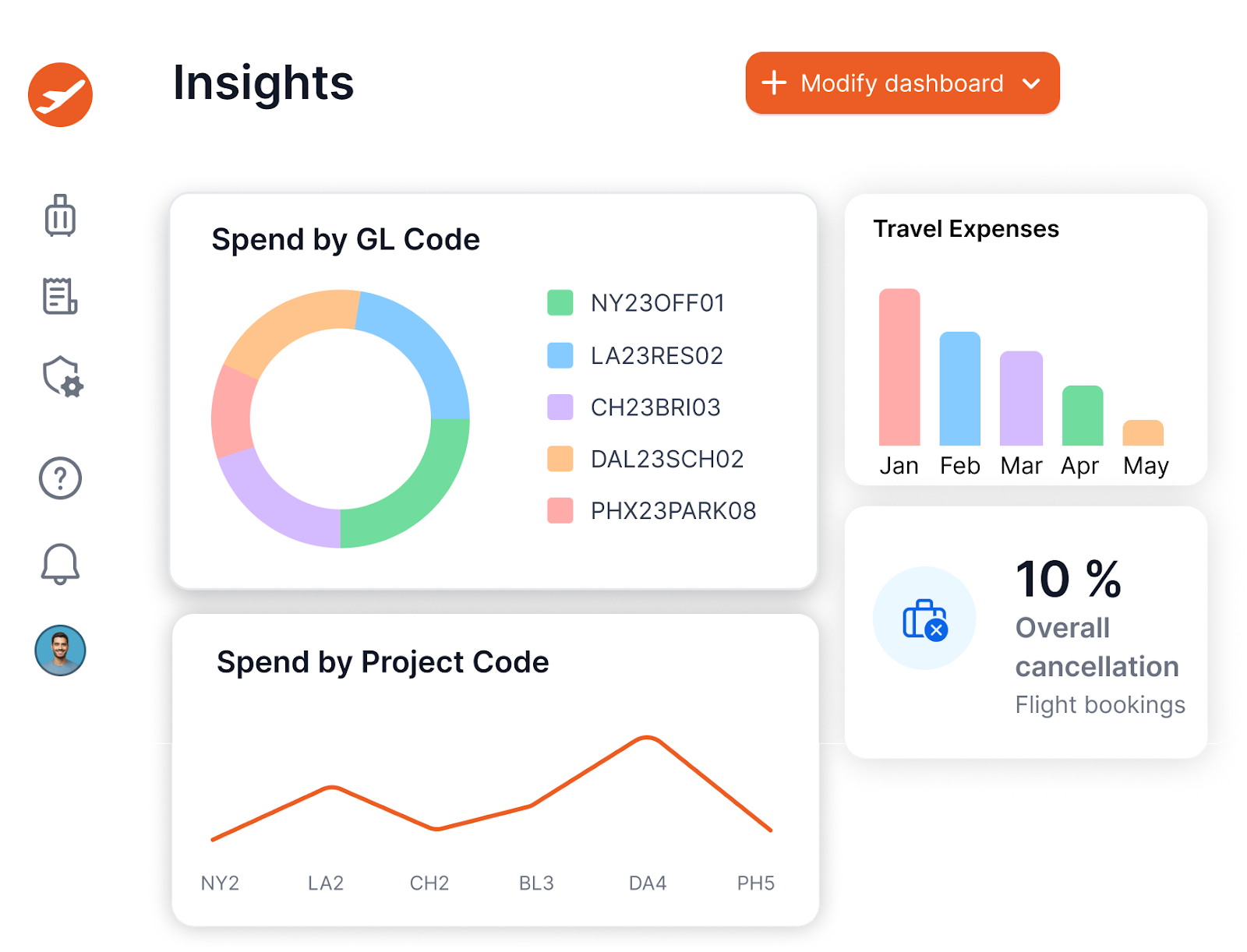

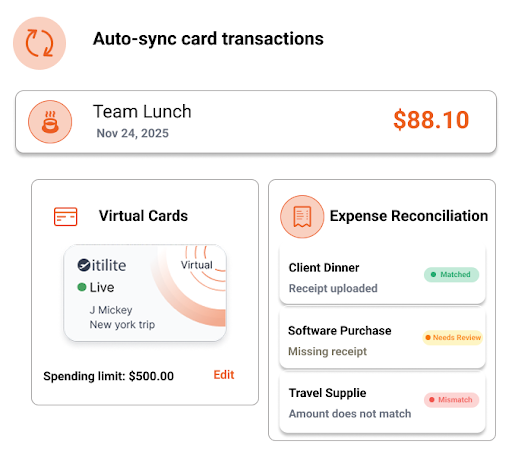

Track Every Transaction in Real-Time

Itilite’s Corporate Expenses Cards provide real-time visibility, allowing finance teams to track every expense as it happens, ensuring compliance and preventing unauthorized spending.

- Instant transaction visibility via Itilite’s platform

- Track spending across departments and employees

- Set up real-time alerts for unauthorized purchases

- Make adjustments quickly to stay within budget

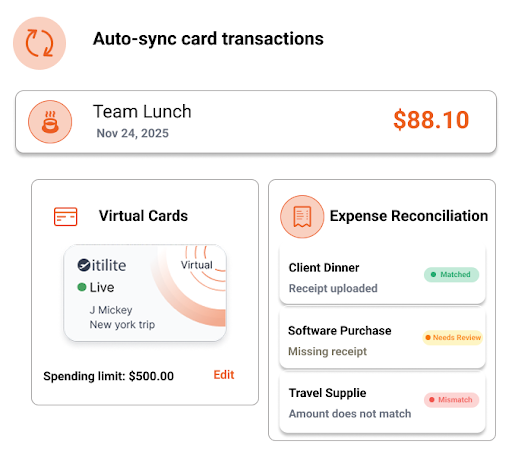

Automate Your Expense Reporting

With Itilite, transactions are automatically recorded and matched to receipts, streamlining the expense reporting process and reducing manual errors.

- Automated categorization of expenses

- Instant receipt capture via the mobile app

- Seamless matching of transactions and receipts

- Real-time synchronization with Itilite’s expense management platform

Control Your Spending Automatically

Set customizable spending limits for employees and categories, with automatic checks against company policies, ensuring every purchase is compliant with corporate rules.

- Set individual or department-specific spending limits

- Automatically check purchases against policy rules

- Enforce per-category limits for better budgeting

- Gain control over travel, meals, and office supply expenses

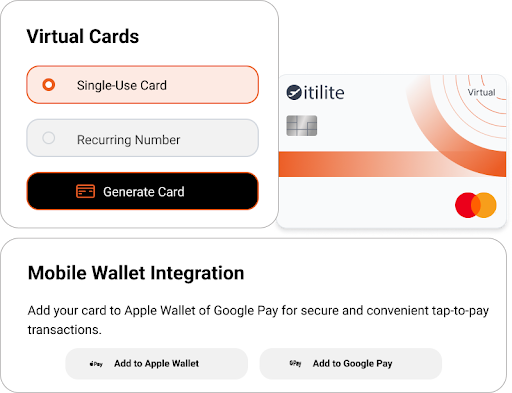

Issue Unlimited Cards Without Extra Fees

With Itilite, businesses can issue an unlimited number of virtual cards for one-time purchases and physical cards for regular expenses, all with no additional fees.

- Unlimited virtual cards for online or one-time transactions

- One physical card issued per employee for everyday expenses

- No extra costs for card issuance or management

- Easy integration with digital wallets like Apple Pay

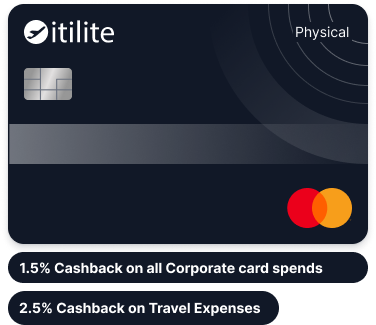

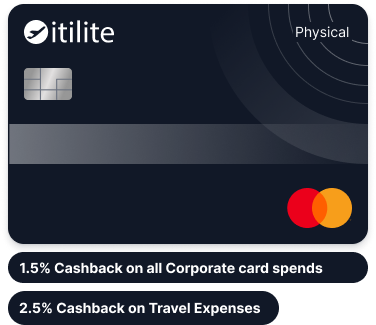

Maximize Savings with 1.5% Cashback

Earn cashback on every transaction. Itilite offers a flat 1.5% cashback for all card spends, which is transferred directly to your company’s account, helping you save on business expenses.

- 1.5% cashback on all corporate card spends

- Up to 2.5% cashback on significant travel expenses

- Cashback transferred directly to the company account

- Simplify expense tracking while increasing savings

Corporate Cards 101: A Comprehensive Guide

Discover the basics of Corporate Expense Cards and learn how they simplify expense management, boost financial control, and automate reporting for businesses.

Corporate Expense Cards are specialized payment tools that businesses provide to employees for work-related expenses such as travel, meals, office supplies, and other operational needs. These cards offer several advantages over traditional reimbursement systems where employees use personal funds and wait for reimbursement.

With Corporate Expense Cards, all transactions are processed under the company’s account, providing real-time insights into spending, eliminating the need for reimbursements, and ensuring that purchases are compliant with company policies. They’re often integrated into expense management systems like Itilite, allowing for automated reporting, transaction categorization, and receipt matching.

Key Benefits of Corporate Expense Cards:

- Centralized Payment System: Transactions are processed under the company’s account, which gives businesses greater visibility and control over all spending.

- Real-Time Transaction Monitoring: Track every purchase in real time, which helps identify discrepancies or unauthorized purchases immediately.

- Automated Reporting: Corporate Expense Cards automatically categorize transactions and match receipts, making the reporting process faster and more accurate.

- Policy Enforcement: Customizable spending rules and limits can be set to ensure employees comply with company policies for different expense categories.

- Seamless Integration: Corporate Expense Cards integrate smoothly with financial software like QuickBooks and NetSuite to streamline the reconciliation process.

How Do Corporate Expense Cards Work?

Corporate Expense Cards work by issuing physical or virtual cards to employees. These cards are linked to the company’s central account, enabling the business to track, categorize, and manage all employee expenses in real time through a software platform like Itilite.

Employees use these cards just like personal credit cards, but the difference is that all transactions are logged automatically and integrated into the expense management system. Receipts can be captured via mobile apps, and transactions are matched with the corresponding receipts, helping finance teams quickly reconcile expenses.

Virtual Cards vs. Physical Cards: Which One Is Right for Your Business?

- Physical Cards: These traditional plastic cards are used for in-person purchases such as meals, transport, and hotel check-ins.

- Virtual Cards: Digitally generated cards used for secure online transactions. Virtual Cards for Business Expenses are ideal for one-off purchases, vendor payments, and employees who make primarily online transactions. They can also be added to mobile wallets for tap-and-pay use.

Both types of cards provide the same core functionality, real-time tracking, spending controls, and integration with the company’s expense management system.

How Do Corporate Expense Cards Help With Policy Enforcement?

A major advantage of Corporate Expenses Cards is the ability to automatically enforce company spending policies. With Itilite’s Corporate Expense Cards, businesses can define spending rules for each employee, department, or expense category.

For example, if a company policy limits meals to $50 per day, any transaction over that limit will be flagged for review. This reduces manual oversight and ensures that employees follow company guidelines without requiring additional intervention from finance teams.

What Are the Financial Benefits of Corporate Expense Cards?

Corporate Expense Cards offer significant financial benefits for businesses. Here’s how:

- Cashback on Purchases: Itilite’s Corporate Expense Cards provide a flat 1.5% cashback on all card spends, transferred directly to the company account. This can help offset operational costs.

- Zero Fees: Unlike traditional credit cards, Itilite’s cards come with no annual fees, setup costs, or hidden charges, helping businesses save money.

- International Usage: Corporate Expense Cards are accepted worldwide, making them an ideal solution for companies with global operations. However, international transaction fees may apply.

How to Get Corporate Expense Cards?

Getting started with Itilite’s Corporate Expense Cards is simple:

- Request a Demo: Schedule a demo to explore the platform’s capabilities and learn how Itilite’s Corporate Expense Cards can streamline your business expenses.

- Set Up Spending Limits: Customize your company’s policies, approval workflows, and spending limits.

- Issue Cards: After setup, physical cards will be issued to employees, and virtual cards can be created immediately.

Onboard Employees: Train your employees to use the cards and the expense management app for easy reporting.

Frequently Asked Questions

What are Corporate Expenses Cards?

Corporate Expenses Cards are payment tools issued to employees for business-related expenses. They help businesses maintain control over spending while automating expense reporting.

How do Corporate Expenses Cards work?

Employees use these cards for approved business expenses. Transactions are tracked in real-time and automatically categorized, reducing manual reporting and improving financial visibility.

What is the difference between virtual and physical cards?

Virtual cards are for online transactions, while physical cards are used for in-person expenses. Both are linked to the company’s central account for easy tracking.

How can I enforce spending limits with Corporate Expenses Cards?

You can set custom limits for each employee or department, and Itilite automatically checks every transaction against your company’s policies.

Are there any fees associated with Itilite’s Corporate Expenses Cards?

No, there are no annual, setup, or transaction fees for Itilite’s Corporate Expenses Cards. No hidden charges either.

How do I integrate Itilite Corporate Cards with my accounting system?

Itilite integrates seamlessly with financial software like QuickBooks and NetSuite, streamlining the reconciliation process.

Can Corporate Expenses Cards be used internationally?

Yes, Itilite Corporate Expenses Cards can be used globally where the Mastercard network is accepted. However, international transaction fees may apply.

What are the cashback benefits of using Itilite Corporate Cards?

Itilite Corporate Expenses Cards offer a flat 1.5% cashback on all purchases, with up to 2.5% cashback on significant travel spends.

Can I issue unlimited Corporate Expenses Cards for my employees?

Yes, Itilite allows businesses to issue an unlimited number of virtual and physical cards without any additional charges.

How do I apply for Itilite Corporate Cards for my business?

To apply, simply request a demo on the Itilite website. Once approved, physical and virtual cards will be issued based on your company’s needs.