Consider your team is traveling for an industry conference. One employee books their flight with a corporate card, while another uses a purchasing card to order branded merchandise for the event.

Both expenses are essential, but which payment method improves your business? Purchasing card vs corporate card?

Here’s the thing: while corporate cards streamline individual travel expenses like flights and hotels, purchasing cards excel at handling procurement-related costs. The key is knowing when to use it accurately.

In the U.S., the credit card penetration is estimated to reach 68.44% by 2029. By strategically implementing the right card, you can save on administrative costs. Moreover, the right payment solution isn’t just about convenience, efficiency, and control.

This blog will discuss two types of company-issued cards and which is more beneficial for your business.

What is a Purchasing Card?

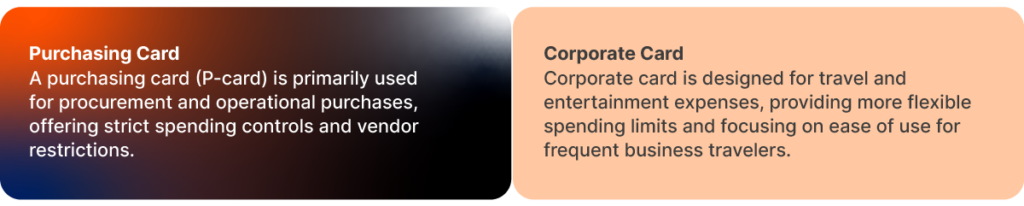

A purchasing card (P-card) is a company-issued credit card. It streamlines the procurement process. It enables employees to purchase goods and services directly from vendors without traditional purchase orders and invoices.

This card typically comes with strict spending controls and limits. It can include restrictions on vendor types and purchase categories. It’s primarily applicable for low-value and regular orders such as office supplies. This ensures compliance with company procurement policies.

What is a Corporate Card?

A corporate card and a purchasing card aim to simplify expense management. However, the corporate card is used for a broader range of expenses. It covers the costs of business travel to vendor payments. Therefore, it has more flexible spending limits. These cards facilitate smoother and quicker transactions. It also reduces the need for employees to use personal funds during business trips.

Purchasing Card vs Corporate Card: Differences

Let’s see the key differences:

1. Purchasing Card (P-card)

1.1 Purpose

Procurement and Purchasing of Goods and Services

The primary difference in purchasing card vs corporate card is the purpose. P-cards are issued mainly to help buy goods and services needed for company operations. This includes many items such as office supplies, equipment, and other operational materials.

Streamline Purchase Process and Reduce Paperwork

P-cards simplify purchasing by eliminating the need for traditional purchase orders and lengthy approval processes. This reduction in paperwork and administrative tasks helps companies save time and resources.

1.2 Usage

Authorized Employee Purchases

Another difference in purchasing card vs corporate card is usage. P-cards are typically given to employees with the authority to make purchases on behalf of the company. These employees use the card to buy items necessary for their departments or projects.

Specific Categories of Spending

P-cards are often used for designated spending categories, such as office supplies, maintenance items, and other operational needs. This specificity helps manage and control the company’s budget more effectively.

1.3 Understanding Controls and Limits

Strict Spending Controls and Limits

Further, the difference between purchasing card vs corporate card is controls. P-cards usually come with predefined spending limits to prevent excessive or unauthorized expenditures. These limits ensure the card is used appropriately and within the company’s budget constraints.

Vendor and Purchase Type Restrictions

Companies can restrict P-cards to use only with certain approved vendors or for specific types of purchases. This helps maintain control over where and how the company’s money is spent.

Monitoring and Reporting Transactions

All transactions made using P-cards are closely monitored and reported. Detailed records of purchases are kept to ensure compliance with the company’s procurement policies and to facilitate audits and reviews.

1.4 Advantages

Reduces the Need for Purchase Orders and Invoices

By using purchasing card vs corporate card, companies can reduce their need to rely on traditional purchase invoices. This streamlines the purchasing process and reduces administrative work.

Improves Efficiency in the Purchasing Process

Using P-cards speeds up the procurement process. It allows employees to quickly purchase necessary items without going through a lengthy approval chain.

Provides Detailed Tracking and Reporting of Purchases

P-cards offer detailed tracking and reporting capabilities. It enables companies to monitor spending patterns, analyze expenses, and ensure compliance with internal policies. This level of transparency is beneficial for financial management.

2. Corporate Card

2.1 Purpose

Travel and Entertainment (T&E) Expenses and General Business Expenses

Corporate card vs p-card is primarily used to cover travel and entertainment. It can be expenses such as flights, hotel stays, meals, and other business-related costs. These cards simplify the process of managing and reimbursing these expenses for employees.

Simplifying Expense Management

The primary aim of corporate cards is to streamline the expense management process. It makes it easier for employees to handle business-related expenses without using their personal funds. It also reduces the administrative burden on finance departments.

2.2 Usage

Employees Who Frequently Travel or Incur Business-Related Expenses

Business travelers receive corporate cards for work-related trips and expenses. Individuals with occupations entailing frequent business expenditures, like sales staff and executives.

Commonly Used for Travel, Dining, Lodging, and Other Business-Related Expenses

These cards are often used to pay for travel expenses. These include airfare, car rentals, hotel rooms, dining, and other needed costs during trips or meetings.

2.3 Controls and Limits

Flexible Spending Limits Compared to P-cards

A purchasing card vs corporate card often comes with more flexible spending limits than P-cards. It allows for higher expenditures that are common with travel and entertainment activities.

Less Restrictive Spending Controls

While corporate cards do have spending controls, they are generally less restrictive than those on P-cards. The focus is more on ensuring expenses align with company travel and entertainment policies rather than strict procurement guidelines.

Monitoring and Focus on Travel and Expense Policies

We monitor expenses incurred using corporate cards. We do this to ensure they follow the company’s travel and expense policies.

2.4 Advantages

Easy Tracking and Reimbursement of Business Expenses

Purchasing card vs corporate card facilitates straightforward tracking and reimbursement processes for business expenses, providing convenience for both employees and the finance department.

Reduces the Need for Personal Funds

By providing corporate cards, companies reduce the necessity for employees to use their personal funds for business expenses, alleviating the financial burden on employees and ensuring timely payments.

Detailed Statements for Expense Reporting and Accounting

Corporate cards offer detailed monthly statements, helping employees and finance departments with accurate expense reporting, accounting, and reconciliation processes. This enhances transparency and aids in financial planning and audits.

Have Your Expenses Sorted with itilite Cards

“Price is what you pay, value is what you get” – Warren Buffett

When choosing between a purchasing card vs corporate card, it’s essential to understand their different uses and benefits. With itilite corporate cards, employees can enjoy the freedom of cashless transactions, eliminating the need to use personal funds and wait for reimbursements.

These cards come with flexible spending limits tailored to individual needs, ensuring that employees can cover all travel-related expenses, from flights and hotels to dining and car rentals, without hassle.

To know more about the benefits, book a demo today.