Thousands of employees travel for work every year, resulting in increased flight and hotel bookings. According to Statista, the hotel market in the United States alone is anticipated to experience a rise in revenue, projected to reach $110.50 billion by 2024. Furthermore, the number of hotel users is expected to reach 167.48 million users by 2028.

With so many people traveling frequently, hotel payments remain a major challenge. Another major challenge that most hotels and travelers face is credit card payments. The common challenges that both face are fraud and declined payments. This is where credit card authorization or CC auth comes into the picture.

This blog will discuss why cc auth is needed for hotels and travelers. It also discusses why organizations must leverage credit card authorization for hotel bookings.

What is Credit Card Authorization?

Credit card authorization or cc auth for a hotel allows a company to give the hotel permission to charge a central company card for their stay and expenses. In short, when an employee is staying at a hotel, his/her company calls up the hotel and informs them to charge the company card instead of the employee’s personal card.

A few days before the check-in, the company fills out the credit card authorization form with relevant details and sends it to the hotel. This process enables the employee to travel without carrying the company’s physical credit card. Hence ensuring seamless payment handling and convenience.

Why is CC Auth Needed?

CC authorization is needed because hotels require permission to charge a card that is not physically present and to prevent any future chargebacks by the cardholder. For businesses, particularly those handling a high volume of transactions, managing credit card authorizations can be a significant administrative task.

Challenges with the CC Auth Process

Credit card authorization is not a cakewalk. It comes with its own set of challenges. Some of the challenges that companies face include:

1. Time-Consuming Process

Let’s consider an example of a travel administrator managing 40 bookings per day. If the authorization process for each booking takes 5 minutes, the travel admin spends 200 minutes, 3 hours, and 20 minutes daily on credit card authorization for the hotel alone. This time includes entering card details, waiting for the authorization response, and managing any issues that arise if a card is declined.

Moreover, reconciling credit card authorization forms also takes additional time. For instance, let’s assume the finance team spends 2 minutes per transaction on reconciliation. For 40 bookings, this amounts to 80 minutes (1 hour and 20 minutes) daily.

Overall, the organization spends 280 minutes (4 hours and 40 minutes) per day managing the credit card authorization process for 40 bookings. This time includes both the initial authorization and the subsequent reconciliation process. This is a very time-consuming and cumbersome process. Organizations must be spending hours of their productive time managing the CC auth process. Hence, CC authorization is required for corporate hotel booking.

2. Check-In Denials

The payment could still face issues after the company authorizes the credit card to the hotel. This could be for various reasons. For instance, the person responsible for handling cc authorization for the hotel might not be available, the front desk person at the hotel might not be aware of any cc auth process, the card provided might fail, or there might be some sort of technical glitches.

In such cases, both the traveler and the company often face immediate challenges:

Check-In Denial: Without authorization, the hotel might deny the traveler the ability to check-in.

Traveler Payment: The traveler may be asked to use their personal card to cover the stay. This can be inconvenient and stressful, particularly if the traveler is unprepared for such a situation.

These problems result in an unpleasant experience for the traveler and can reflect poorly on the corporate travel management process.

3. Invoice Collection

The travel manager faces a significant challenge in collecting invoices from multiple hotels post-checkout. This task is time-consuming because the travel manager must contact each hotel individually, navigate varying procedures, and ensure timely receipt of invoices. Inconsistent response times and processes across hotels further complicate this administrative duty, requiring persistent follow-up to ensure accurate financial documentation for business travel expenses.

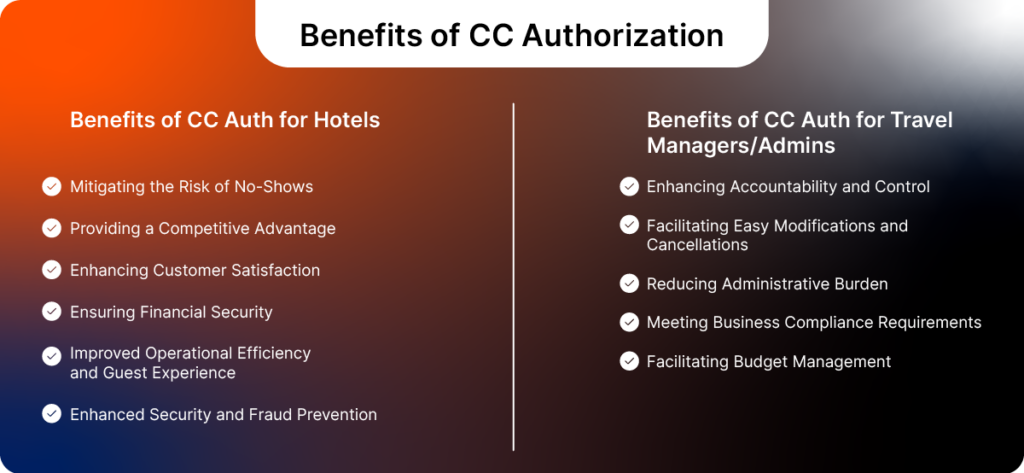

Benefits of CC Auth for Traveler Managers/Admins

Apart from the challenges, CC auth has a multitude of benefits for traveler managers, admins, and the organization.

1. Centralizes the Travel Payments

CC auth centralizes travel payments by consolidating all travel expenses onto a single corporate account. This simplifies financial tracking, ensures unified billing, and improves expense management. It also enhances control over travel budgets and streamlines the reconciliation process, making monitoring and managing business travel costs easier.

2. Eliminates Out-of-pocket Expenses and Reimbursement for Employees

Credit card authorization avoids asking employees to pay out of pocket by directly charging all travel expenses to the company’s corporate card. This means that hotel stays are billed directly to the company. This eliminates the need for employees to use their personal cards and apply for reimbursement later.

3. Limits Card Risks to the Authorized Amount

CC authorization for hotels limits card risks by ensuring that only the authorized amount is charged for transactions. If there is an extra charge, the cardholder has the right and the evidence to provide for any kind of chargeback.

4. Enhances Accountability and Control

Credit card authorization ensures that the booking process aligns with corporate policies and procedures, reducing non-compliance risk. It also provides a transparent and auditable record of all transactions, which is crucial for internal audits and ensuring that all travel expenses are accounted for and authorized.

5. Facilitates Easy Modifications and Cancellations

Corporate travel plans can change frequently due to unforeseen circumstances such as meeting rescheduling or flight delays. CC auth makes it easier for businesses to handle modifications or cancellations. Since the funds are pre-authorized, the hotel can quickly adjust the booking without the need for additional payment verification. This flexibility is crucial for businesses that require a seamless and hassle-free booking experience.

6. Meets Business Compliance Requirements

Many companies have stringent compliance requirements regarding travel and expenses. CC auth helps meet these requirements by providing a transparent and auditable record of all transactions. This transparency is crucial for internal audits and for ensuring that all travel expenses are accounted for and authorized. Credit card authorization ensures that the booking process aligns with corporate policies and procedures, reducing non-compliance risk.

7. Facilitates Budget Management

Credit card authorization helps companies manage their travel budgets more effectively. By pre-authorizing certain funds for hotel bookings, companies can better control their expenses. This allows travel managers to allocate travel budgets accurately, ensuring they stay within the company’s financial constraints. Additionally, the detailed transaction records provided by CC authorization make it easier to analyze travel spending patterns and identify areas where cost savings can be achieved.

itilite Can Help you Eliminate the CC Authorization Process

As corporate travel continues to grow, the importance of efficient and secure booking processes cannot be overstated. By understanding and leveraging CC auth’s benefits, hotels and businesses can enjoy a more streamlined, secure, and satisfactory booking experience.

Or else, you can take the assistance of itilite for managing the credit card authorization or cc auth process. itilite is a new-age travel management company that helps businesses and employees manage business travel seamlessly. If you struggle with managing the credit card authorization process, itilite will help you use one-time virtual cards for every hotel booking. With itilite, you can free up much of your time and focus on other important tasks. We also help you in limiting fraud and safeguard all your transactions.

We also help companies and travel managers eliminate check-in denials and invoice collection. This eliminates time spent connecting with hotels or identifying the reason for check-in denial.

To know more about itilite, book a free demo now.