Corporate Card Rewards Redemption Saving

Itilite turns company spending into savings with cashback, negotiated supplier rates and automated redemption, reclaim value across travel and expenses

Trusted by 500+ companies

Corporate card rewards as a financial lever

A unified card and T&E platform converts everyday payments into measurable savings with cashback, negotiated supplier deals and live spend visibility for finance teams.

- Issue unlimited cards to employees for control and savings.

- Centralize company spend to capture cashback returns monthly.

- Let negotiated supplier deals reduce your base travel rates.

- Auto-track travel credits and unused vendor balances.

- Use role-based limits to prevent out-of-policy spend.

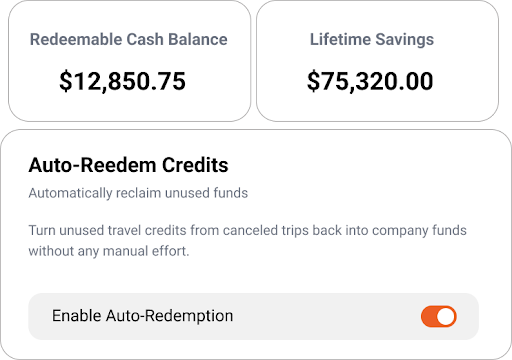

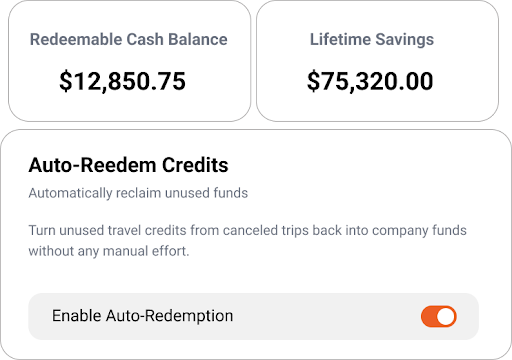

Cashback & Redemption: How to maximize direct returns

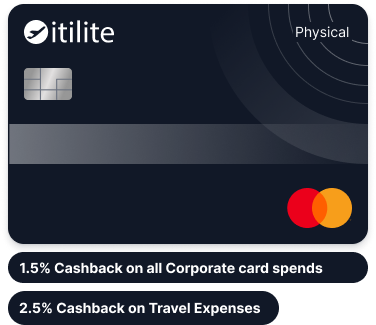

Convert card rebates into real cash flow with transparent payout rules and automated Corporate Card Reward Redemption that posts to your operating account.

- Flat cashback on general spends improves liquidity.

- Tiered travel cashback boosts booking-level returns.

- Direct cash payout avoids complex point conversion.

- Auto-redeem unused travel credits for company funds.

- Combine cashback with negotiated rates for more value.

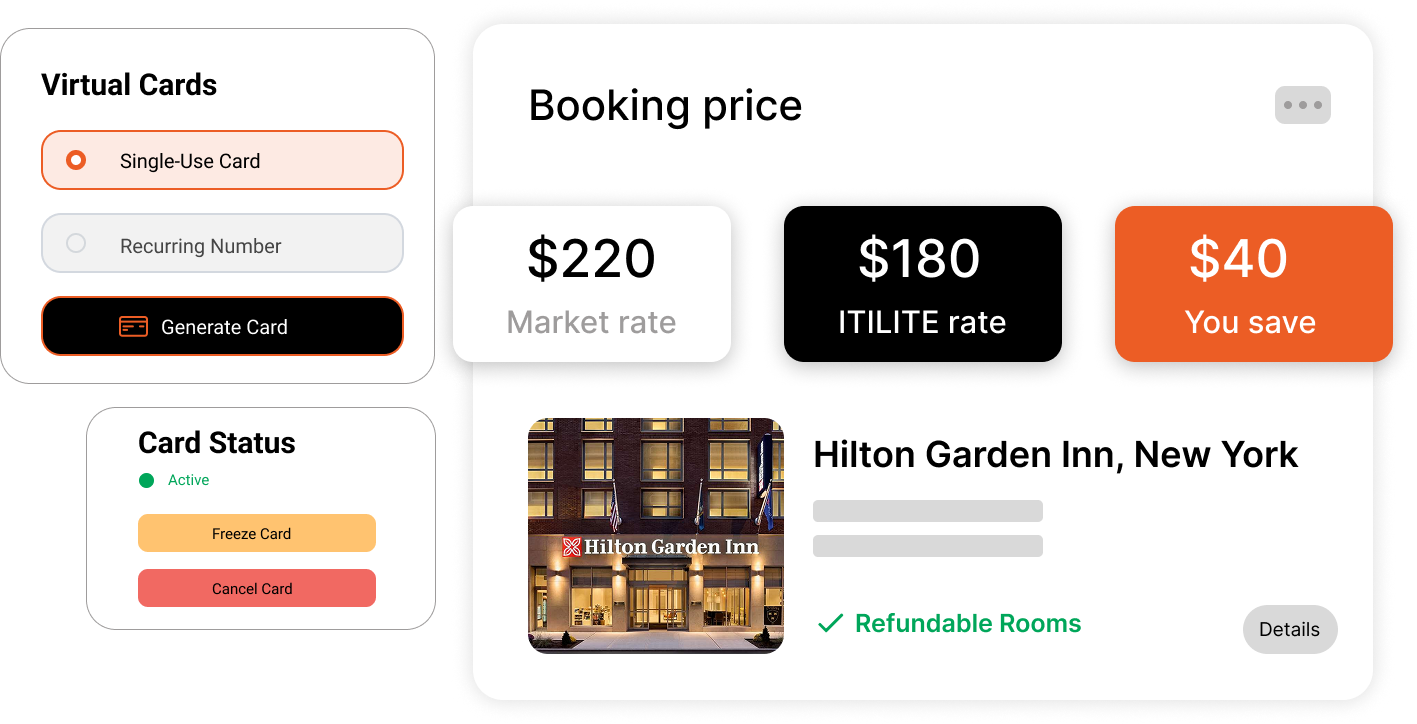

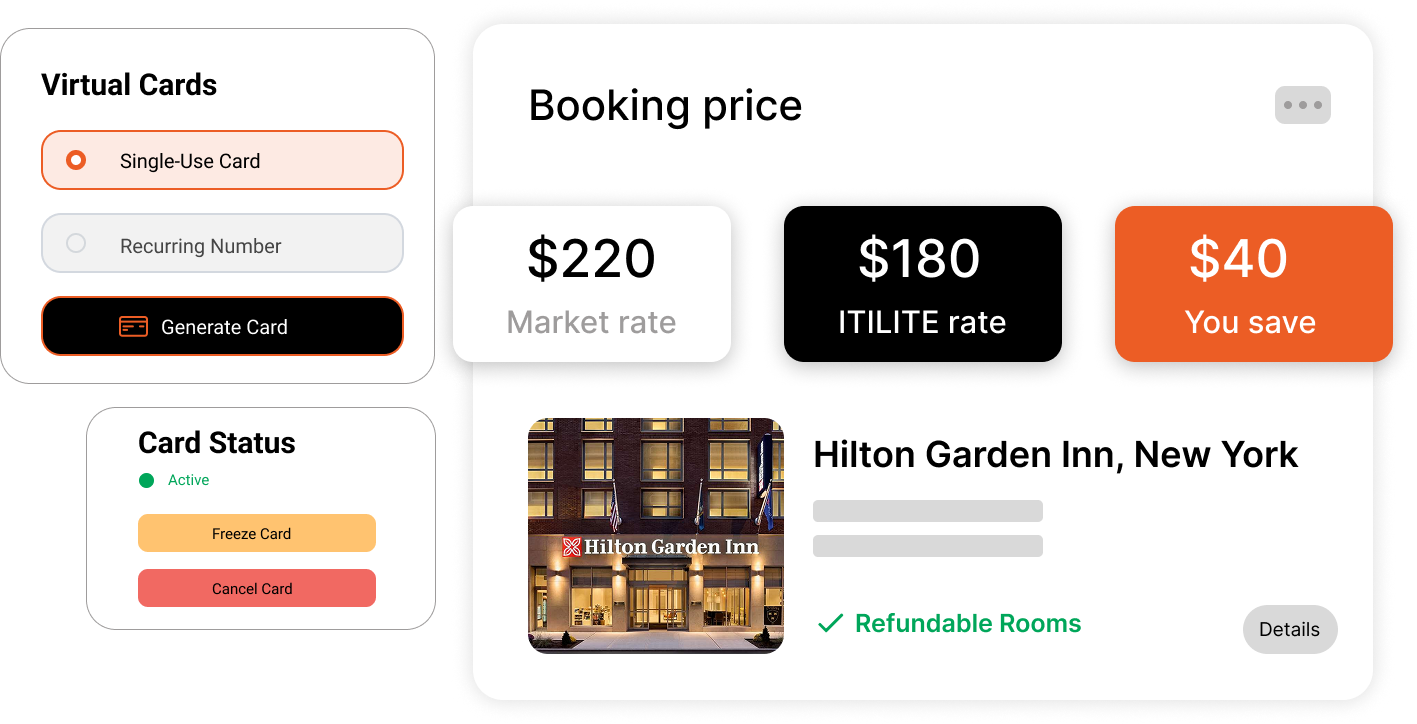

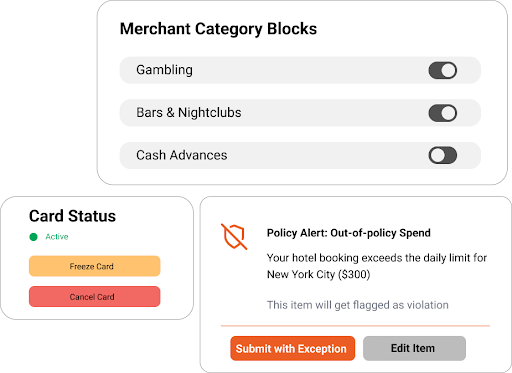

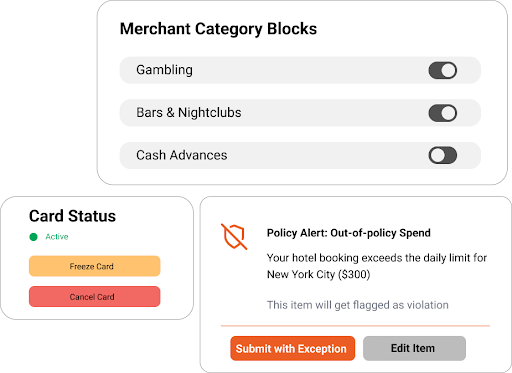

Controls & Compliance: Preventing spend leakage companywide

Enforce merchant blocks, card limits and approval flows so teams spend only where policy allows, while finance retains real-time visibility.

- Set per-card spend caps and instant freezes.

- Block categories that don’t match business policy.

- Use time-bound virtual cards for vendor payments.

- Require approvals for large or unusual spends.

- Keep audit trails for each transaction event.

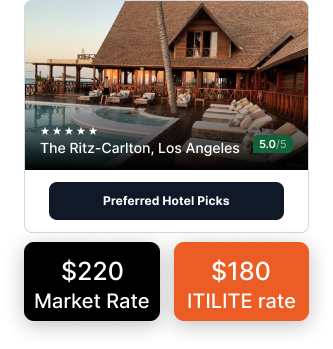

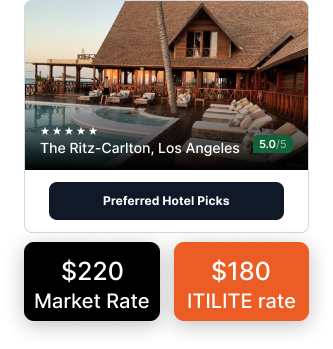

Integrated Travel Savings and Property-Specific Rates

Booking travel through Itilite surfaces property-specific rates and negotiated supplier offers, ensuring a lower base price plus card-level returns.

- Preferred hotels surface first at booking.

- Negotiated rates reflect your actual company volumes.

- Airline perks appear for high-frequency routes.

- Consolidated invoices simplify supplier payments.

- Auto-apply hotel perks and vendor credits.

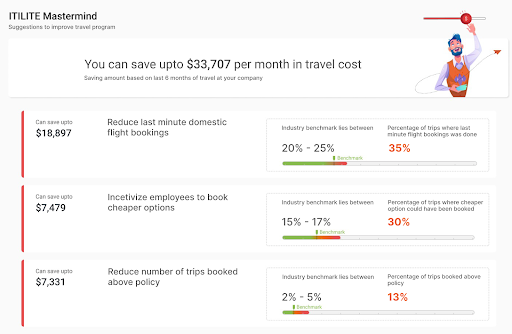

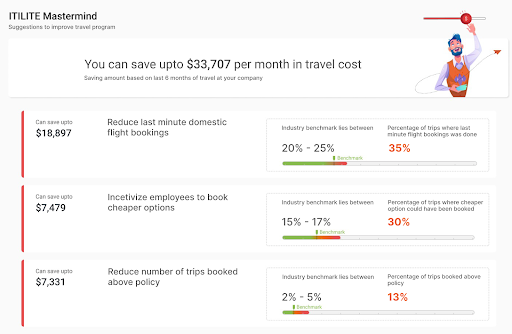

Reporting, AI Insights and Continuous Program Optimization

Use Itilite Mastermind and dashboards to quantify rewards, find savings, and tune policies so the program keeps improving.

- Receive monthly saving and compliance recommendations.

- Visualize spend trends and reward flows in dashboards.

- Identify duplicate subscriptions and unnecessary vendors.

- Monitor vendor concentration and renegotiate suppliers.

- Automate reconciliation and reward posting to GL codes.

What Every Buyer Should Know About Corporate Card Rewards

This section explains the basics, benefits, and best practices around corporate card rewards for buyers researching solutions; it’s an informative guide suitable for decision-makers and practitioners.

Companies exploring corporate card rewards often ask the same set of foundational questions: what exactly is a corporate card rewards program, how does reward redemption work, and how do you measure real savings? Below is a practical, no-nonsense guide.

What is a corporate card rewards program?

A corporate card rewards program returns a portion of company card spend back to the organisation, typically as cashback, statement credit, or points that can be redeemed. The most useful programs prioritize cash or credits that post to the company account (not personal points), ensuring accounting transparency and immediate value capture.

How does reward redemption typically work?

Redemption methods vary: some providers deposit cash directly to company bank accounts; others issue statement credits or convert rewards into merchant credits. Corporate Card Reward Redemption is highest value when deposits are automated and visible in your monthly close. Confirm the cadence (monthly/quarterly), minimum thresholds, and posting mechanics before committing.

Are Business Credit card rewards the same as travel program perks?

No, Business Credit card rewards typically focus on category rebates (e.g., office spend, subscriptions), while travel perks are supplier-negotiated benefits (property-specific rates, upgrades). The best outcome is combining both: cashback on spend plus lower negotiated travel pricing.

Where do real savings come from besides cashback?

Savings also come from better negotiated rates driven by consolidated booking data, reclamation of unused flight/hotel credits, fewer reimbursements, and reduced finance hours for reconciliation. When bookings are routed through a single platform, you also increase leverage to negotiate property-specific rates.

What should I watch for when comparing providers?

Watch for hard-to-redeem points, expiration rules, and opaque redemption fees. Ensure the provider supports direct Corporate Card Reward Redemption, transparent posting, and reporting that ties reward flows to cost centers.

How do you measure ROI?

Track direct cashback deposited, percentage reduction in out-of-policy spend, average daily rate improvements from negotiated hotel pricing, and time saved in finance operations. Dashboards and AI insights help quantify these benefits over 3–12 month windows.

Implementation best practices

Mandate platform bookings, issue virtual cards by role or project, block non-essential MCCs, and review redemption statements monthly. Reinforce employee compliance with prioritized preferred suppliers to maximize negotiated savings and rewards.

Why choose an integrated provider like Itilite?

Integrated platforms close the loop: card usage generates data → data enables negotiations → negotiated rates + cashback = measurable net savings. Itilite combines refunds, automated reconciliation, and Mastermind insights in one interface to make Corporate card rewards meaningful for finance.

Frequently Asked Questions

What are Corporate card rewards and how do they work?

Corporate card rewards return a portion of business spending to the company as cashback or credits; Itilite deposits cashback directly to your company account.

How does Corporate Card Reward Redemption happen?

Redemption is automated or scheduled; Itilite supports Corporate Card Reward Redemption that posts directly to operating accounts.

How can digitizing expense reimbursement through itilite save time?

Redemption is automated or scheduled; Itilite supports Corporate Card Reward Redemption that posts directly to operating accounts.

What are Business Credit card rewards differences?

Business Credit card rewards focus on business categories, reporting and reconciliation, designed for cashflow and GL impact.

How much cashback can we expect from Itilite?

Typical structures are 1.5% cashback on general spends and up to 2.5% on travel booked through the platform.

Can we issue unlimited cards to employees?

Yes, Itilite supports unlimited virtual and physical cards with role-based controls.

Do rewards complicate accounting or reconciliation?

No, Itilite posts rewards to company accounts and flags redemptions in reconciliation reports.

Are there fees to redeem rewards?

No hidden fees; Itilite redeems cashback directly and avoids complex point conversion charges.

How do negotiated property-specific rates work with rewards?

Bookings through Itilite prioritize negotiated rates; when combined with cashback, total net savings increase noticeably.

How do I stop employees booking outside the platform?

Use policy enforcement, spend controls, and reporting to detect leakage and incentivize compliant bookings.

How do I track Corporate card rewards over time?

Use Itilite dashboards and Mastermind reports to track cumulative rewards, Corporate Card Reward Redemption instances, and the net ROI.