Corporate Card Expense Reconciliation

Automate expense Reconciliation for every corporate card swipe with accurate matching, instant checks, and Quick Expense Report Reconciliation directly inside ITILITE.

Trusted by 500+ companies

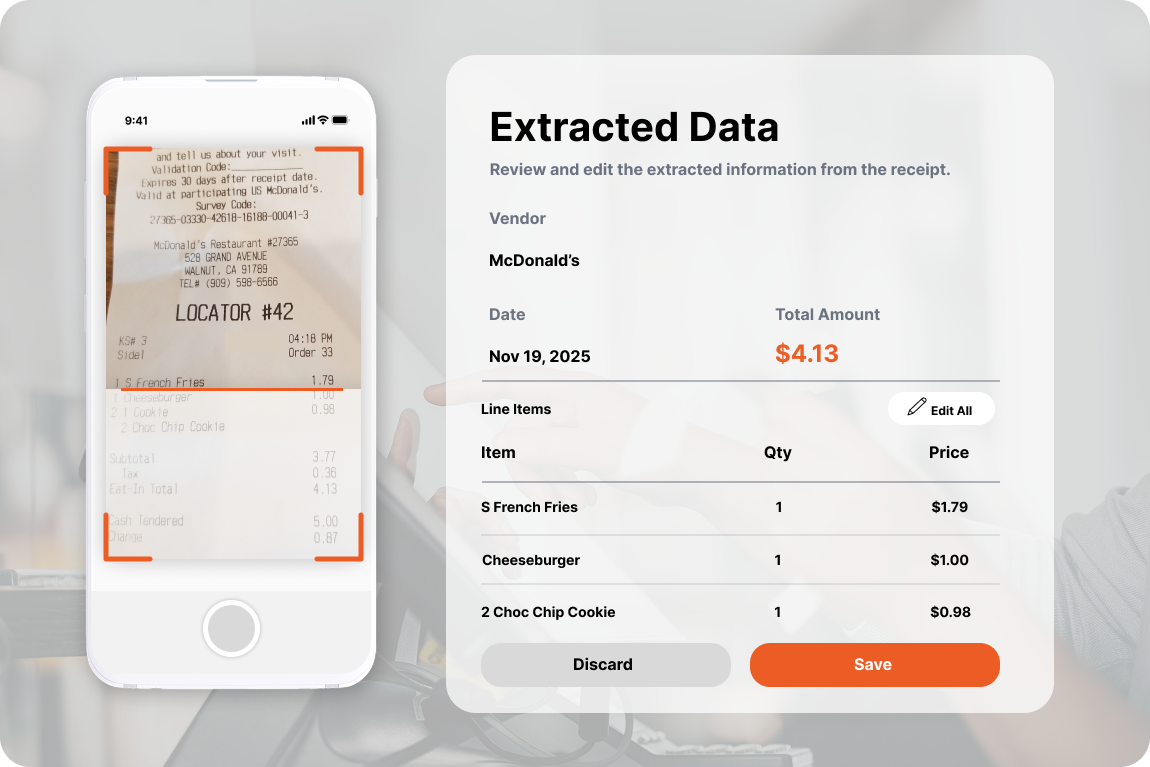

Real-Time Card and Receipt Matching

Match every corporate card transaction with receipts instantly. ITILITE automates expense reconciliation and gives finance teams Quick Expense Report Reconciliation in one place.

- Auto-sync card transactions

- OCR extracts receipt data

- Matches vendor, date, amount

- Reduces errors and duplicates

Automated Policy and Compliance Checks

ITILITE enforces your expense rules automatically. Every report goes through policy checks to keep your expense reconciliation clean and ensure Quick Expense Report Reconciliation.

- Flags out-of-policy spend

- Alerts sent instantly

- Custom rule engine

- Less manual follow-up

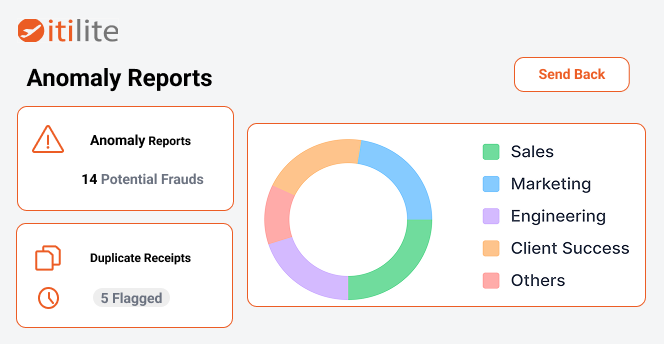

Powerful Fraud and Duplicate Detection

AI detects unusual spending and duplicate claims, strengthening expense reconciliation. Finance teams get reliable Quick Expense Report Reconciliation with minimal manual work.

- Detects duplicate claims

- Spots weekend spends

- Flags altered receipts

- Reduces financial risk

Seamless ERP and Accounting Integration

Push approved expenses into your ERP with one click. ITILITE completes expense reconciliation and enables Quick Expense Report Reconciliation across all accounting systems.

- Syncs date, vendor, amount

- Pushes GL-coded values

- Works with major ERPs

- No manual export needed

Faster Approvals and Clearer Workflows

Route expenses to the right approvers automatically. ITILITE speeds expense reconciliation and supports Quick Expense Report Reconciliation with transparent workflows.

- Multi-level approvals

- Smart routing rules

- Mobile approvals ready

- Full audit trail kept

Explore the Basics of Expense Reconciliation

Learn the fundamentals of expense reconciliation, why it matters, and how Quick Expense Report Reconciliation helps teams stay accurate and audit-ready.

What Is Corporate Card Expense Reconciliation?

Corporate card expense reconciliation is the process of matching each card transaction with its supporting documents, usually receipts or invoices, to confirm accuracy and legitimacy. Finance teams review amounts, dates, vendors, and categories to ensure the books are correct. This step is essential for preventing errors, detecting fraud, and ensuring clean audits.

The goal of expense reconciliation is not just to verify spend, but to create a reliable financial record. When done manually, it becomes slow, messy, and error-prone. That’s where automated systems like ITILITE come in, offering Quick Expense Report Reconciliation with real-time matching and smarter controls.

Why Do Companies Need Expense Reconciliation?

A company needs this process to protect itself from incorrect reports, policy violations, and hidden risks. Without consistent expense reconciliation, small errors compound and create inaccurate financial statements. A finance leader might also struggle with budgeting and forecasting if the underlying data is flawed.

expense reconciliation ensures:

- your accounting system records the correct numbers

- transactions are legitimate

- taxes and regulatory requirements are met

- audits move smoothly

- teams gain full visibility into corporate spending

This is also why Quick Expense Report Reconciliation is becoming a priority, especially for fast-growing companies.

How Does Corporate Card Data Get Matched?

The matching process involves comparing three pieces of information:

- Card transaction details from the bank

- Employee-submitted receipts

- The expense report inside the platform

Matching includes checking the vendor name, date, amount, and description. Any mismatch triggers review. This is the heart of expense reconciliation and the most time-consuming part when done manually.

What Are the Main Challenges Finance Teams Face?

Common challenges include missing receipts, duplicates, late submission, wrong categories, unapproved vendors, and mismatched amounts. Manual spreadsheets make these worse.

Automated platforms address these issues by using OCR to read receipts, AI to flag anomalies, and rules to enforce compliance. These tools also make Quick Expense Report Reconciliation possible so teams finish reviews faster.

How ITILITE Supports Accurate Reconciliation

ITILITE connects directly with your corporate card provider, reads receipts using OCR, matches transactions instantly, and checks every line against policies. This reduces manual oversight and improves the accuracy of expense reconciliation. The system also supports Quick Expense Report Reconciliation by giving finance teams a complete, real-time view of all corporate card spend.

Frequently Asked Questions

What is Expense reconciliation?

Expense reconciliation is the process of matching receipts, reports, and card data to ensure accurate financial records. ITILITE automates this step for reliability.

Why is corporate card reconciliation important?

It ensures transactions are valid and error-free. ITILITE makes this faster with automated checks.

How does ITILITE improve Quick Expense Report Reconciliation?

Real-time card sync, OCR, and AI help ITILITE deliver Quick Expense Report Reconciliation without manual work.

Does ITILITE detect duplicate expenses?

Yes, AI flags duplicates during expense reconciliation automatically.

Can ITILITE push expenses into my ERP?

Yes. ITILITE integrates with major ERPs to sync reconciled expenses instantly.

How does ITILITE handle missing receipts?

The system flags missing proof during expense reconciliation and alerts employees.

Does ITILITE support travel-linked corporate card spend?

Yes. Trips booked in ITILITE are tied directly to expense reconciliation.

How fast can approvals happen?

Approvals can be completed on mobile, helping Quick Expense Report Reconciliation.

Does itilite support reimbursements in multiple currencies?

Yes. AI detects unusual spend patterns that impact expense reconciliation.

Is ITILITE suitable for global teams?

Yes. ITILITE supports multi-currency expenses and global expense reconciliation workflows.

What is Expense reconciliation?

Expense reconciliation is the process of matching receipts, reports, and card data to ensure accurate financial records. ITILITE automates this step for reliability.

Why is corporate card reconciliation important?

It ensures transactions are valid and error-free. ITILITE makes this faster with automated checks.

How does ITILITE improve Quick Expense Report Reconciliation?

Real-time card sync, OCR, and AI help ITILITE deliver Quick Expense Report Reconciliation without manual work.

Does ITILITE detect duplicate expenses?

Yes, AI flags duplicates during expense reconciliation automatically.

Can ITILITE push expenses into my ERP?

Yes. ITILITE integrates with major ERPs to sync reconciled expenses instantly.

How does ITILITE handle missing receipts?

The system flags missing proof during expense reconciliation and alerts employees.

Does ITILITE support travel-linked corporate card spend?

Yes. Trips booked in ITILITE are tied directly to expense reconciliation.

How fast can approvals happen?

Approvals can be completed on mobile, helping Quick Expense Report Reconciliation.

Does ITILITE help reduce fraud?

Yes. AI detects unusual spend patterns that impact expense reconciliation.

Is ITILITE suitable for global teams?

Yes. ITILITE supports multi-currency expenses and global expense reconciliation workflows.