Corporate Card Centralize Travel Payment System

Manage corporate travel efficiently with ITILITE’s centralized payment system, ensuring compliance, real-time tracking, and seamless expense reporting for every team member.

Trusted by 500+ companies

How can my team spend safely without risking company funds?

ITILITE virtual and physical cards protect your money while giving managers full control.

- Cards link directly to the centralized payment system

- Set spending limits per employee or team

- Transactions automatically follow travel policies

- Virtual cards reduce risk of exposing main account

How do we avoid sharing main corporate cards with hotels?

ITILITE generates unique one-time hotel cards for every booking to secure payments automatically.

- Unique card created for each pay-at-hotel booking

- No sensitive data shared with hotels

- Eliminates manual credit card authorization forms

- Prevents extra payment gateway charges

How do I ensure travel policies are always followed?

ITILITE enforces policies in real-time, alerting managers immediately about any out-of-policy spending.

- Transactions checked against predefined rules

- Alerts for unusual or out-of-policy spend

- Managers view compliance across all bookings

- Policy enforcement applies to all cards and payments

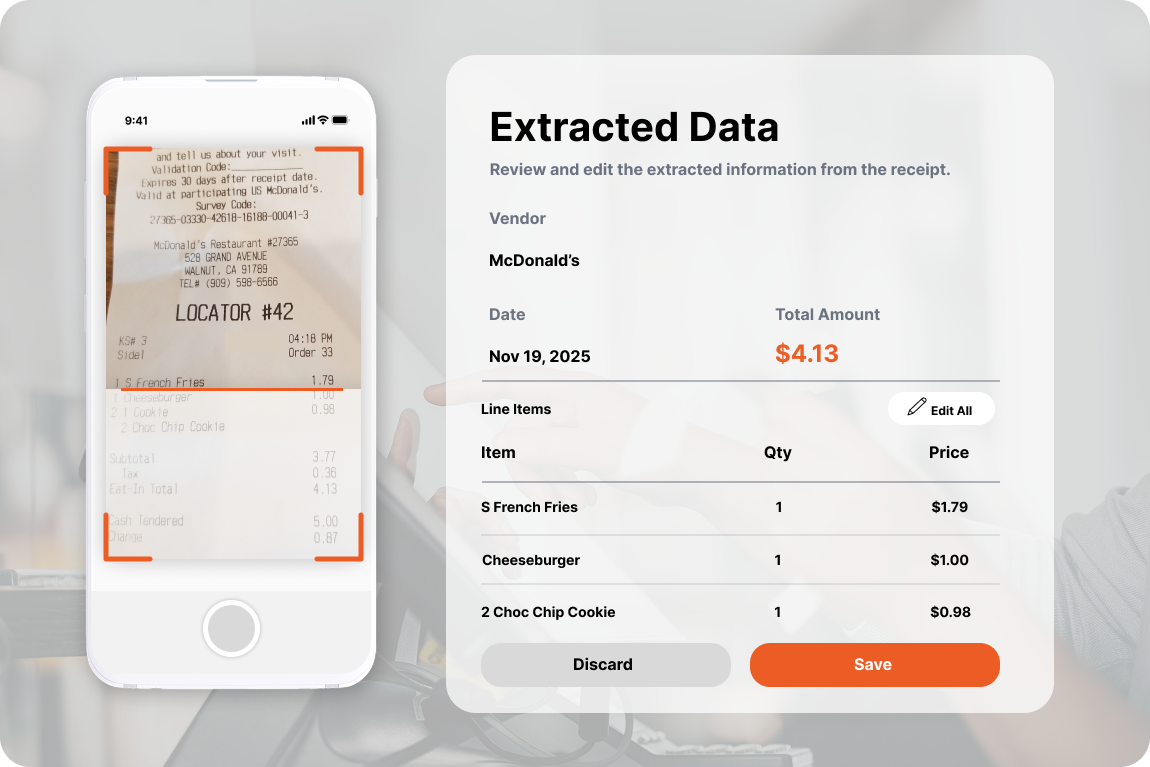

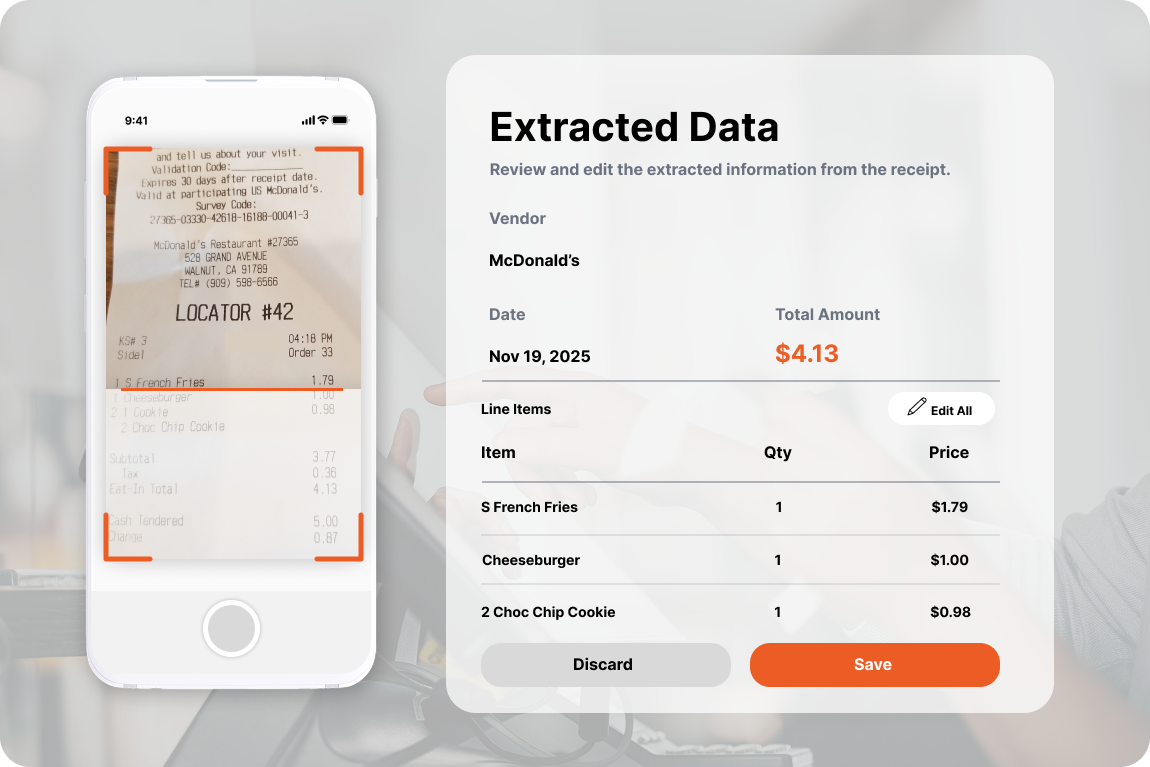

How can expense reports be faster and more accurate?

ITILITE automates reporting by combining card data and OCR technology for quick approvals.

- Card transactions feed directly into reports

- OCR extracts vendor, date, and amount

- Multi-level approval workflows included

- Reports ready for finance review instantly

Can employees manage expenses while traveling?

ITILITE’s mobile app allows instant capture, tracking, and submission of expenses on the go.

- Snap receipts and auto-link to transactions

- Real-time updates on spending and balances

- Approvals and comments handled via mobile

- Ready-to-submit reports with a single tap

What You Need to Know About Centralized Payment Systems

Discover how centralized payment systems improve corporate travel, simplify approvals, and protect company funds.

What Is a Centralized Payment System?

A centralized payment system consolidates all corporate payments into one platform. Employees no longer use personal cards and submit reimbursements, they spend via virtual or physical cards issued by the company. ITILITE ensures real-time policy enforcement, automated approvals, and full visibility into all travel spending.

How Centralized Travel Payments Improve Compliance

Centralized Travel Payments allow finance teams to enforce travel policies instantly. ITILITE blocks out-of-policy spending, tracks expenses in real-time, and logs all transactions for audit and regulatory compliance. Employees can book flights, hotels, and rentals knowing their payments are pre-approved and secure.

Security and PCI DSS Compliance

ITILITE uses end-to-end encryption, key management, and Level 1 PCI DSS certification to secure all card data. One-time hotel cards further protect company funds by ensuring card numbers never leave ITILITE’s secure environment.

Expense Management Made Simple

OCR technology reads receipts, extracting vendor, date, amount, and tax info, and links them automatically to transactions. Employees submit expenses on mobile or web; finance teams receive automated, audit-ready reports instantly. Multi-level workflows accelerate approvals, reduce delays, and improve accuracy.

AI for Fraud Prevention

ITILITE AI detects duplicate expenses, unusual patterns, and mismatched receipts. Suspicious transactions are flagged before reimbursement, reducing leakages and ensuring the centralized payment system remains secure.

Multi-Currency and Global Travel Support

For companies with international teams, ITILITE supports multiple currencies, converts amounts to base currency for reporting, and maintains global compliance. Finance teams get consistent reporting for all regions.

Implementation Tips

- Review current travel policies and spending patterns

- Define approval hierarchies and spending limits

- Train employees on mobile app usage and reporting

- Integrate ITILITE with ERP or accounting systems

Monitor performance and adjust policies over time

Frequently Asked Questions

How does ITILITE protect corporate card details?

ITILITE uses virtual cards, one-time hotel cards, and AES 256-bit encryption for all sensitive transactions.

Can employees see expenses instantly?

Yes, all transactions reflect in real-time on mobile app and web portal.

How does ITILITE automate approvals?

Reports route through multi-level workflows based on amount, category, or department.

What makes one-time hotel cards secure?

Reports route through multi-level workflows based on amount, category, or department.

Does ITILITE integrate with accounting systems?

Yes, ITILITE connects with SAP, Oracle, QuickBooks, and more for real-time reconciliation.

How does AI detect duplicates or fraud?

AI analyzes transaction patterns, matches receipts via OCR, and flags anomalies automatically.

What are the benefits of automated expense reporting?

Reduces manual work, ensures accuracy, speeds reimbursement, and enhances compliance.

Can ITILITE handle global travel?

Yes, multi-currency support and global compliance features manage international expenses.

Why choose ITILITE over traditional corporate cards?

Centralized payments, real-time policy enforcement, automation, and enhanced security make ITILITE superior.