Corporate Travel Expense Filing Process

Trusted by 500+ companies

Capture Every Expense Instantly

Employees capture receipts right after payment using the Itilite app. Expenses are auto-read and filed, reducing manual effort and missing receipts.

Each transaction captured on Itilite instantly creates a digital record linked to the trip, vendor, and payment source.

This ensures no business expense goes undocumented and speeds up the overall expense filing process.

- Snap and upload receipts on mobile

- Auto-read amount, date, and vendor

- Tag to trip or project instantly

Build Reports in a Few Clicks

With auto-drafted expenses, employees can group items into complete reports in minutes, ready for submission and review without complex spreadsheets.

Itilite turns raw expenses into structured, categorized reports automatically.

Employees can preview, edit, and submit everything in one place, ensuring the travel expense filing process stays organized and accurate.

- Auto-drafted expense reports

- Smart categorization by type

- Policy alerts before submission

Real-Time Policy Checks

Itilite enforces company travel policies in real-time, flagging out-of-policy spends instantly and prompting employees before they submit.

Policy checks happen as employees file expenses, not afterward.

This ensures fewer policy violations and less back-and-forth between managers and finance teams.

- Real-time alerts for out-of-policy items

- Custom rules for per diems and categories

- Transparent compliance tracking

Fast, Error-Free Approvals

Managers approve or send back reports right from the web or mobile app. Itilite auto-routes approvals, so reviews are faster and more reliable.

The system ensures approvers only see reports relevant to them.

Bulk approvals, reminders, and comment tracking make the expense filing process efficient at every level.

- Automated approval routing

- Manager notifications and reminders

- Bulk and single-report approval options

Finance Review and Payouts

Finance teams verify, audit, and reimburse expenses with a few clicks. Itilite supports ACH payouts, credit card sync, and audit trails automatically.

Every approved expense flows to finance with audit-ready details.

Finance admins get visibility across all reports, reimburse faster, and ensure compliance.

- ACH and bank transfer reimbursements

- Audit-ready verification logs

- Automated finance dashboard

Configurable Roles and Permissions

Admins manage policies, user roles, and approval hierarchies in one dashboard, ensuring the expense filing process aligns with internal governance.

Admins assign submitters, approvers, and finance admins with clear rules.

This keeps expense management structured, compliant, and auditable end-to-end.

- Role-based permissions

- Configurable approval flows

- Policy and compliance control

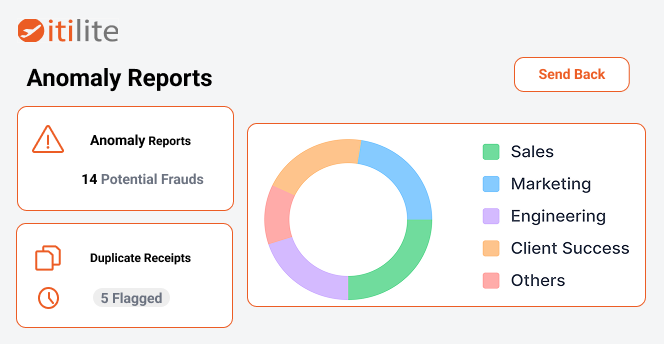

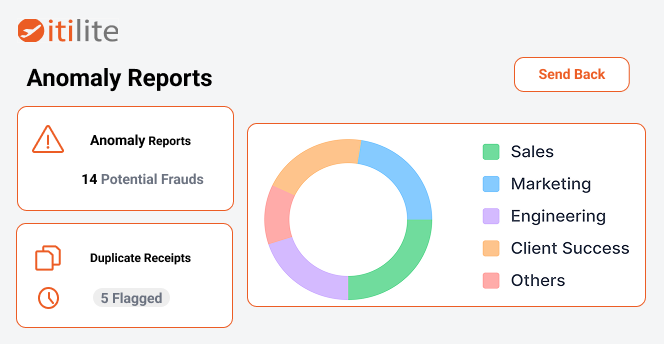

AI Fraud Detection and Insights

Itilite uses AI to flag duplicate receipts, weekend spends, or altered data, helping finance focus only on exceptions, not every single report.

Fraud detection is built into every stage of the travel expense filing process

With machine learning, Itilite spots irregularities early and keeps reimbursements transparent.

- Detect duplicate or altered receipts

- Flag weekend or off-policy spending

- View anomaly reports by department

Learn More About Expense Filing and Why It Matters

Get a complete overview of how the expense filing process works, its benefits, and why modern automation tools like Itilite are transforming it.

What actually happens during the expense filing process?

Expense filing starts the moment an employee incurs a business cost. Each expense needs to be recorded, justified, approved, and reimbursed.

In practice, this means gathering receipts, categorizing expenses, verifying policy compliance, and finally processing payments through finance.

A clear process ensures employees get reimbursed quickly while finance teams maintain control over company spending.

Why does a structured process matter for companies?

Without a defined workflow, reimbursements can pile up, duplicate entries slip through, and budgets lose accuracy.

A structured expense filing process helps teams stay compliant, audit-ready, and fair to employees, especially in organizations with frequent business travel.

Common pain points in manual expense filing

- Lost or unreadable receipts

- Late submissions and missing data

- Slow approvals due to unclear accountability

- Policy violations discovered only after payout

These inefficiencies not only frustrate employees but also waste finance time and increase compliance risk.

What does automation change in the expense filing process?

Automation reduces manual work and human error. Receipts are captured instantly, data is auto-read, and reports move through pre-set approval flows.

It creates real-time visibility for finance and faster reimbursements for employees, all while ensuring policy rules are enforced automatically.

How should companies design their travel expense filing process?

Start by defining clear categories (flights, hotels, meals, etc.), policies, and approval levels.

Then, adopt tools that integrate directly with travel booking and card data, so expenses appear automatically instead of being entered later.

Finally, set timelines for submission and reimbursement to maintain consistency across teams.

How do policy rules fit into expense filing?

Policies are the backbone of compliance. They define what can be reimbursed, spending limits, and documentation requirements.

A good system enforces these rules in real time, prompting employees before submission rather than rejecting claims afterward.

What are signs your expense filing process needs an update?

- Employees submit late or incomplete reports

- Approvers spend too much time verifying small details

- Finance audits reveal frequent mismatches

- Employees wait too long for reimbursements

If these sound familiar, it’s a cue that your travel expense filing process needs automation or policy integration.

What metrics should finance teams track?

Measure key indicators like average time to reimburse, number of policy violations, and percentage of reports auto-approved.

Tracking these helps you assess the health of your expense filing process and identify bottlenecks before they impact employees.

What are the compliance and audit implications?

Accurate records of receipts, policy checks, and approvals create a defensible audit trail.

This protects the company during internal or external audits and ensures all reimbursements are backed by verifiable data.

The bottom line

An effective expense filing process does more than reimburse, it ensures accountability, financial visibility, and employee trust.

Automated systems handle this seamlessly, freeing finance teams to focus on strategy instead of manual verification.

Frequently Asked Questions

Who can file expenses on Itilite?

Any employee assigned the “Submitter” role or higher can create and file expenses within the platform.

Can managers approve expenses on mobile?

Yes. Approvers can review, comment, or approve reports directly from the Itilite mobile app.

How long does reimbursement take?

With ACH integrations, reimbursements are typically processed within one business cycle after approval.

Does Itilite auto-categorize expenses?

Yes. Itilite’s OCR and AI automatically categorize expenses by type and project.

Can multiple approvers review the same report?

Yes, multi-level approvals can be configured for departments or spend thresholds.

What if an expense violates policy?

Out-of-policy items are flagged immediately. Employees can edit or add justification before submission.

How does Itilite ensure data security?

All data is encrypted at rest and in transit, ensuring privacy and compliance.

Can Itilite integrate with my ERP or accounting software?

Yes, Itilite integrates with major systems like QuickBooks, NetSuite, and SAP.

Are reimbursements available outside the U.S.?

Currently, ACH reimbursements are supported for U.S. accounts. Global payout integrations are being expanded.

What makes Itilite’s expense filing process unique?

Its deep travel integration, AI-based audits, and unified workflow for booking and expense filing make it stand out.