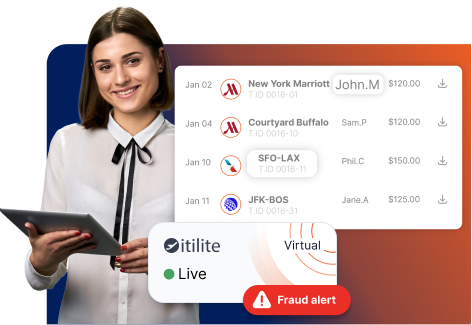

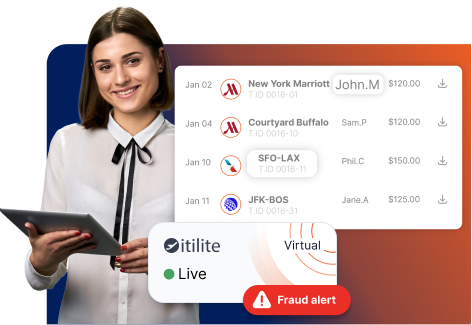

Central payments for your travel bookings

- Pay for hotels without issuing corporate cards

- *Applicable for companies registered in the United States of America

Customers loving the itilite experience

Centralize payments; get rid of reimbursements and managing employee cards

No more out-of-pocket payments for employees

Central card

- Use a single company card embedded in itilite travel for company-wide payments

- Issue transaction level virtual cards from a company card account for hotel payments

Wallet

- Use a pre-paid wallet for all travel bookings

Centralized travel payments

- Switch from employee paid to company paid

- Save time by getting a monthly, centralized invoice for all your travel spends

Still wasting time on credit card authorization forms?

- Get rid of credit card authorization process

- Reduce check-in denials

- Eliminate fraud risk

Enable guest bookings

- Allow guests to self-book travel on your company’s itilite travel account

- Enable travel bookings for recruitment candidates

Reduce finance team’s effort

- Automate credit card reconciliation with itilite card

- Real time visibility of employee spends to enhance cash flow management and budgeting

- Reduce fraud risk on corporate cards

Flat 1.5% cashback on all spends with itilite cards

- Upto 2.5% cashback on itilite travel spends

- Credit limit that doesn’t fluctuate

- Direct cash transfer; no more confusing reward points

Frequently asked questions (FAQs)

What are centralized travel payments?

Centralized travel payments are systems for managing all travel-related expenses through a single, unified account or platform. This approach streamlines the booking, payment, and reconciliation processes, thus offering organizations better control and oversight of travel expenditures.

How do centralized travel payments work?

Centralized travel payments work by consolidating all travel expenses—such as flights, hotels, and car rentals into a single account. Employees can use a corporate credit card or a centralized billing system for travel-related purchases.

How to avoid out-of-pocket expenses for employees when they travel for business?

Use a travel platform that allows adding a central card for all bookings made on the platform. Hence, employees can book their travel while charging a central company card for each booking.

Some travel platforms also allow a wallet system, wherein the company can deposit an amount with the platform. Every travel booking will be charged to that wallet until the balance expires. In this case, employees need not use their personal cards for booking business travel.

For non-travel expenses like meals, local cabs, etc., issue corporate cards to employees to avoid out-of-pocket expenses.

How to solve the problem of reconciling multiple card statements with travel spends?

In order to reconcile multiple card statements, users should get a corporate card program that generates a single statement for all cards. You can also invest in a travel partner who provides corporate cards. As the card transactions and travel transactions reside with the same partner, you will get an enriched statement that will help you map every card transaction to a travel transaction. This avoids the time spent by finance teams on reconciliation.

What are the benefits of using centralized travel payments?

Centralized travel payments offer the following benefits, addressing key challenges faced by companies with non-centralized payment processes:

- Relieves Employees from Personal Expenses: Employees no longer need to use their individual cards for travel expenses, avoiding the inconvenience of waiting for reimbursement and managing personal finances.

- Simplifies Expense Reimbursement: By consolidating all travel expenses into a central account, companies can streamline the reimbursement process, reducing administrative burdens and ensuring accurate tracking of expenditures.

- Eliminates Out-of-Pocket Expenses: With centralized payments, employees are spared from covering travel costs out of pocket, enhancing their financial comfort and facilitating smoother travel experiences.

Learn top 5 benefits of using centralized travel payment card.

What types of travel expenses can be paid using centralized travel payments?

Centralized travel payments typically cover expenses such as flights and pre-paid hotel payments seamlessly. However, pay-at-property hotel bookings require completing credit card authorization forms, which can be tedious.

Car rental companies offer direct billing options, which allow companies to pay a single invoice through centralized payments at the end of the month for usage across all employees.

How to pay centrally for "pay at property" hotel bookings?

Companies commonly utilize credit card authorization to centrally pay for "pay at property" hotel bookings. By completing an authorization form with the necessary details and forwarding it to the hotel, the company ensures smooth payment processing without the need for employees to pay at the hotel. For this purpose, organizations can issue a one-time virtual card that is charged centrally.

Can we customize travel policies within the centralized payment system?

Yes, travel policies can be customized within the centralized payment system by setting specific guidelines, such as spending limits based on designation, type of travel, city of travel, and other parameters. You can also have approval rules in place that can help monitor out-of-policy bookings by employees and curb those at the source.