Automated Travel Financial Reporting

Automate your travel and expense workflows with real-time data, policy control, and audit-ready accuracy. Gain full visibility and reduce manual work with Itilite’s unified system.

Trusted by 500+ companies

Unified Platform for Automated Financial Reporting

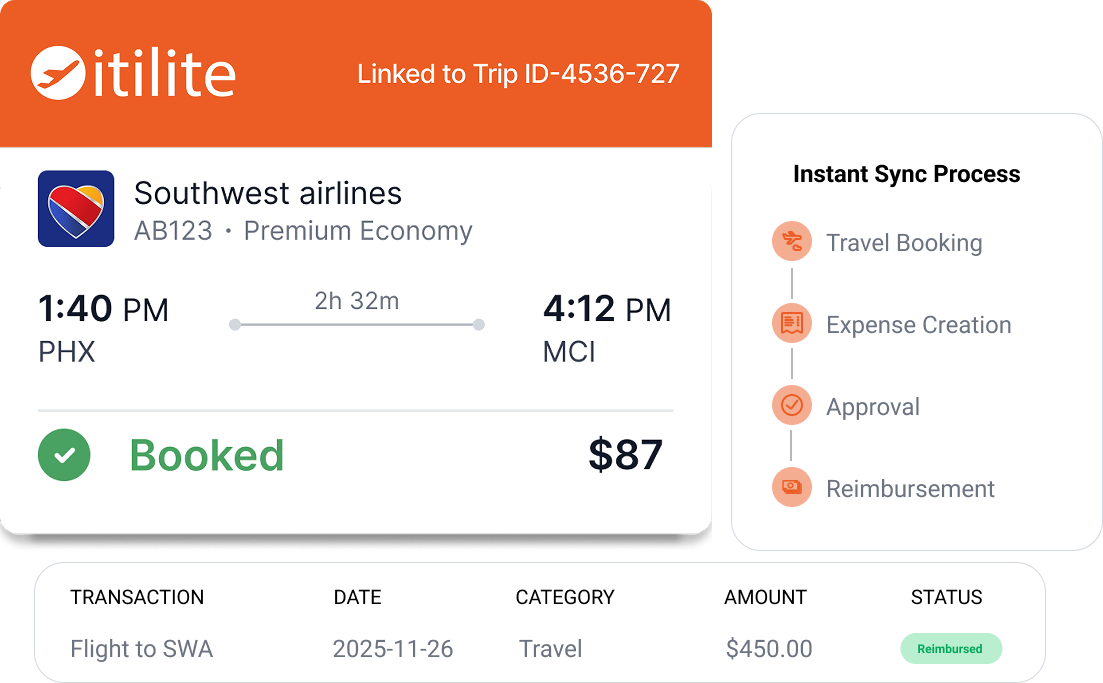

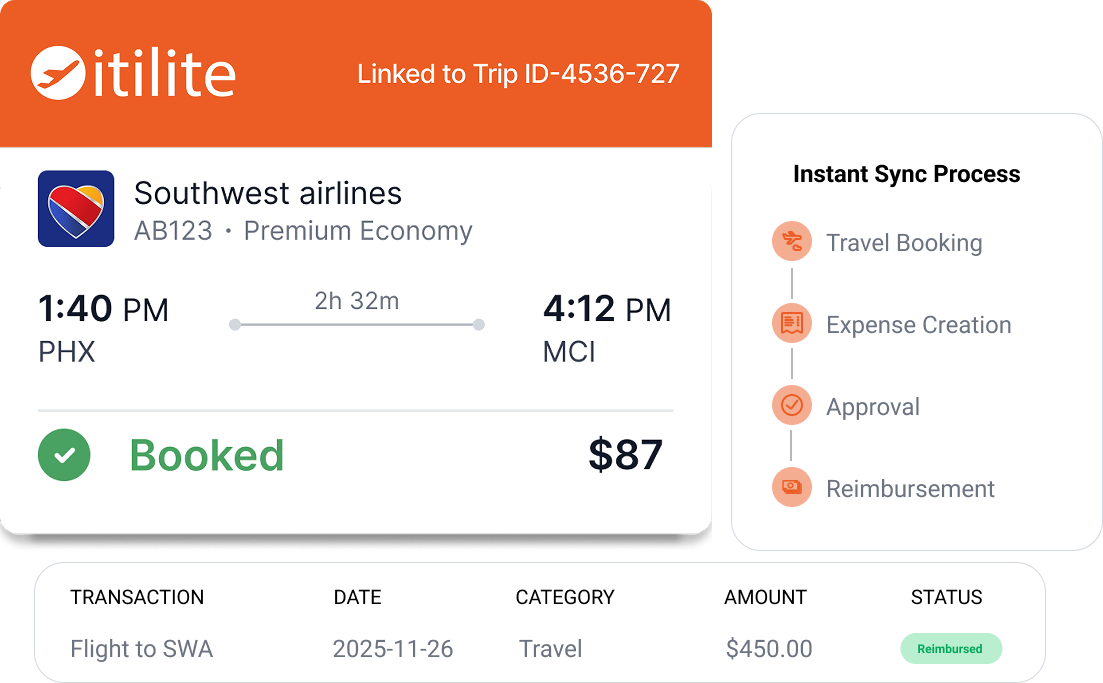

Itilite connects travel booking, expense submission, approvals, and reimbursements to deliver end-to-end Automated Travel Financial Reporting with complete accuracy and transparency.

- All travel and expense data in one place

- Instant sync from booking to expense

- Unified view for finance leaders

- Reduces manual entry errors

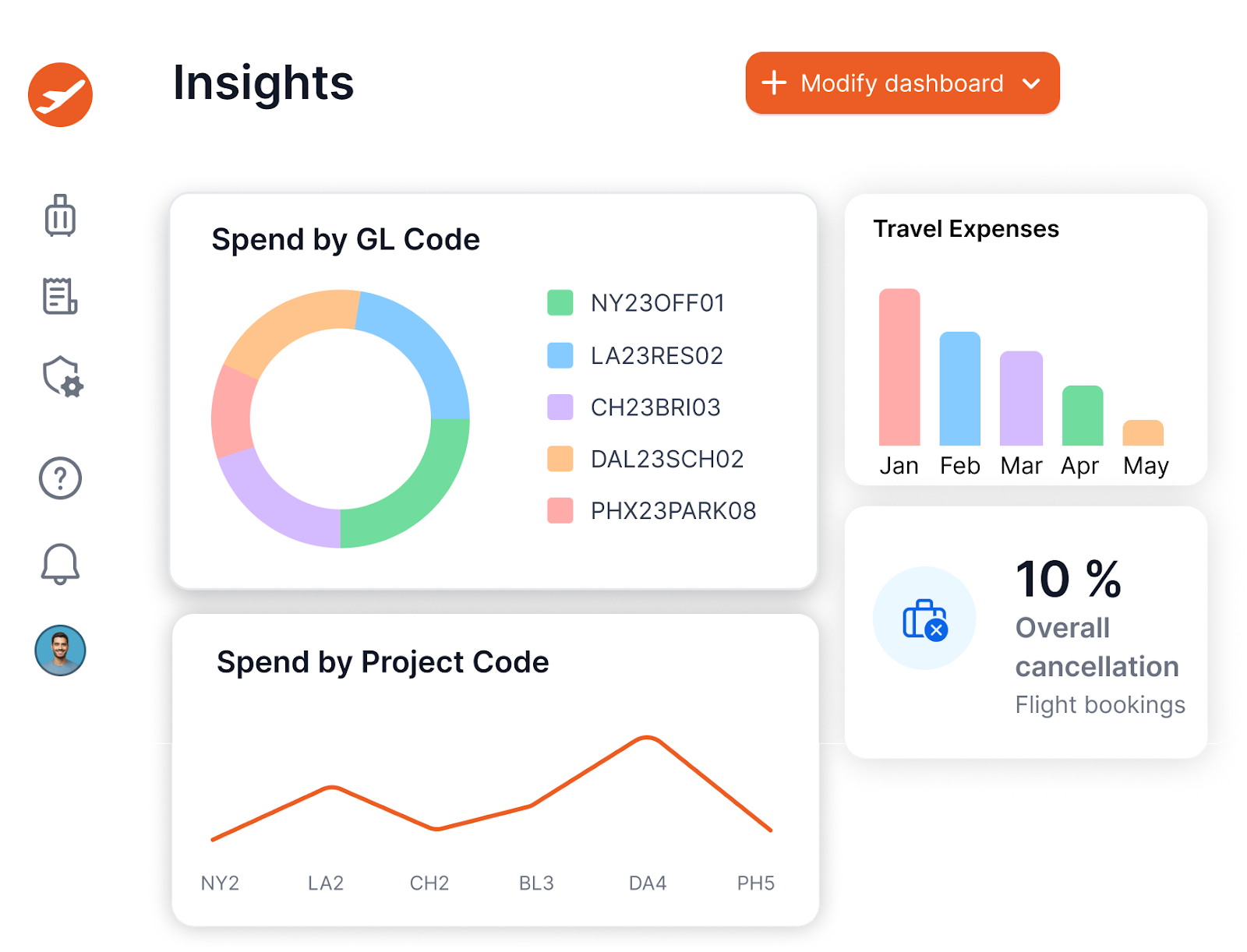

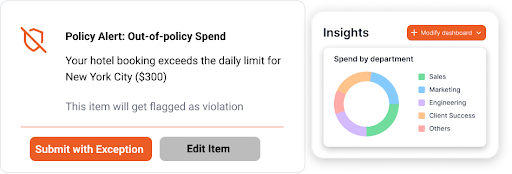

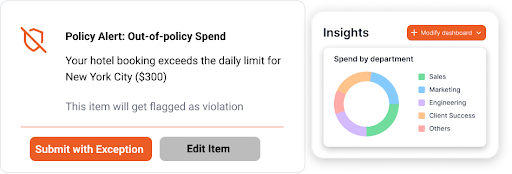

Real-Time Insights and Policy-Led Travel Reporting

Access live dashboards that reveal spend trends, policy risks, and category allocations. Perfect for teams seeking Automated Travel Financial Reporting with full control.

- Instant policy violation alerts

- Live category spend tracking

- Data to guide smarter budgets

- Helps prevent cost leakages

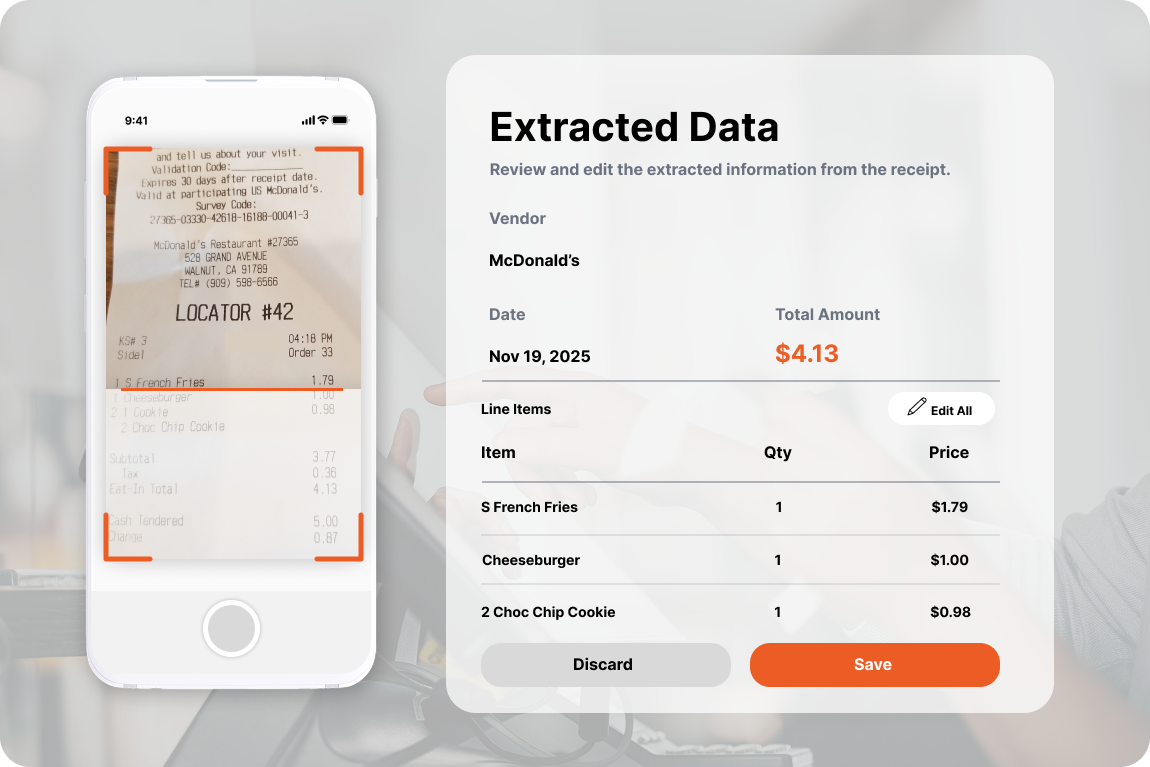

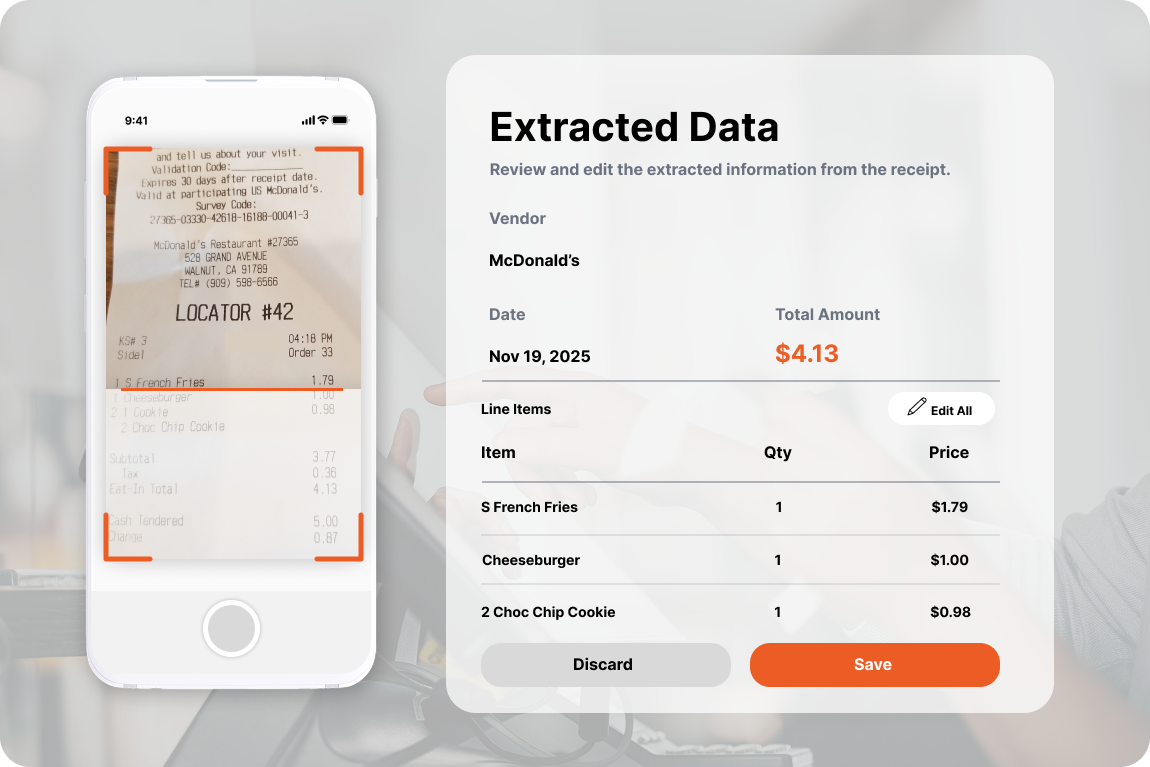

Automation for Receipts, OCR, and Expense Creation

Experience Automated Travel Expense Reporting powered by OCR that extracts receipt data, eliminates manual entry, and builds draft expenses automatically in seconds.

- Auto extraction from receipts

- Draft expenses built instantly

- Accurate item-level details

- Reduces user submission work

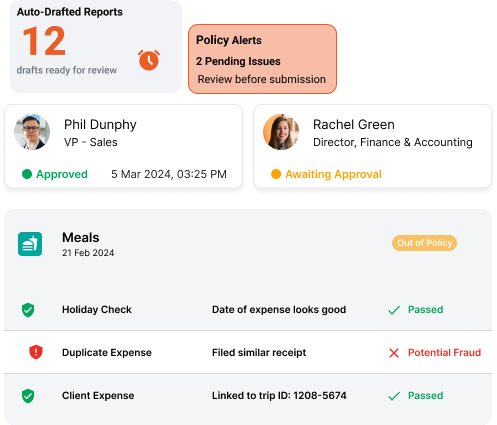

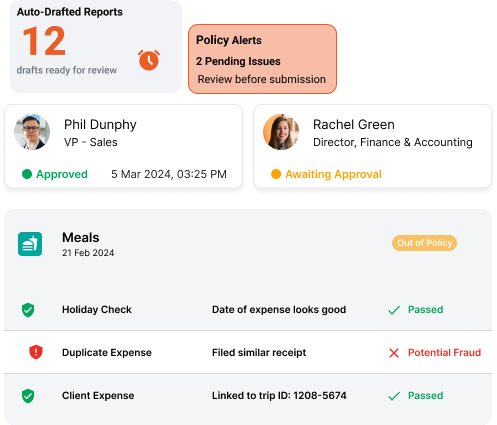

Smart Approvals and Intelligent Audit Automation

Use automated routing, audit checks, and anomaly detection for fast, compliant approvals. Ideal for organizations modernizing Automated Travel Financial Reporting.

- Policy rules checked instantly

- Duplicate claims auto-flagged

- Faster multi-level approvals

- AI-driven anomaly detection

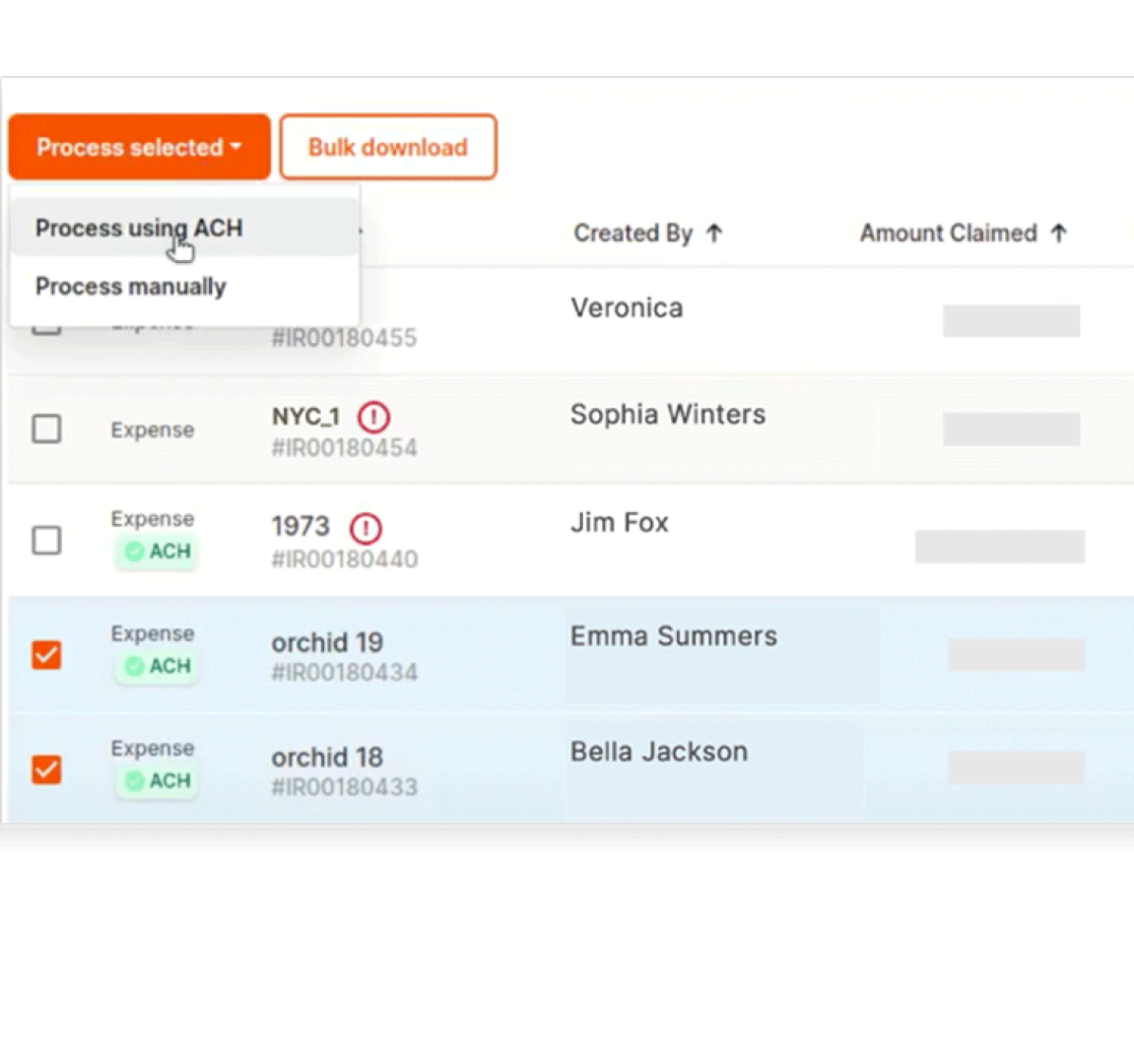

ERP Integrations and Automated Travel Reimbursements

Integrate expense data directly into SAP, NetSuite, and QuickBooks. Ensure smooth Automated Travel Expense Reporting and faster reimbursements without manual uploads.

- Push data to ERP instantly

- Accurate cost center coding

- Automated ACH payouts

- Eliminates export–import steps

Guide to Automated Travel Financial Reporting Basics

Explore foundational concepts, common workflows, and key user queries. This section gives an informational overview of Automated Travel Financial Reporting essentials.

What Is Automated Travel Financial Reporting?

Automated Travel Financial Reporting refers to the use of technology to manage, track, and consolidate all travel-related financial data without manual work. This includes travel bookings, expense entries, receipt capture, approvals, reimbursements, and accounting integration. The goal is to provide finance teams with accurate, real-time data and reduce the time spent reconciling travel expenses.

How Does Automated Travel Expense Reporting Fit Into This?

Automated Travel Expense Reporting is a core component of the overall system. It ensures that receipts, expenses, and trip costs get recorded automatically as employees travel. Tools like OCR and integrated booking workflows allow finance teams to avoid tedious data entry and focus on higher-impact work like analysis and budgeting.

Why Do Companies Need Automation for Travel Finance?

Most companies struggle because travel data sits in several disconnected systems—an OTA, a TMC, spreadsheets, email receipts, and accounting platforms. Automation centralizes everything. Finance teams gain a single source of truth, ensuring accuracy during audits, tax filings, and monthly close.

How Does the Process Work End-to-End?

The automation begins at booking. When an employee books a flight or hotel on an integrated system like Itilite, all booking details sync instantly into the expense module. During the trip, receipts uploaded through the app automatically convert into draft expenses. Policy rules run in the background, approvals route to the right manager, and final expense reports push into ERP software. This creates a seamless chain from travel to finance.

What Are the Main Benefits for Finance Teams?

Finance teams save time, reduce errors, and gain visibility. Automated Travel Financial Reporting helps them validate claims faster, prevent fraud, and gain insights into spending patterns. With Automated Travel Expense Reporting, they no longer need to manually audit receipts or verify basic details. Automation ensures everything is compliant before it reaches their desk.

How Do Policy Controls Improve Compliance?

Automated systems apply company policies in real time. If an employee tries to book a higher fare or submit an out-of-policy expense, the system flags it immediately. This ensures consistency, fairness, and audit-friendly reporting.

How Do Integrations Boost Automation?

ERP, HRMS, and accounting integrations ensure clean data flows. For example, once an expense report is approved, it auto-updates the general ledger, cost centers, and budgets. This removes reconciliation delays and prevents mismatched entries.

How Does Itilite Support These Workflows?

Itilite combines travel booking, Automated Travel Financial Reporting, and Automated Travel Expense Reporting inside a single platform. This eliminates data fragmentation, provides real-time visibility, and enables true automation from booking to reimbursement.

Frequently Asked Questions

What is Automated Travel Financial Reporting?

It refers to the automation of all financial processes related to corporate travel, including booking data, expenses, audits, and reimbursements.

How is Automated Travel Expense Reporting different?

It focuses specifically on automating receipts, expenses, approvals, and reimbursements.

How does Itilite automate receipt capture?

Employees snap a photo; OCR extracts data and builds a draft expense automatically.

Can policy violations be detected automatically?

Yes, the system flags out-of-policy bookings and expenses instantly.

Does Itilite integrate with ERPs?

Yes, including SAP, NetSuite, QuickBooks, Oracle, and more.

How does automation reduce fraud?

AI-driven checks identify duplicates, inflations, and suspicious claims.

What dashboards does Itilite offer?

Live spend analytics, category trends, budget utilization, and policy insights.

Are reimbursements automated?

Yes, approved expenses can be reimbursed via automated ACH payouts.

Does automation help with tax audits?

Yes, all expense data is accurate, categorized, and audit-ready.

Why should finance teams choose Itilite?

It provides end-to-end travel and expense automation, reducing manual effort and improving visibility.