Do your employees go on frequent business trips? And you have to spend thousands of dollars on each trip? Does it get difficult to manage the expense reimbursement process? If you’ve answered yes to all these questions, then you are not alone. The majority of travel managers and admins across the globe struggle with expense management related to business travel.

As per business travel news, business travel spending for 2024 is expected to hit $236.8 billion and is expected to reach $252.8 billion by 2027. As your employees embark on frequent business trips, meticulously tracking and managing their travel expenses can quickly become daunting. This challenge only intensifies when it’s time for reimbursement. Enter centralized travel payment card-a card that simplifies the expense management process for business travel.

With such centralized travel cards, you do not have to deal with cash advances, employee reimbursements, and spending tracking. Companies can streamline everything through a unified payment solution.

In this blog, we list five main benefits of using centralized travel payment cards.

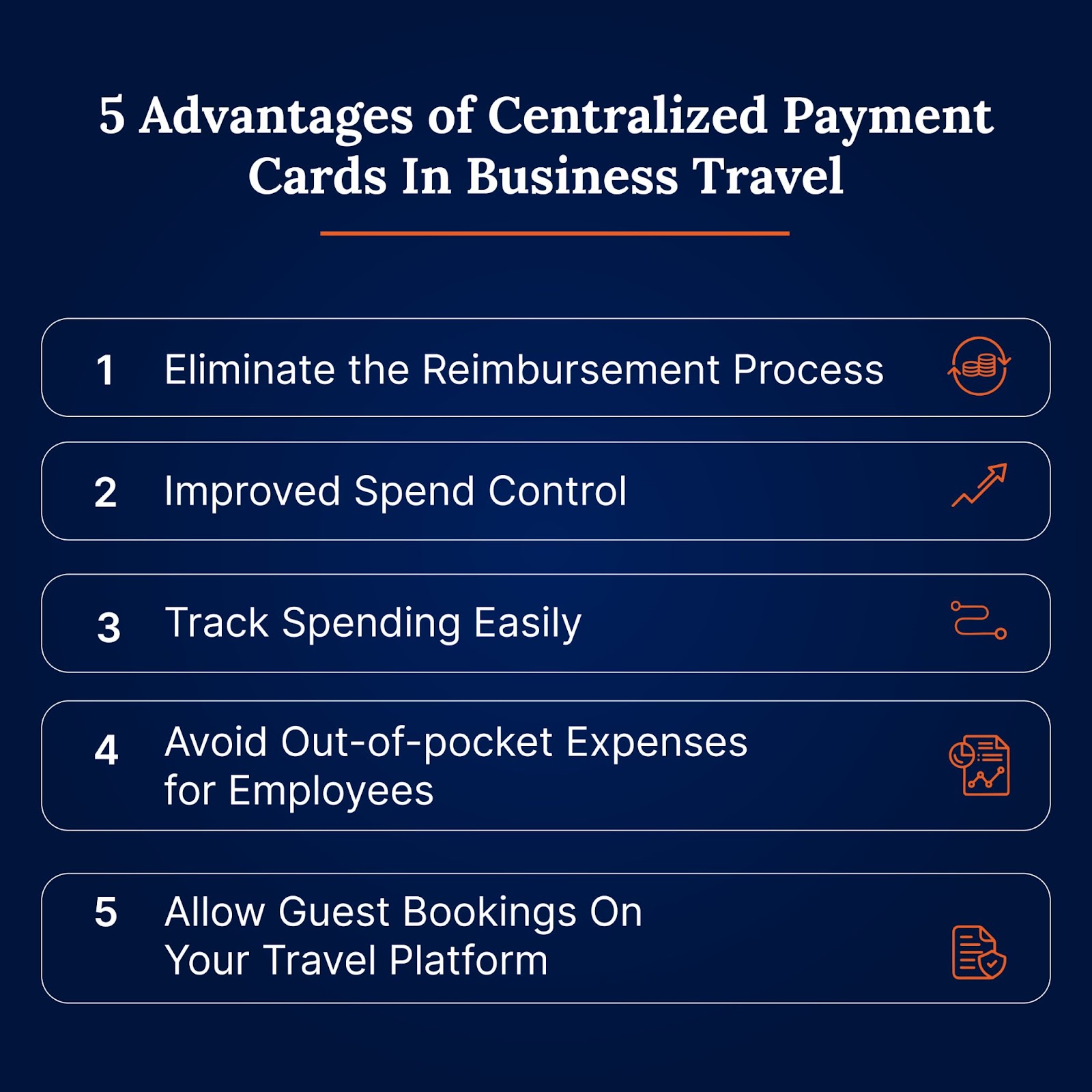

5 Advantages of Centralized Payment Cards in Business Travel

Centralized travel payment cards have many advantages. Mentioned below are the five main benefits:

1. Eliminate the Reimbursement Process

One of the biggest challenges with business travel expenses is the reimbursement process.

Employees who go on a business trip incur various expenses such as travel, accommodation, client entertainment and meals, incidental expenses, and many more. If they use multiple personal cards for every transaction, they should collect receipts and tie charges to expense reports. If you’re a travel or finance manager, then during the reimbursement process, looking up and verifying all these expenses manually becomes very tedious and time-consuming.

Centralized travel payment cards eliminate the reimbursement process. Since all purchases are made on a single card, the charges are aggregated in a single place. Employees do not need to collect and submit piles of receipts. There is no need for employees to apply for reimbursements. Hence, no payments are made through employees’ personal cards.

A streamlined process like this saves a lot of time and hassle. This efficiency gain ultimately provides major cost savings and improved productivity.

2. Improved Spend Control

Without a centralized travel card, travel expenses are spent through multiple credit cards. In such scenarios, it is difficult for companies to track and validate travel expenses. Moreover, when employees use their personal credit cards, there is no limit on the number of expenses for business travel. However, with centralized travel payment cards, companies can gain greater control over employee spending and travel expenses.

A centralized card enters all charges into a central expense management system. Every data is collected and stored in one place. They all get auto-populated, including date, time, amount transacted, vendor details, purchase history, etc. Travel managers can run reports to analyze spending patterns or catch any irregularities. If a fraudulent or unauthorized transaction is made, the software instantly detects it.

With a centralized card, companies can set spending limits and control permissions. Before handing each card over to an employee, you can set a spending limit for each card. Companies and travel managers can configure specific travel policies and restrictions that are specific to an employee’s role. For instance, higher limits may be set if an employee travels often for business purposes.

Additionally, visibility and control of spending results in better compliance. Employees will be more cautious in spending when they know they’re being monitored.

3. Track Spending Easily

A centralized travel payment card simplifies the spending tracking across the organization. Instead of having employees make purchases on multiple individual credit cards, you can streamline this through one central payment system, making it simple to extract spending data.

With centralized travel cards, travel managers and finance departments can easily monitor and evaluate employee expenditures. As the card is integrated with expense management software, the transactions are automatically recorded. This gives them real-time control over expenses without having to request employees submit their receipts.

Finance and travel managers can easily log into the system and instantly analyze spending by category, time period, employee, or any other parameter. This gives organizations much more flexibility and control over travel expenses.

Once the expense reports are sent to the accounting department, they can easily check them for accurate reimbursements.

Suggested Read:

A Guide to Travel Expense Reimbursement Process

4. Avoid Out-of-pocket Expenses for Employees

Most employees travel for business purposes from your company. During their travels, they must use their personal cards to make business-related expenses, or your company should issue a card to every employee. If an employee has to spend around $2000 dollars for his trip, he/she may be hesitant to do so due to financial strains.

With a centralized payment card, employees don’t have to worry about making expenses from their pockets. Instead, using the centralized travel payment card all the expenses made by employees get recorded in the expense management system. This way, companies can centralize all the invoices for travel spending. It also saves a lot of time and effort for employees and companies.

5. Allow Guest Bookings On Your Travel Platform

Let us consider a situation where your company organizes a travel conference in Chicago. You have invited business professionals and other esteemed guests from across the globe to attend this conference. You must book flights and accommodations for them according to their preferences. If the flights or hotels do not meet the guests’ requirements, they can have a bad travel experience. Additionally, if your company organizes a recruitment process, interviewees or guests might have to pay for their travel.

However, non-employees/guests can book the flights with a centralized travel payment card, hotels or car rentals within your company’s travel program. They can self-book their travel options as per their comfort and need. Moreover, with a centralized travel card, your company can enable travel bookings for recruitment candidates, guests, business partners, etc. This saves a lot of time and effort.

Maximize Efficiency and Control with Centralized Travel Payment Cards

Centralized travel payment cards benefit both employees and companies. The cards simplify the corporate travel management process and save a lot of time and effort. They optimize spending and help with financial transparency, thus ensuring cost savings.

Looking for the best-centralized travel card in the market? itilite is your answer. With itilite card, you save up to 30% of your travel costs. Our cards come with robust, flexible spending limits and real-time spending visibility. You can use a single company card, embed it with itilite travel for company-wide payments, and issue transaction-level virtual corporate cards from a company card account for hotel payments. Additionally, you can get a monthly centralized invoice for all your travel spends. And the best part? Get notified for out-of-policy spending and fraudulent expenses.